- Canada

- /

- Oil and Gas

- /

- TSX:RBY

Rubellite Energy (TSE:RBY) shareholders have lost 37% over 1 year, earnings decline likely the culprit

Rubellite Energy Inc. (TSE:RBY) shareholders should be happy to see the share price up 21% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 37% in a year, falling short of the returns you could get by investing in an index fund.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Rubellite Energy

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

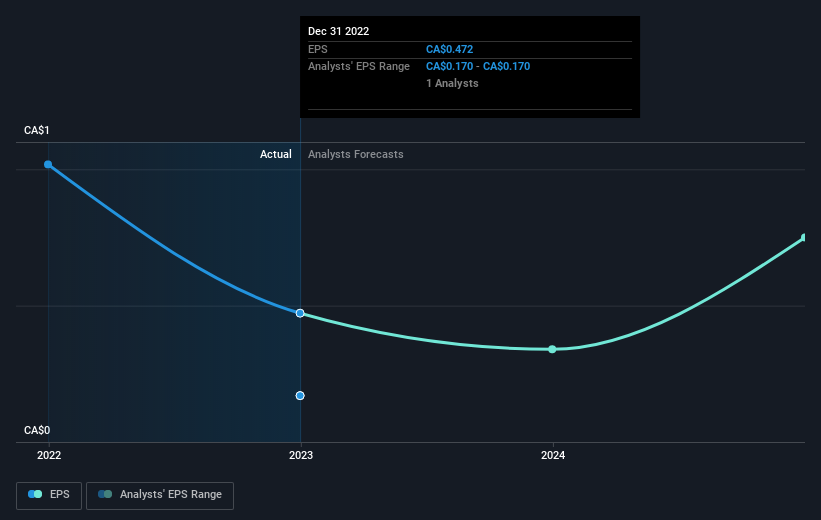

Unhappily, Rubellite Energy had to report a 54% decline in EPS over the last year. This fall in the EPS is significantly worse than the 37% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Rubellite Energy shareholders are down 37% for the year, even worse than the market loss of 8.9%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 21% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Rubellite Energy (including 1 which can't be ignored) .

Rubellite Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RBY

Rubellite Energy

An energy company, engages in the exploration, development, production, and marketing of heavy crude oil, natural gas, and bitumen assets in Alberta, Canada.

Undervalued with proven track record.

Market Insights

Community Narratives