Stock Analysis

As the Canadian market experiences subtle shifts amid declining interest rates and a cautious optimism for economic stability, investors are closely monitoring opportunities within the TSX. In this context, dividend stocks emerge as particularly noteworthy, offering potential resilience and steady income in a landscape marked by evolving financial dynamics and central bank policies.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.61% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.15% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.45% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.19% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.43% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.72% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.54% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.43% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.35% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.04% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

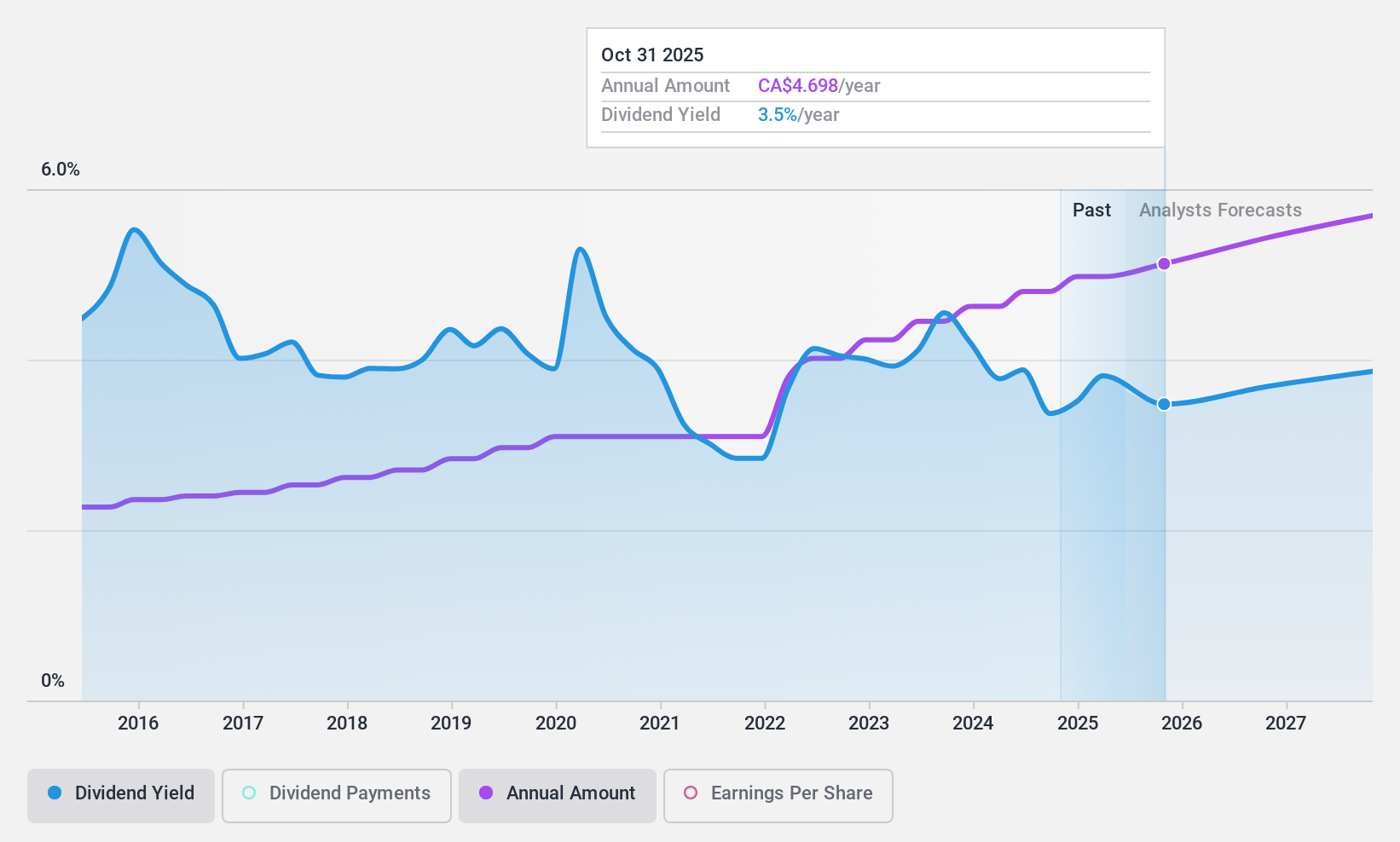

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada, with a market cap of CA$38.29 billion, offers a range of financial services to individuals, businesses, institutional clients, and governments both in Canada and internationally.

Operations: National Bank of Canada generates revenue through three primary segments: Wealth Management (CA$2.61 billion), Personal and Commercial Banking (CA$4.33 billion), and Financial Markets, excluding U.S. Specialty Finance and International, which contributes CA$2.76 billion; additionally, the U.S. Specialty Finance and International segment adds CA$1.16 billion.

Dividend Yield: 3.9%

National Bank of Canada, trading at 41% below our fair value estimate, offers a modest dividend yield of 3.91%, lower than the top Canadian dividend payers. Despite this, dividends have shown reliability and growth over the past decade, supported by a stable payout ratio (42.5%). Recent strategic moves include raising its common share dividend to CAD 1.10 and appointing Scott Burrows to its board, enhancing financial expertise amid various capital-raising activities totaling over CAD 1 billion in equity and fixed-income offerings.

- Delve into the full analysis dividend report here for a deeper understanding of National Bank of Canada.

- In light of our recent valuation report, it seems possible that National Bank of Canada is trading behind its estimated value.

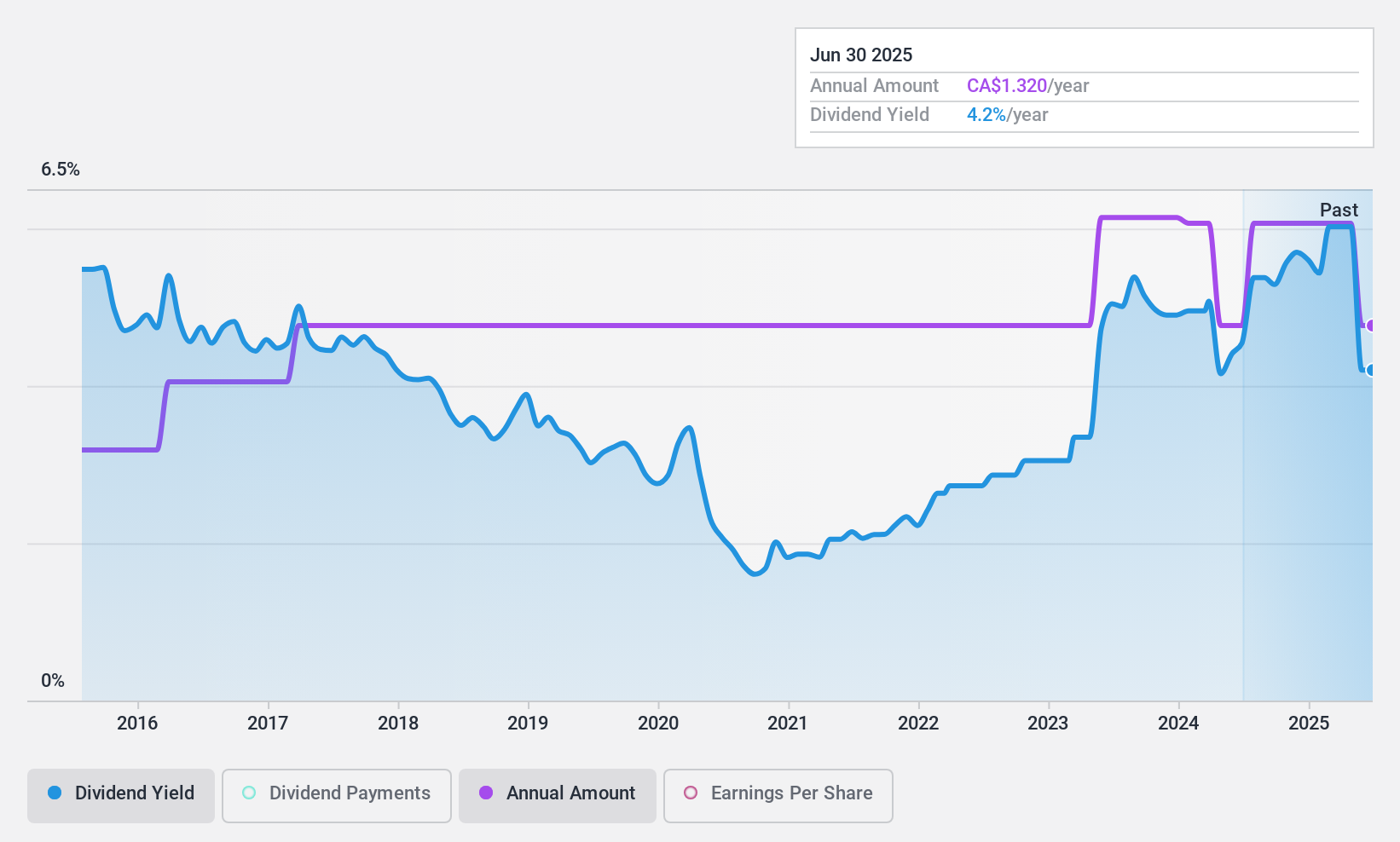

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, operating in North America, specializes in the design, manufacture, and distribution of packaging containers and healthcare supplies with a market capitalization of CA$318.57 million.

Operations: Richards Packaging Income Fund generates its revenue primarily from the wholesale of miscellaneous items, totaling CA$416.97 million.

Dividend Yield: 4.5%

Richards Packaging Income Fund offers a consistent dividend yield of 4.54%, though it's below the top Canadian dividend payers' average. The fund trades at 55.1% under its estimated fair value, suggesting potential undervaluation. Dividends are well-supported by both earnings and cash flows, with payout ratios of 38.5% and 19.4%, respectively, ensuring sustainability. Recent affirmations of monthly distributions at CAD 0.11 per unit underline its commitment to steady shareholder returns despite recent dips in quarterly earnings and sales figures from the previous year.

- Click to explore a detailed breakdown of our findings in Richards Packaging Income Fund's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Richards Packaging Income Fund shares in the market.

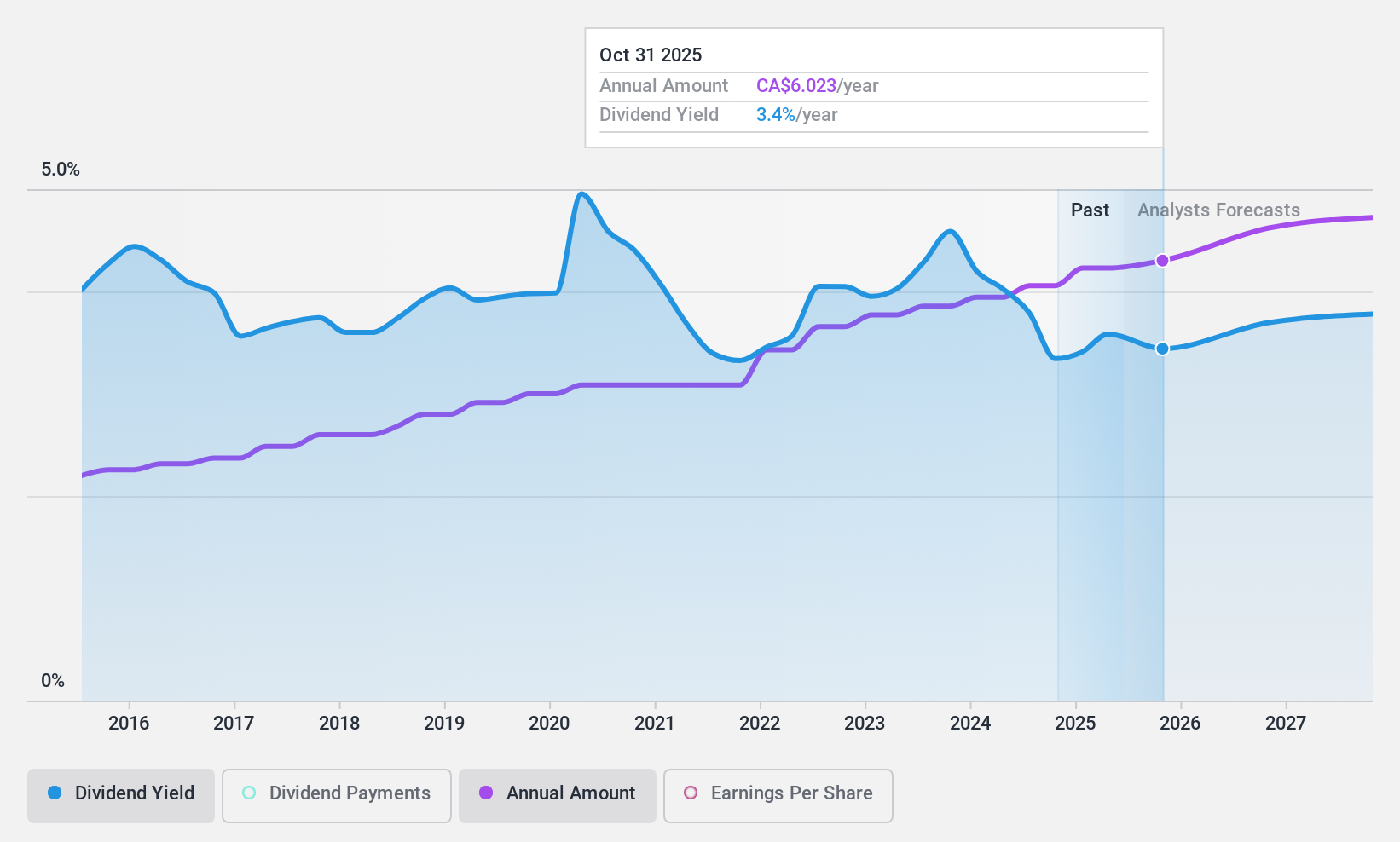

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada, a diversified financial service company with global operations, has a market capitalization of approximately CA$215.84 billion.

Operations: Royal Bank of Canada generates revenue through segments including Personal & Commercial Banking (CA$20.92 billion), Wealth Management (CA$17.47 billion), Capital Markets (CA$10.70 billion), and Insurance (CA$5.91 billion).

Dividend Yield: 3.7%

Royal Bank of Canada offers a modest dividend yield of 3.72%, below the top quartile in the Canadian market. Despite this, its dividends are sustainable with a 50% payout ratio and expected to remain well-covered at 48.2% in three years. The bank's earnings have grown by 9.3% over the past year and are projected to increase by 3.84% annually, supporting future dividend stability and growth. RBC's trading value is currently 29.9% below its estimated fair value, indicating potential upside for investors seeking both income and capital appreciation opportunities.

- Navigate through the intricacies of Royal Bank of Canada with our comprehensive dividend report here.

- Our valuation report unveils the possibility Royal Bank of Canada's shares may be trading at a premium.

Taking Advantage

- Click here to access our complete index of 34 Top TSX Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Richards Packaging Income Fund is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RPI.UN

Richards Packaging Income Fund

Designs, manufactures, and distributes packaging containers and healthcare supplies and products in North America.

Flawless balance sheet established dividend payer.