- Canada

- /

- Energy Services

- /

- TSX:PSD

Pulse Seismic (TSX:PSD) Profit Margin Surges, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

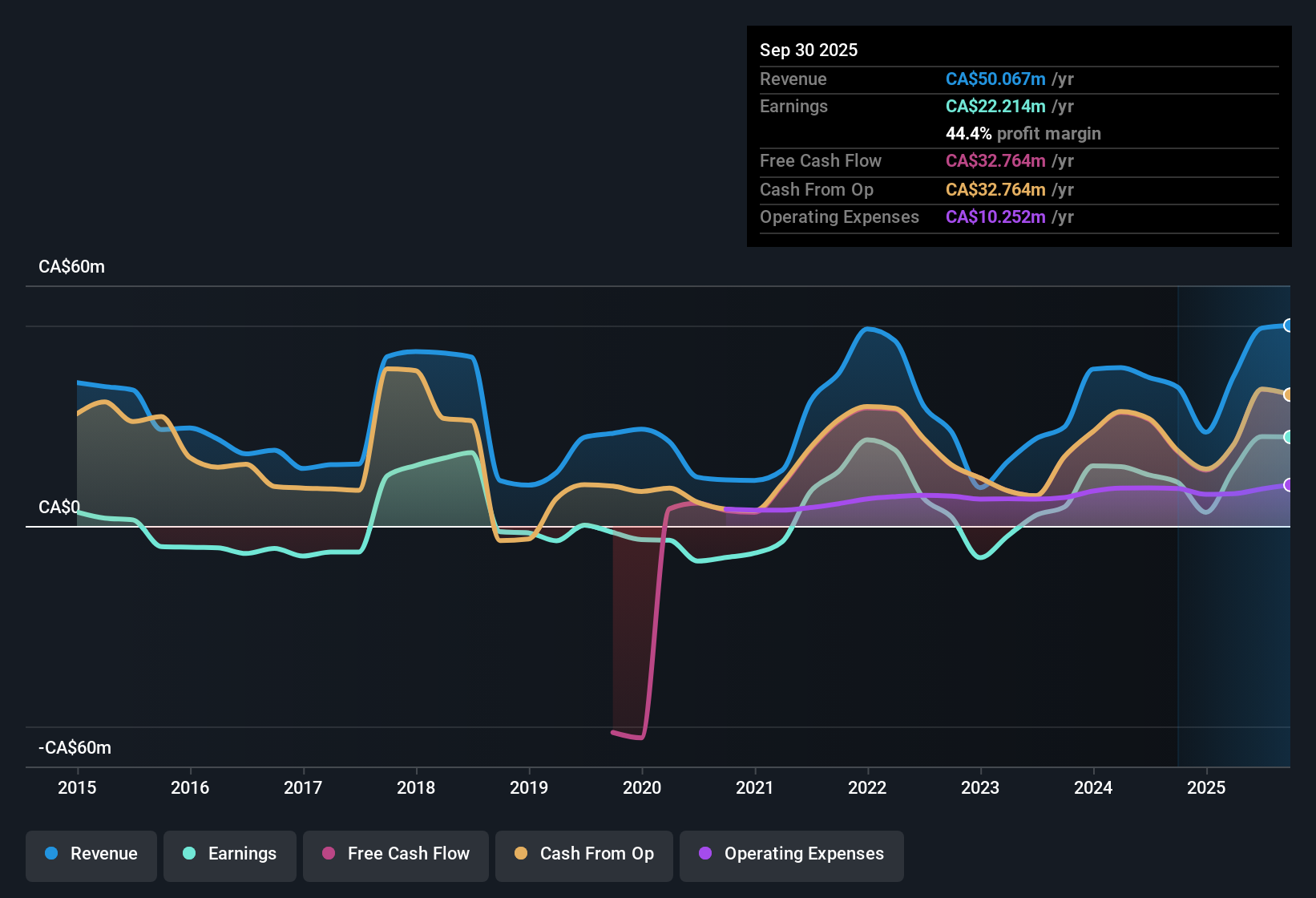

Pulse Seismic (TSX:PSD) delivered a net profit margin of 44.4%, rising from 31.5% a year ago, while earnings increased by 103.4% over the past twelve months. Over the last five years, annual earnings growth averaged 30.9%, reinforcing a clear acceleration in profit momentum for investors to consider.

See our full analysis for Pulse Seismic.The real question is how these headline numbers compare with the most widely followed market narratives. Let’s dive in and see which stories are confirmed, and which might need rewriting.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Peers

- Pulse Seismic now operates at a net profit margin of 44.4%, well above last year's 31.5% and far outpacing typical sector benchmarks for data and services providers.

- Rapid margin expansion heavily supports the bullish view that the company is building a high-quality earnings base.

- This margin strength indicates not just a rebound but potentially sustainable profitability that few sector peers match.

- What is surprising is how the margin leap aligns with the argument that recurring, high-margin data licensing can drive compounding earnings, especially as competitors struggle to reach similar efficiency.

Valuation Remains at a Steep Discount

- Despite strong fundamentals, shares trade at a price-to-earnings ratio of just 7x, compared to an industry average of 14.9x and peer average of 15.5x.

- The prevailing market view sees this steep discount as a rare combination with the company's DCF fair value of CA$31.03 far above the current share price of CA$3.07.

- Investors looking for value may find the disconnect between earnings quality and market pricing especially compelling, given most valuation multiples appear undemanding even after recent growth.

- This sizable discount challenges the notion that quality growth stories come only with a valuation premium, setting Pulse Seismic apart among North American service peers.

Dividend Sustainability Flags a Key Risk

- Dividend sustainability stands out as the company’s main risk, pointing investors toward careful review of cash flows and payout ratios for future income reliability.

- The prevailing market view acknowledges that even with robust earnings growth and margin performance, dividend-focused investors may remain cautious if cash collected proves volatile.

- Critics highlight that without detailed dividend coverage ratios, investors relying primarily on income should temper expectations until the company demonstrates clear payout support through steady free cash flow.

- This lingering concern is relevant for anyone prioritizing predictable dividends over appreciation, despite recent operational wins.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pulse Seismic's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid earnings growth and margin gains, dividend reliability remains uncertain because inconsistent cash flows could undermine future income for yield-focused investors.

If stable income is your priority, use our these 2006 dividend stocks with yields > 3% to quickly spot companies with yields above 3% and a proven record of sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>