- Canada

- /

- Oil and Gas

- /

- TSX:PPL

Do Pembina Pipeline’s Latest Results Hint at Resilient Operations or Emerging Challenges? (TSX:PPL)

Reviewed by Simply Wall St

- Pembina Pipeline Corporation recently released its second quarter 2025 results, reporting sales of C$1.79 billion and net income of C$417 million, both lower than the same period last year, alongside the announcement of a common share dividend of C$0.71 for the third quarter.

- While sales and profits for the quarter declined year-over-year, the company’s earnings for the first half of 2025 remained broadly consistent with the prior year, highlighting some underlying stability in its operations.

- With quarterly revenue and net income falling compared to 2024, let’s explore how this earnings outcome could adjust Pembina’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

Pembina Pipeline Investment Narrative Recap

To be a Pembina Pipeline shareholder, you need to believe in the company's ability to deliver stable long-term income from its established pipeline assets while executing on export terminal expansions and joint ventures despite near-term margin pressures. This quarter’s results, with sales and earnings lower year-over-year, do little to change the significance of upcoming pipeline toll resets as the key short-term catalyst and the risk that rate settlements continue to weigh on margins in the near future remains unchanged. Of the company’s recent announcements, the declared common share dividend of C$0.71 per share is particularly relevant. Even with fluctuating earnings, Pembina’s commitment to shareholder returns through consistent dividends highlights its ongoing effort to provide income, though the payout ratio remains something to watch as fee-based growth faces structural headwinds. By contrast, investors should be aware that margin stability is highly dependent on the outcomes of current and pending toll settlement negotiations, and ...

Read the full narrative on Pembina Pipeline (it's free!)

Pembina Pipeline's outlook anticipates CA$8.1 billion in revenue and CA$2.0 billion in earnings by 2028. This reflects a -0.2% annual revenue decline and a CA$0.3 billion earnings increase from the current CA$1.7 billion.

Uncover how Pembina Pipeline's forecasts yield a CA$58.61 fair value, a 14% upside to its current price.

Exploring Other Perspectives

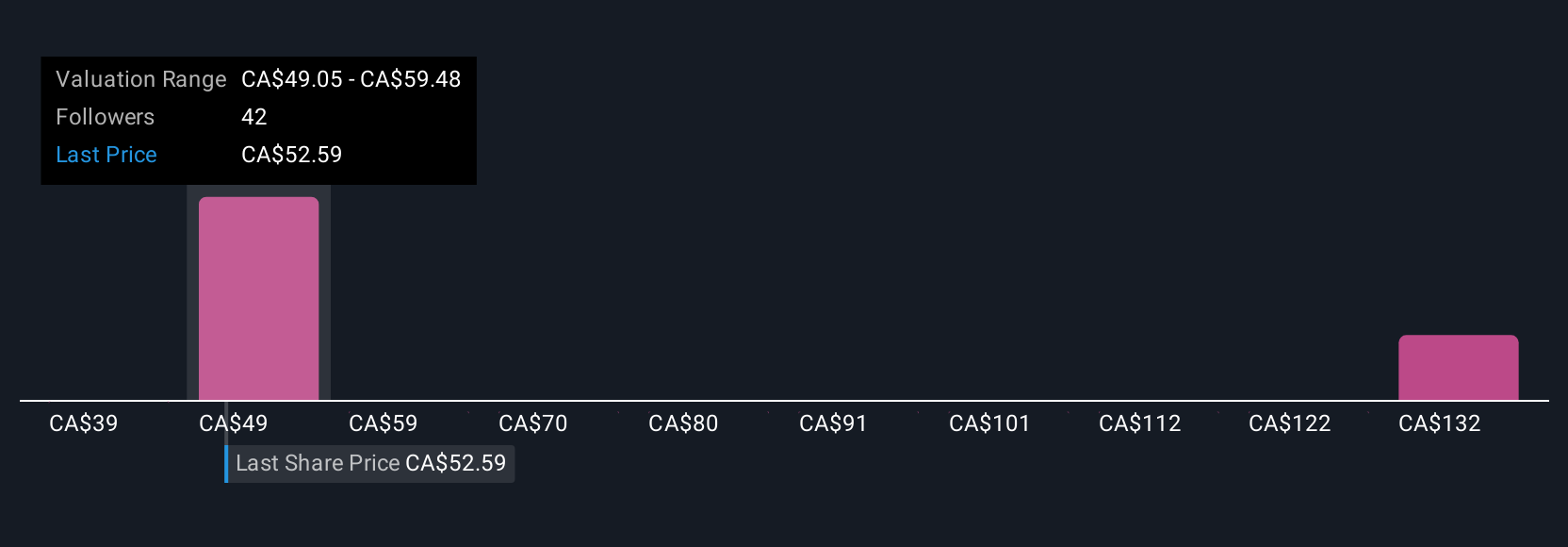

Fair value estimates from six members of the Simply Wall St Community range widely, from C$38.63 to C$141.95 per share. With margin pressure from toll resets still weighing on near-term earnings, you can explore these differing viewpoints to further inform your perspective on Pembina’s outlook.

Explore 6 other fair value estimates on Pembina Pipeline - why the stock might be worth over 2x more than the current price!

Build Your Own Pembina Pipeline Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pembina Pipeline research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pembina Pipeline research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pembina Pipeline's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PPL

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives