Stock Analysis

- Canada

- /

- Consumer Finance

- /

- TSX:GSY

Top TSX Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

Recent market trends have shown a notable shift, with the TSX demonstrating resilience amid fluctuations in the tech sector and broader indices. As interest rates decline and corporate earnings rise, investors may find particular value in growth companies with high insider ownership, which can signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 55.0% |

| goeasy (TSX:GSY) | 21.5% | 15.5% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.4% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 67.2% |

| Alpha Cognition (CNSX:ACOG) | 18% | 66.5% |

| Artemis Gold (TSXV:ARTG) | 31.4% | 45.6% |

| Silver X Mining (TSXV:AGX) | 14.1% | 144.2% |

| Almonty Industries (TSX:AII) | 17.7% | 105% |

Let's dive into some prime choices out of from the screener.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$9.01 billion.

Operations: The company's revenue is primarily generated from the Americas at CA$2.53 billion, followed by Europe, the Middle East & Africa at CA$730.10 million, Asia Pacific at CA$616.58 million, and Investment Management services contributing CA$489.23 million.

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group is actively expanding, evidenced by a recent partnership to enhance its European footprint and involvement in major real estate projects in Mississippi. Despite trading 51.8% below its estimated fair value and showing substantial earnings growth (38.3% per year), concerns persist due to shareholder dilution over the past year and debt not being well-covered by operating cash flow. Insider transactions have been mixed, with no significant purchases recently, contrasting with earlier buying trends.

- Take a closer look at Colliers International Group's potential here in our earnings growth report.

- Our expertly prepared valuation report Colliers International Group implies its share price may be too high.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market cap of approximately CA$3.15 billion.

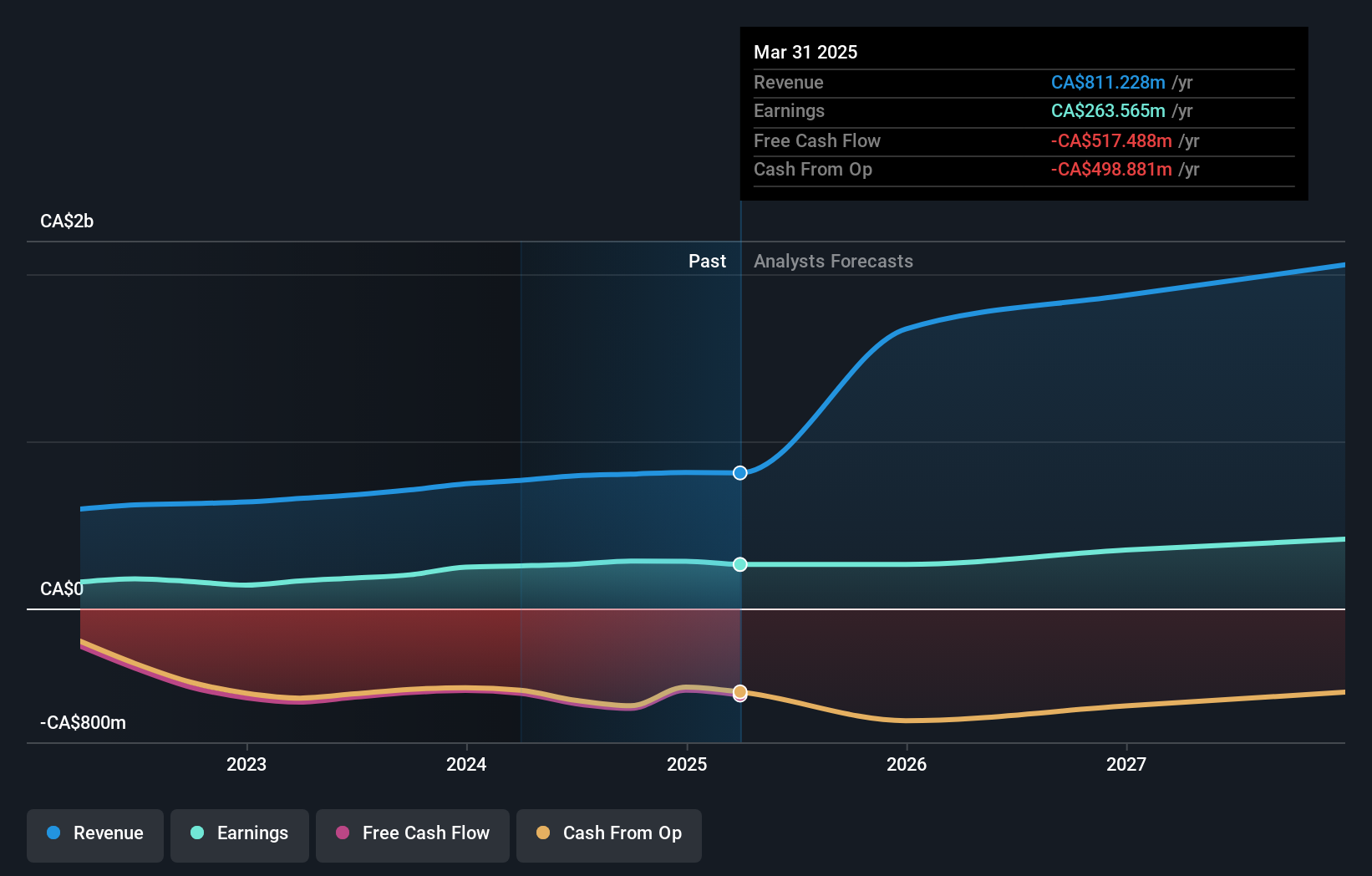

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

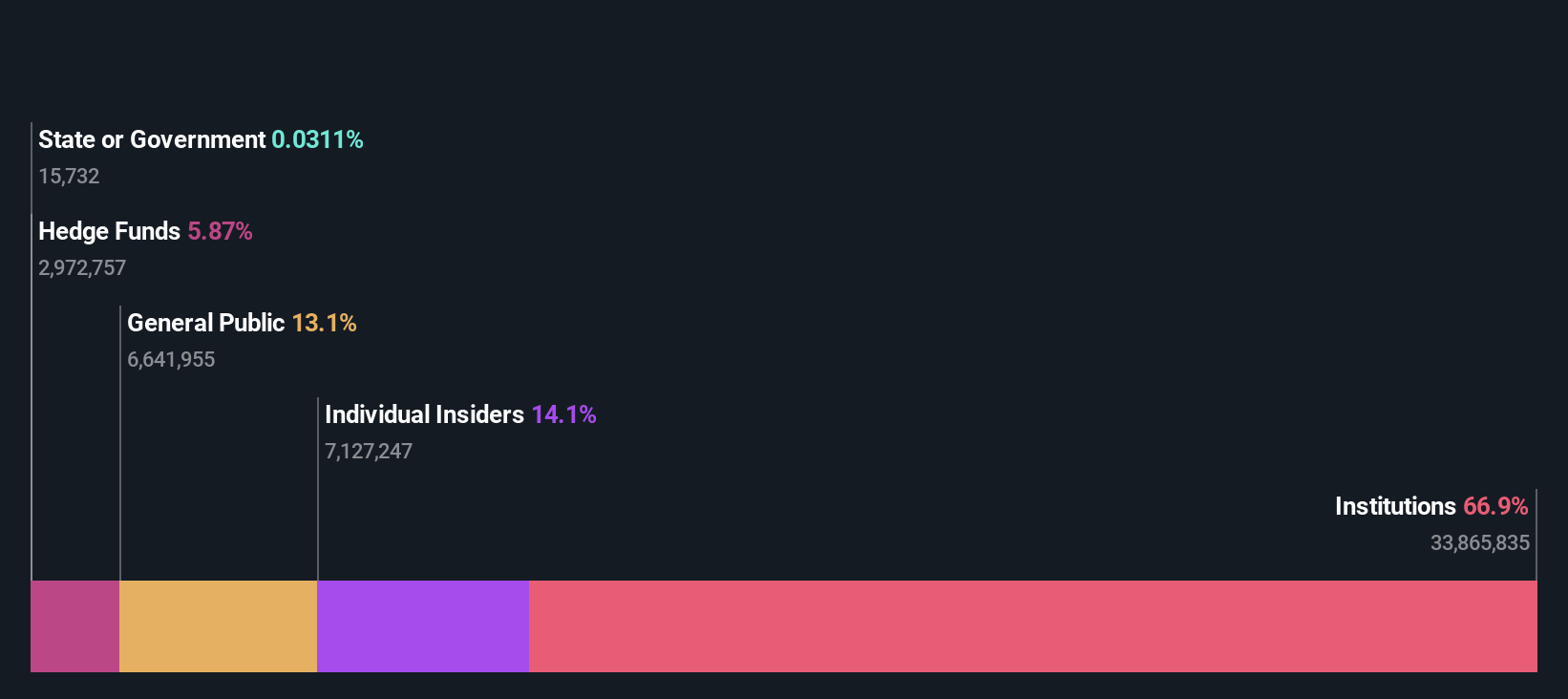

Insider Ownership: 21.5%

Earnings Growth Forecast: 15.5% p.a.

goeasy Ltd., a Canadian company with significant insider ownership, recently enhanced its financial agility by expanding its credit facility to C$550 million, ensuring robust support for future growth. Despite leadership changes with CEO Jason Mullins stepping down by year-end but remaining on the board, the company maintains continuity. Financially, goeasy is poised for strong growth with revenue increasing at 32.2% annually and earnings up 15.53% per year, outpacing market averages significantly. However, challenges include a dividend coverage issue and high levels of non-cash earnings impacting quality.

- Get an in-depth perspective on goeasy's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that goeasy's current price could be quite moderate.

North American Construction Group (TSX:NOA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: North American Construction Group Ltd. offers mining and heavy civil construction services in Australia, Canada, and the United States, with a market capitalization of approximately CA$724.10 million.

Operations: The company generates revenue by providing mining and heavy civil construction services across Australia, Canada, and the United States.

Insider Ownership: 11.5%

Earnings Growth Forecast: 31.4% p.a.

North American Construction Group Ltd., with substantial insider buying recently, shows promising growth prospects. Its earnings are expected to grow 31.37% annually, outstripping the Canadian market forecast of 14.7%. Revenue growth also surpasses market expectations at 17.2% annually compared to the market's 7.3%. However, current profit margins have dipped to 5.2% from last year's 9%, signaling potential concerns in operational efficiency despite a strong ownership and financial outlook.

- Dive into the specifics of North American Construction Group here with our thorough growth forecast report.

- Our valuation report here indicates North American Construction Group may be undervalued.

Make It Happen

- Dive into all 29 of the Fast Growing TSX Companies With High Insider Ownership we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether goeasy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

High growth potential with proven track record and pays a dividend.