- Canada

- /

- Oil and Gas

- /

- TSX:PPL

Pembina Pipeline (TSX:PPL): Valuation Perspectives Following $225 Million Subordinated Notes Offering and Strategic Capital Moves

Reviewed by Kshitija Bhandaru

Pembina Pipeline (TSX:PPL) just wrapped up a $225 million subordinated notes offering. This marks another step in its proactive approach to financial management. The proceeds will go toward redeeming preferred shares and supporting general corporate needs.

See our latest analysis for Pembina Pipeline.

Pembina’s recent moves, including the $225 million notes offering, updates on its Greenlight power project, and preferred share dividends, have kept investors buzzing. After a strong run that saw an 8.3% share price gain over the past 90 days, momentum remains solid even as the 1-year total shareholder return clocks in at -2.2%. Longer-term investors have enjoyed a robust 156% total return over five years, showing that despite short-term swings, Pembina continues to reward patient shareholders.

If you’re looking for fresh opportunities in today’s market, broaden your search and discover fast growing stocks with high insider ownership

But with shares up nearly 8% in the last three months, is Pembina actually trading below its true value, or has investor enthusiasm already priced in future growth? Is there still a buying opportunity, or has the market already moved ahead?

Most Popular Narrative: 5.9% Undervalued

Pembina Pipeline’s share price remains slightly below the narrative’s fair value estimate, hinting at untapped upside if bullish projections hold true. While the gap is not dramatic, it signals that the market has not fully priced in some major catalysts that underpin the consensus outlook.

Strong ongoing investments in expanding midstream and export terminal assets (notably Cedar LNG, Prince Rupert LPG terminal, and new pipeline projects) position Pembina to capture incremental volumes and diversify revenue sources. This supports both top-line growth and future EBITDA expansion.

Want to understand what is fueling that valuation premium? There is one key forecast included: Pembina’s long-term earnings power could reach new heights if these mega-projects deliver. Curious which future profit increase the narrative expects—and what number will really move the needle? The full story breaks down the exact financial projections driving this fair value target.

Result: Fair Value of $58.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pipeline toll resets and Pembina’s heavy reliance on major capital projects could put pressure on profit margins and pose risks to future growth.

Find out about the key risks to this Pembina Pipeline narrative.

Another View: Market Multiples Tell a More Cautious Story

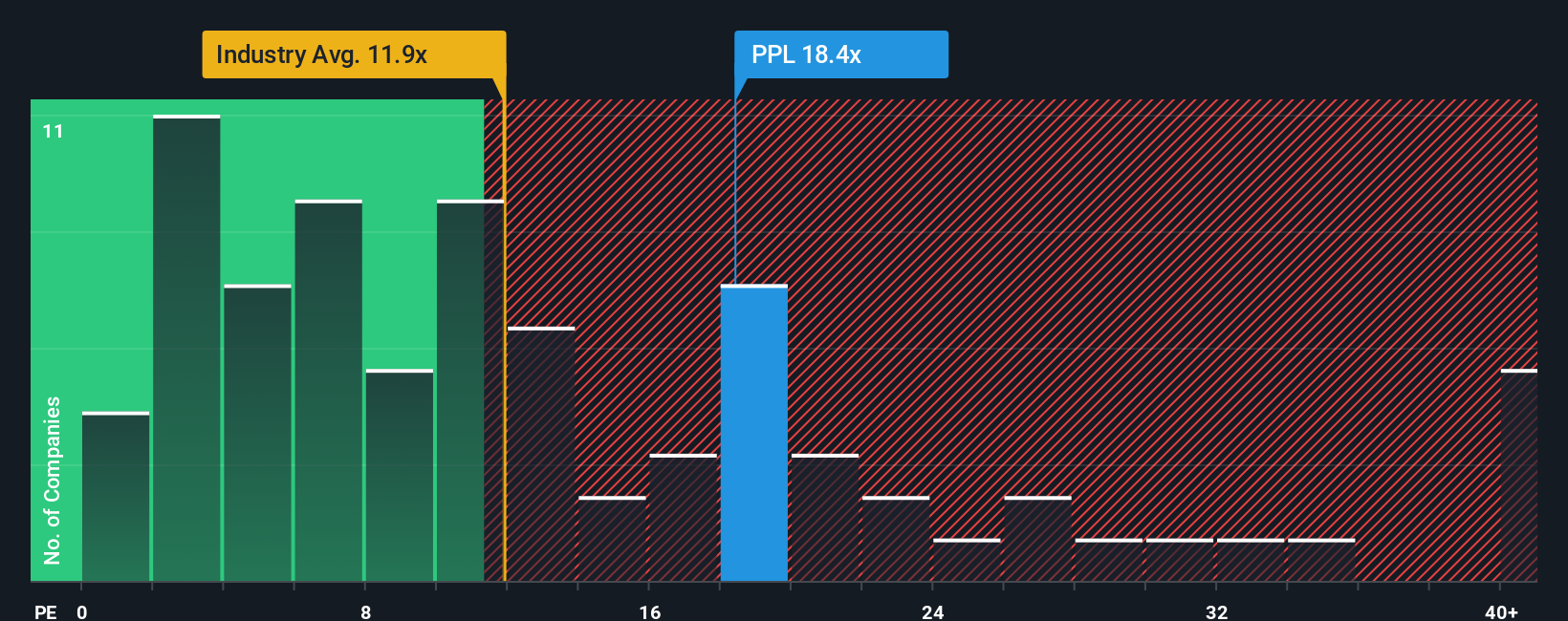

While the analyst consensus gives Pembina Pipeline a fair value above today’s price, the market’s own price-to-earnings ratio presents a more cautious picture. Pembina trades at 18.4 times earnings, which is higher than both its peer average of 19.8x and the Canadian Oil and Gas industry average of 11.9x. However, the fair ratio sits at just 16x, suggesting the market could adjust toward this level if optimism decreases. Is the current price supported by future growth, or could these premium valuations expose investors to downside if expectations change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pembina Pipeline Narrative

If you see things differently or want to dig deeper into the numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Pembina Pipeline research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Arm yourself with fresh investing opportunities beyond Pembina Pipeline. Take a smarter path by powering up your research and discovering your next big winner today with these handpicked stock ideas:

- Uncover the potential of high-yield investments and secure steady returns by checking out these 19 dividend stocks with yields > 3%.

- Spot hidden gems in technology and stay ahead of the curve by exploring these 24 AI penny stocks poised to transform entire industries.

- Tap into value opportunities with these 898 undervalued stocks based on cash flows to find stocks trading below their intrinsic worth and position yourself for future gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives