- Canada

- /

- Oil and Gas

- /

- TSX:MER

How Meren Energy's Dividend Hike and Project Advances (TSX:MER) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Meren Energy announced a substantial dividend increase, alongside significant progress in reducing Reserve-Based Lending debt and advancing major projects in Namibia and Nigeria.

- This move highlights the company’s confidence in future cash flows and emphasizes its ongoing commitment to shareholder value despite volatility in global commodity markets.

- With the dividend boost highlighting management's confidence, we'll examine how these latest developments shape Meren Energy's investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Meren Energy Investment Narrative Recap

To be a Meren Energy shareholder, you need to believe in the company’s ability to transform its large African oil and gas portfolio into sustainable long-term cash flow, mainly by delivering major projects like Venus in Namibia. The recent dividend hike signals confidence, but it doesn't fully resolve short-term risks tied to declining production and the current pause in Nigerian drilling, so its immediate impact on stable earnings is limited.

Among the latest announcements, the commitment to repay Reserve-Based Lending debt stands out, especially as Meren juggles high capital commitments and operational execution risks. This de-leveraging effort directly supports one of the business’s most important catalysts: funding new projects to offset declining production while aiming for future profitability.

By contrast, looming questions about reserve depletion and the absence of near-term production growth remain information investors should consider before...

Read the full narrative on Meren Energy (it's free!)

Meren Energy's narrative projects $1.0 billion revenue and $299.9 million earnings by 2028. This requires 91.5% yearly revenue growth and a $528.9 million earnings increase from current earnings of $-229.0 million.

Uncover how Meren Energy's forecasts yield a CA$2.61 fair value, a 43% upside to its current price.

Exploring Other Perspectives

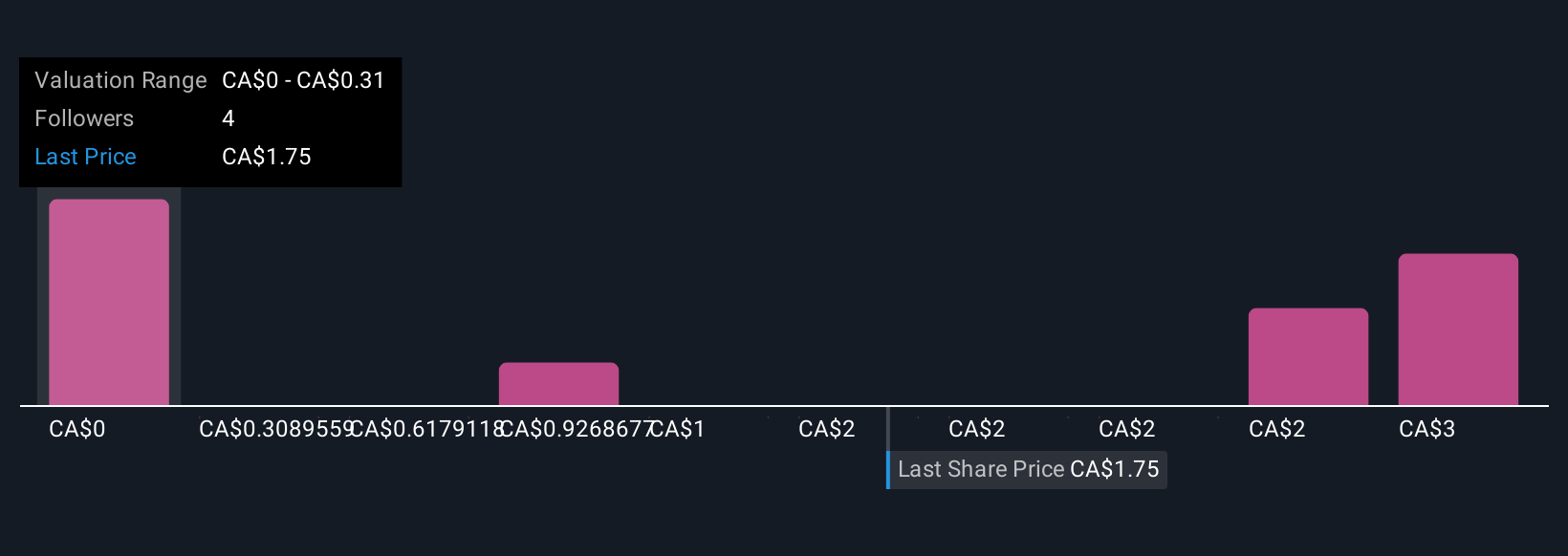

Seven Simply Wall St Community estimates put Meren’s fair value between US$0.31 and US$3.08 per share, showing views can be miles apart. While many focus on long-term project delivery to drive future returns, you should weigh how current risks to production levels could shape both sentiment and price action.

Explore 7 other fair value estimates on Meren Energy - why the stock might be worth as much as 69% more than the current price!

Build Your Own Meren Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meren Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Meren Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meren Energy's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MER

Meren Energy

Operates as an oil and gas exploration and production company in Nigeria, Namibia, South Africa, and Equatorial Guinea.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026