- Canada

- /

- Oil and Gas

- /

- TSX:WCP

Three TSX Dividend Stocks Offering Yields From 3.3% To 7.1%

Reviewed by Simply Wall St

The Canadian market has shown positive momentum, with a 1.2% increase over the last week and an impressive 11% rise over the past year. With earnings expected to grow by 15% annually in the near future, dividend stocks could be particularly appealing for investors seeking both growth potential and steady income streams.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.75% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.13% | ★★★★★★ |

| Enghouse Systems (TSX:ENGH) | 3.50% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.53% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.37% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.91% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.51% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.31% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.27% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.04% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

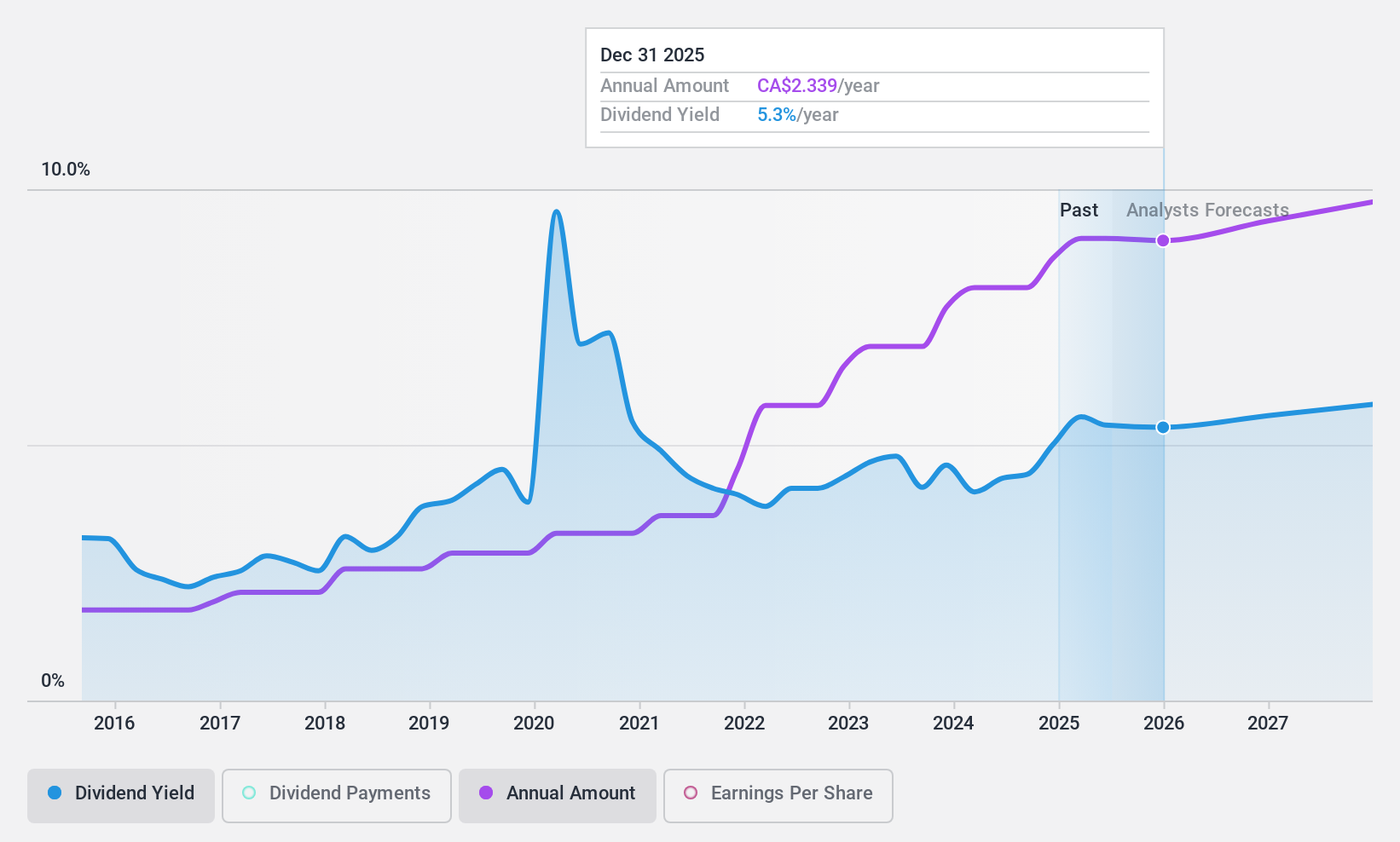

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited, with a market capitalization of CA$101.11 billion, is engaged in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs).

Operations: Canadian Natural Resources Limited generates revenue primarily from its North American exploration and production activities, which contributed CA$17.43 billion, followed by its oil sands mining and upgrading operations at CA$15.80 billion, with smaller contributions from midstream and refining at CA$0.97 billion, as well as exploration and production in the North Sea and offshore Africa totaling CA$1.16 billion.

Dividend Yield: 4.3%

Canadian Natural Resources Limited offers a stable dividend yield of 4.31%, which is lower than the top quartile of Canadian dividend payers. The company has demonstrated consistent dividend growth and reliability over the past decade, supported by a solid payout ratio of 56.2% and cash payout ratio of 49.1%, ensuring dividends are well covered by both earnings and cash flow. Recent financials show a dip in net income to CAD$987 million from CAD$1,799 million year-over-year for Q1 2024, alongside a revenue decrease to CAD$8,244 million from CAD$8,630 million. Despite this downturn, CNQ continues its shareholder returns policy robustly with recent stock splits and an ongoing share buyback program totaling CAD$3,239 million for repurchased shares.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Natural Resources.

- Insights from our recent valuation report point to the potential undervaluation of Canadian Natural Resources shares in the market.

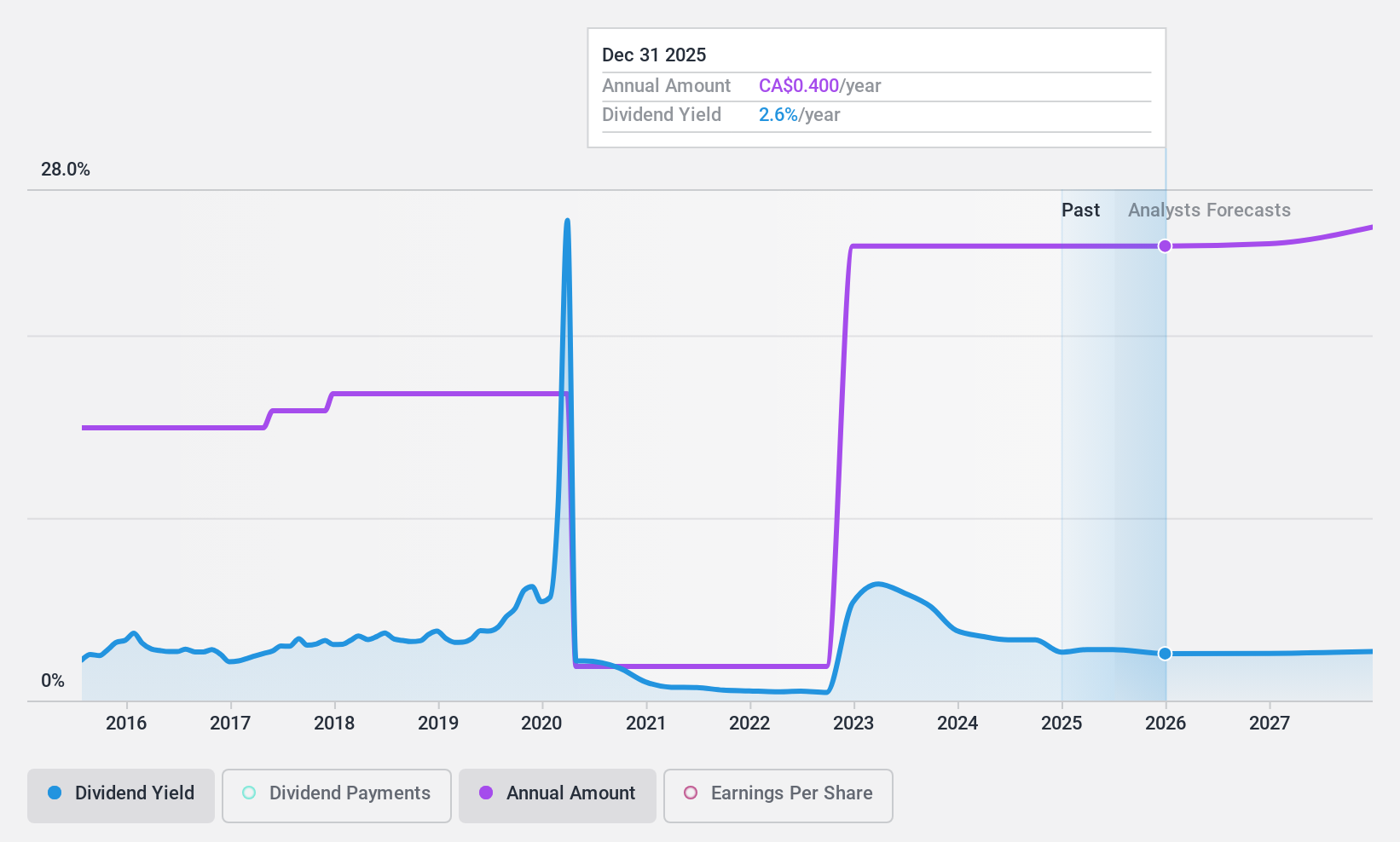

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in waste management and energy infrastructure primarily in Canada and the United States, with a market capitalization of approximately CA$3.04 billion.

Operations: Secure Energy Services Inc. generates CA$7.81 billion from its Energy Infrastructure segment and CA$1.09 billion from Environmental Waste Management.

Dividend Yield: 3.4%

Secure Energy Services Inc. recently declared a quarterly dividend of CA$0.10 per share, affirming its commitment to shareholder returns despite a challenging forecast with earnings expected to decline annually by 31.4% over the next three years. The company's dividend is supported by a payout ratio of 20.6% and a cash payout ratio of 63.8%, indicating sustainability from both earnings and cash flow perspectives. Additionally, Secure completed significant share buybacks totaling CA$250 million, enhancing shareholder value through reduced share count and supporting its capital structure with an extended CA$800 million credit facility until May 2027.

- Click here to discover the nuances of Secure Energy Services with our detailed analytical dividend report.

- According our valuation report, there's an indication that Secure Energy Services' share price might be on the cheaper side.

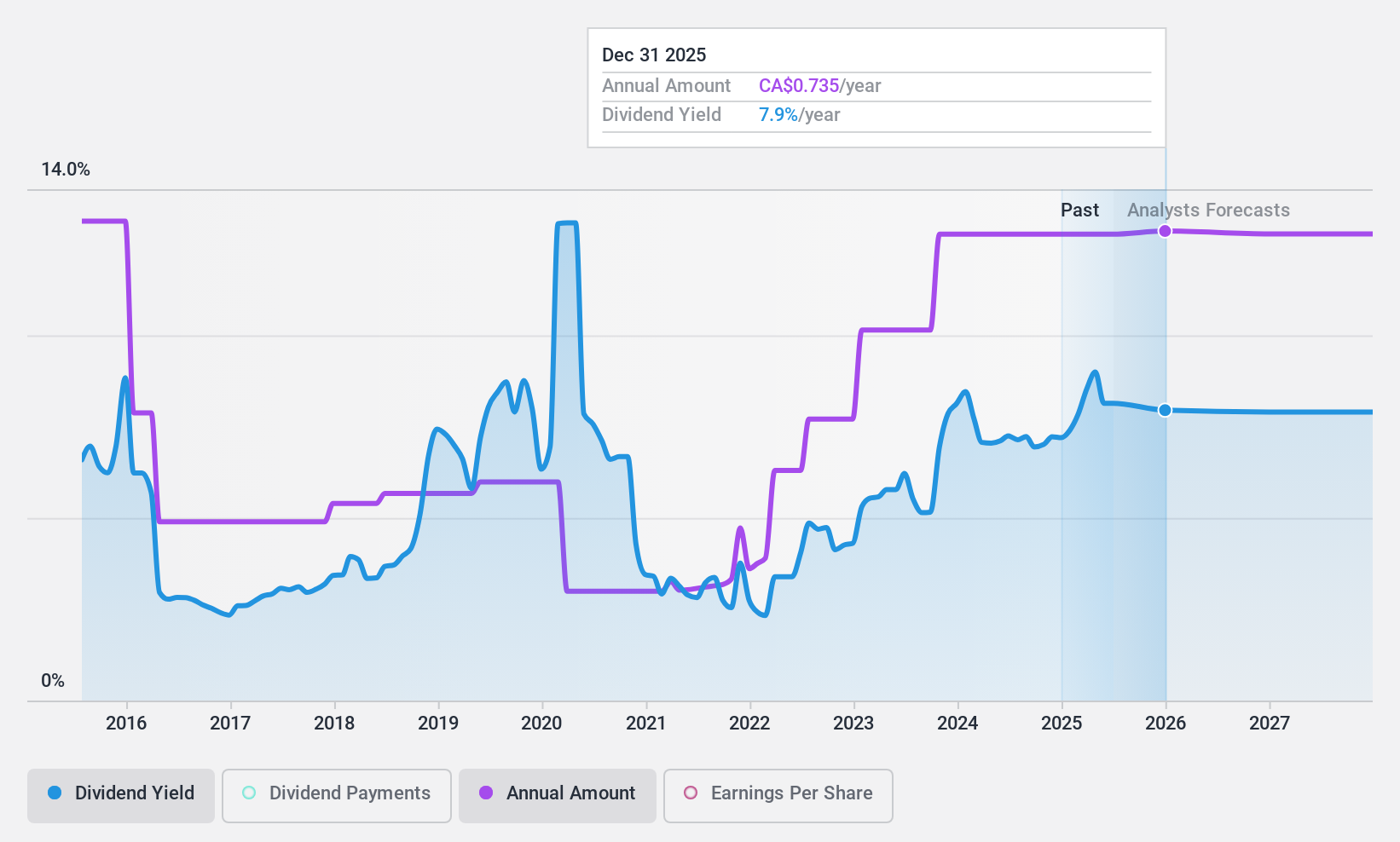

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company that acquires, develops, and produces oil and gas assets in Western Canada, with a market capitalization of approximately CA$5.90 billion.

Operations: Whitecap Resources Inc. generates CA$3.23 billion from its oil and gas exploration and production activities.

Dividend Yield: 7.1%

Whitecap Resources Inc. maintains a consistent dividend, recently affirming a monthly payment of CAD 0.0608 per share, reflecting its commitment to shareholder returns. The company's dividends are well-covered by earnings with a payout ratio of 56.1% and by cash flows with a cash payout ratio of 82%, indicating sustainability. Despite lower profit margins year-over-year—from 33.5% to 21.3%—Whitecap actively pursues growth through acquisitions and has announced significant share buybacks, enhancing shareholder value while navigating market challenges effectively.

- Take a closer look at Whitecap Resources' potential here in our dividend report.

- The valuation report we've compiled suggests that Whitecap Resources' current price could be quite moderate.

Turning Ideas Into Actions

- Investigate our full lineup of 33 Top TSX Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives