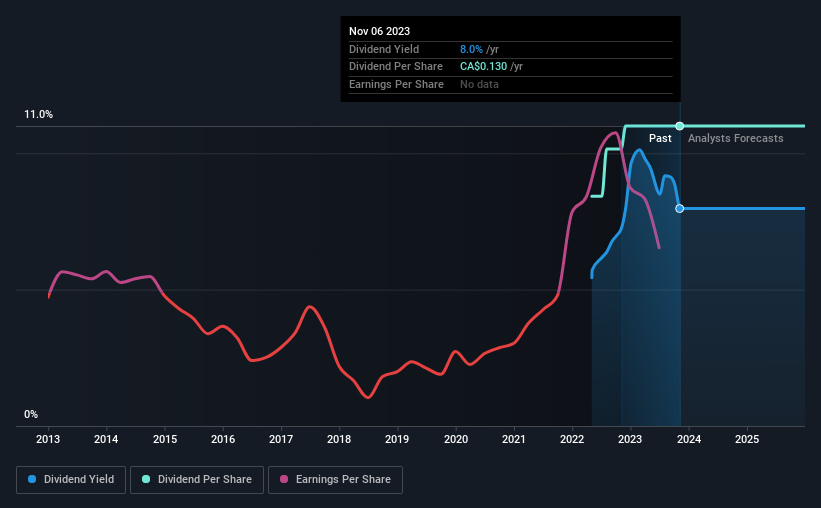

Pine Cliff Energy Ltd. (TSE:PNE) will pay a dividend of CA$0.0108 on the 30th of November. The dividend yield will be 8.0% based on this payment which is still above the industry average.

View our latest analysis for Pine Cliff Energy

Pine Cliff Energy Doesn't Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Pine Cliff Energy's dividend made up quite a large proportion of earnings but only 59% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Looking forward, earnings per share is forecast to fall by 18.6% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 120%, which could put the dividend under pressure if earnings don't start to improve.

Pine Cliff Energy Is Still Building Its Track Record

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Pine Cliff Energy's Dividend Might Lack Growth

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Pine Cliff Energy has been growing its earnings per share at 64% a year over the past five years. Earnings per share is growing nicely, but the company is paying out most of its earnings as dividends. This might be sustainable, but we wonder why Pine Cliff Energy is not retaining those earnings to reinvest in growth.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Pine Cliff Energy that investors need to be conscious of moving forward. Is Pine Cliff Energy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PNE

Pine Cliff Energy

Engages in the acquisition, exploration, development, and production of natural gas and crude oil in the Western Canadian Sedimentary Basin.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives