- Canada

- /

- Oil and Gas

- /

- TSX:SCR

Can Strathcona Resources' (TSX:SCR) Dividend Affirmation Reflect Resilience in a Shifting Oil Sands Landscape?

Reviewed by Simply Wall St

- Strathcona Resources Ltd. announced its second quarter 2025 results, reporting CAD 924.1 million in revenue and CAD 230.9 million in net income, alongside mostly stable production and an affirmed quarterly dividend of CAD 0.30 per share.

- Despite lower revenue compared to the prior year, the company delivered higher net income and continued its shareholder return program while tightening its production guidance range for 2025.

- We'll explore how resilient earnings and a dividend affirmation may influence Strathcona's investment narrative and outlook in the oil sands sector.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Strathcona Resources Investment Narrative Recap

To be a shareholder of Strathcona Resources, you need to believe in the company's ability to deliver sustained production growth from its oil sands assets despite volatility in commodity prices and tightening emissions policies. The recent second quarter results show resilient earnings and a steady dividend, but do not significantly change the near-term catalyst: successful organic expansion and efficient execution. The principal risk remains exposure to carbon policy changes, which could pressure profitability if environmental regulations intensify faster than anticipated.

Among the latest updates, Strathcona's affirmation of its quarterly dividend at CAD 0.30 per share draws attention. This decision signals ongoing capital discipline and shareholder returns, but it also matters given current production guidance was only modestly tightened. How well Strathcona can continue to balance capital returns and operational execution is at the heart of short-term investor focus.

In contrast, investors should be aware that accelerated carbon policy shifts could affect future margins and...

Read the full narrative on Strathcona Resources (it's free!)

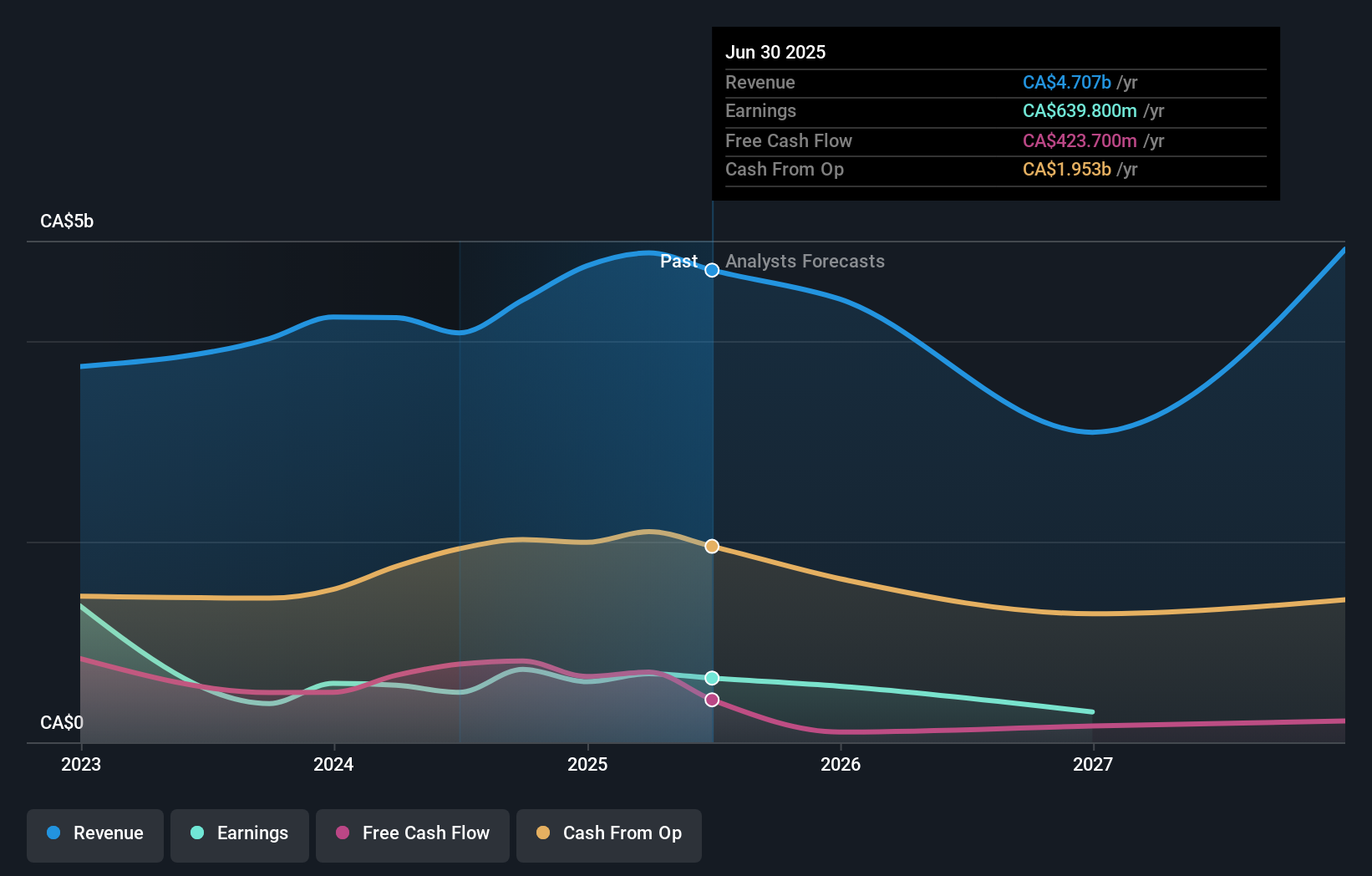

Strathcona Resources' outlook anticipates CA$5.1 billion in revenue and CA$126.6 million in earnings by 2028. This scenario assumes a 2.8% annual revenue growth rate but a substantial earnings decline of CA$513.2 million from current earnings of CA$639.8 million.

Uncover how Strathcona Resources' forecasts yield a CA$36.50 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members offered three fair value estimates for Strathcona ranging from CA$36.50 to CA$167.39 per share. While some see substantial upside, concerns about long-term carbon regulation impact remain front of mind and highlight why opinions across the market can diverge so widely.

Explore 3 other fair value estimates on Strathcona Resources - why the stock might be worth just CA$36.50!

Build Your Own Strathcona Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strathcona Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Strathcona Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strathcona Resources' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SCR

Strathcona Resources

Acquires, explores, develops, and produces petroleum and natural gas reserves in Canada.

Excellent balance sheet and fair value.

Market Insights

Community Narratives