- Canada

- /

- Oil and Gas

- /

- TSX:PKI

Is Parkland’s Recent Growth Sustainable After 15% Rally and US Expansion Uncertainty?

Reviewed by Simply Wall St

Thinking about what to do with your Parkland stock? You are not alone. Whether you are sitting on solid gains or just now considering a position, this is the moment to get specific about value. Parkland has had a run most investors would cheer. It is up 15.6% year-to-date and has gained an impressive 12.4% over the past year. Looking even further back, there is an eye-catching 47.4% gain in the last three years, outpacing many sector peers. Yes, the last month has seen a minor slip with the stock down 2.1%, but that only sharpens the conversation around risk and upside.

What is driving these moves? Lately, talk across the energy and retail fuel space has turned to shifting consumer habits and strategic acquisitions. Parkland’s ability to pivot and capture new opportunities in the changing landscape has caught the attention of both analysts and investors, adding some optimism around where it could be headed next.

Still, with the last close at $37.79 and a value score of 2 out of 6 on our multi-check system, Parkland can not be called screamingly cheap, but there are definitely some valuation signals to pay attention to. That score means it cleared two out of six undervaluation hurdles, which is an interesting setup for deeper investigation.

Let us break down exactly how those valuation methods stack up. Stick around, because by the end we will explore a fresh perspective for spotting true value you might not have considered before.

Parkland scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Parkland Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method for valuing businesses by estimating the company’s future cash flows and discounting them to their present value. This approach helps answer the question, “What is Parkland worth today, based on all the cash it is expected to generate for shareholders?”

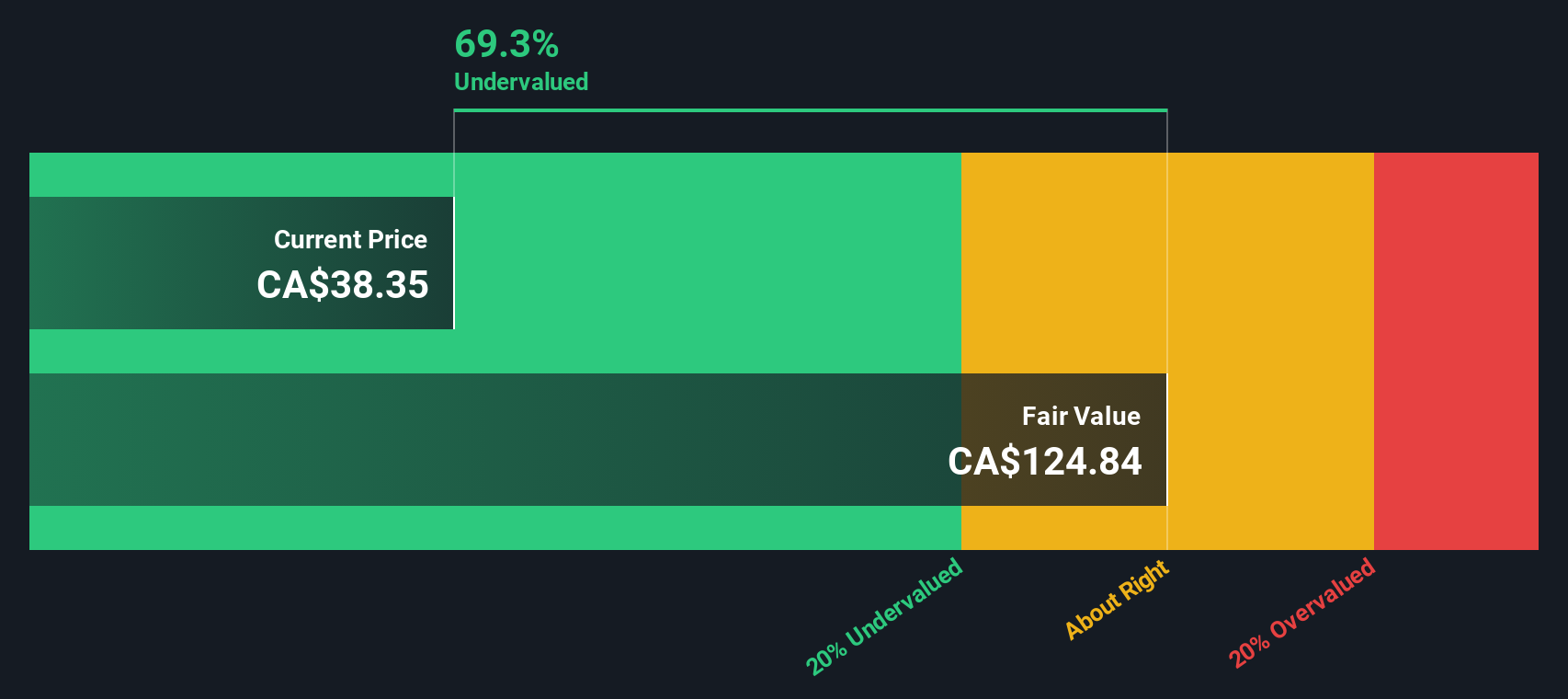

Parkland’s Free Cash Flow (FCF) over the last twelve months was CA$1.17 billion, and analysts project annual figures in the hundreds of millions going forward. The model starts with these analyst forecasts for the next five years, then extrapolates further cash flow growth estimates for the following five years. By 2035, projected FCF rises to CA$1.35 billion, with long-term growth rates tapering off gradually over time.

Using this two-stage model, Parkland’s intrinsic value comes out to CA$125.81 per share. Given the current share price of CA$37.79, the DCF model implies the stock is trading at about a 70% discount to its calculated fair value. This suggests the shares are significantly undervalued by this measure.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Parkland.

Approach 2: Parkland Price vs Earnings

For companies generating consistent profits, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. It reflects how much investors are willing to pay for each dollar of current earnings and is particularly effective for comparing established, profitable businesses like Parkland.

The "right" or fair PE ratio depends not just on current profits, but also on growth outlook and the risks unique to the business and its industry. Faster earnings growth or lower risk usually supports a higher PE, while slower growth or elevated risk can justify a lower multiple.

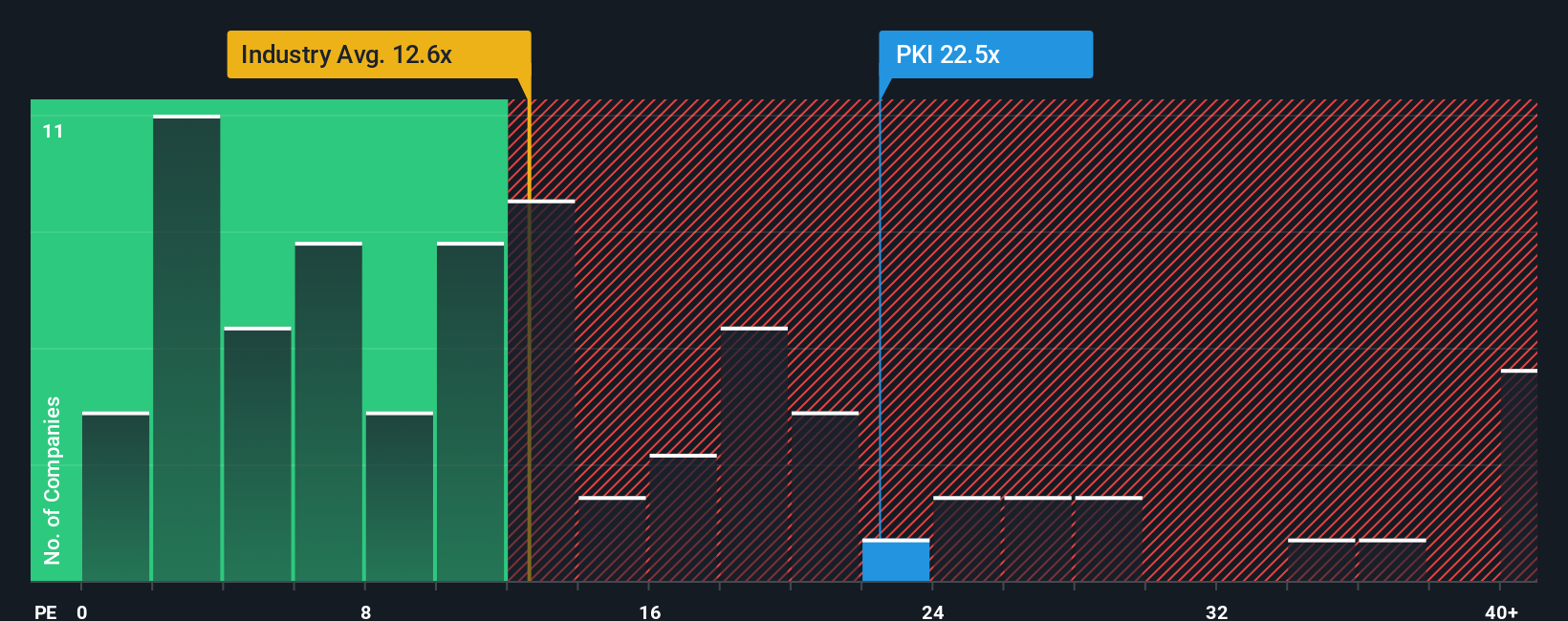

Parkland currently trades at a PE ratio of 22.1x. This sits above both the Oil and Gas industry average of 12.2x and the peer group average of 18.0x. At first glance, this premium might suggest Parkland is overvalued. However, that approach may be missing some context.

Simply Wall St's “Fair Ratio” acts as a nuanced benchmark tailored to Parkland’s specific earnings growth expectations, profit margins, industry, and risk profile. Unlike a straight peer or industry comparison, this proprietary Fair Ratio weighs not just sector norms but also considers market cap and unique business characteristics. For Parkland, the Fair Ratio stands at 18.7x.

Comparing this fair multiple to the company’s actual PE (22.1x) shows Parkland trading above what would be considered fair based on its fundamentals and outlook. While not wildly overvalued, the shares appear somewhat expensive relative to their adjusted potential.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Parkland Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, connecting the dots between what you believe about Parkland’s future, your assumptions for revenue, earnings, and margins, and what you think the stock is actually worth.

Instead of focusing purely on static metrics, Narratives link Parkland’s strategic moves and business trends directly to a financial forecast and a fair value estimate, all based on your own perspective. They make it easy to visualize how changes in the business could play out as gains or losses. This gives you a living picture of your investment thesis.

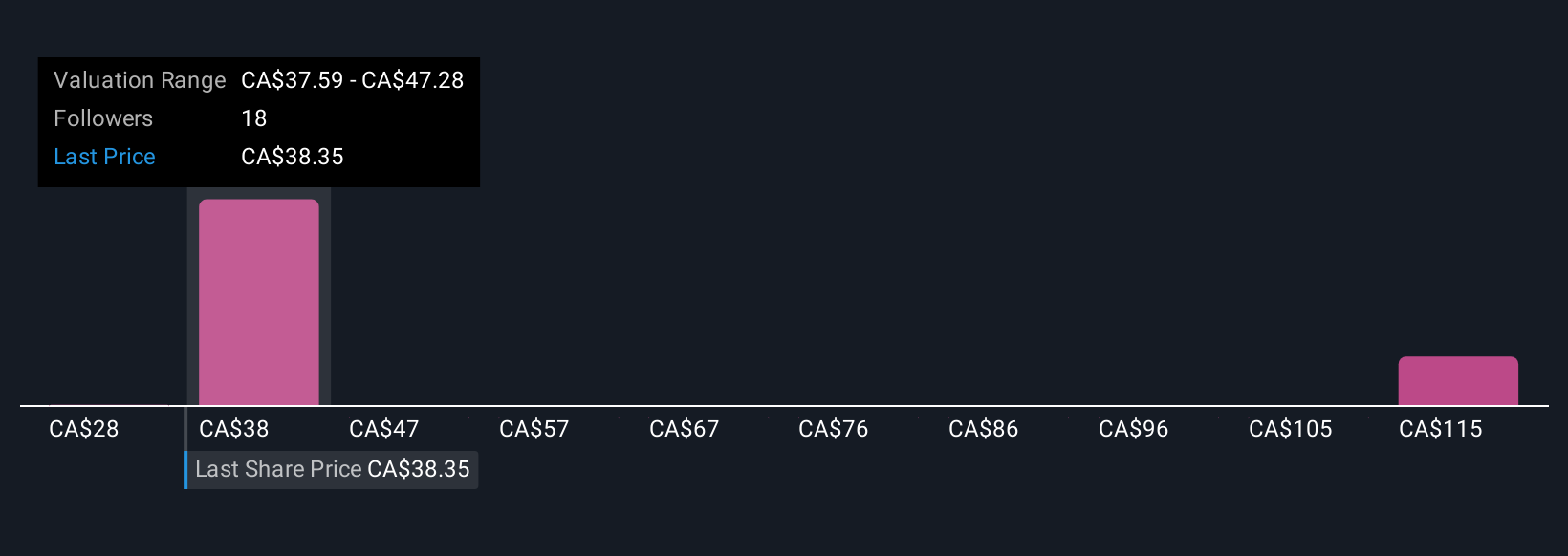

Narratives are a feature on Simply Wall St’s Community page and can be created or updated by millions of investors. You can track your Narrative over time and instantly see how news or company results affect your fair value and whether you might want to buy, sell or hold. Comparing your Narrative’s fair value to the current price helps make decisions less about gut feel and more about facts and forecasts.

For example, some investors currently estimate a fair value of CA$43.06 for Parkland, while others see much lower expectations, depending on whether they focus on risks like U.S. performance or opportunities like Ontario alcohol expansion.

Do you think there's more to the story for Parkland? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PKI

Parkland

Operates food and convenience stores in Canada, the United States, and internationally.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives