- Canada

- /

- Oil and Gas

- /

- TSX:MER

Assessing Meren Energy (TSX:MER) Valuation Following Dividend Hike, Project Progress, and Debt Reduction

Reviewed by Kshitija Bhandaru

Meren Energy (TSX:MER) has caught the market's attention following a major dividend hike, as well as updates on debt reduction and key projects in Namibia and Nigeria. These moves emphasize the company's focus on shareholder returns and steady growth.

See our latest analysis for Meren Energy.

After rallying on the back of its dividend hike and progress in Namibia and Nigeria, Meren Energy’s share price has retraced recently, slipping over the past week and month. Its 1-year total shareholder return of 3.8% hints at underlying resilience. While the year-to-date share price return is negative, the five-year total return still stands as a strong outlier in the energy sector. This suggests that momentum may just be shifting rather than lost.

If Meren’s latest moves have you curious about what else is trending, now’s the perfect time to discover fast growing stocks with high insider ownership

With so much positive momentum and a share price still trading below analysts’ targets, the key question is whether Meren Energy remains undervalued or if recent developments are already reflected in the price and future growth is fully priced in.

Most Popular Narrative: 32.9% Undervalued

The most popular view assigns Meren Energy a fair value well above its last close, suggesting notable upside if bold profit and margin projections are realized.

The fully funded Venus development project in Namibia, with a potential Final Investment Decision in early 2026 and First Oil expected by 2029, positions Meren Energy for significant long-life production and sustainable cash flow. This supports future revenue and earnings growth. Ongoing underinvestment in global upstream oil and gas, combined with Meren's robust resource base and upcoming production projects, could lead to tighter industry supply and potentially higher realized prices, improving free cash flow and margins.

Curious about the ambitious forecasts that power this fair value? Crunchy earnings jumps, surging revenues, and a future profit margin are the secret ingredients. What mix of financial leaps fuels this upside outlook? The full story is packed with surprises you do not want to miss.

Result: Fair Value of $2.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays to key projects or extended periods of low oil prices could quickly undermine Meren Energy’s bullish growth outlook and put future returns at risk.

Find out about the key risks to this Meren Energy narrative.

Another View: Sizing Up the Market Ratio

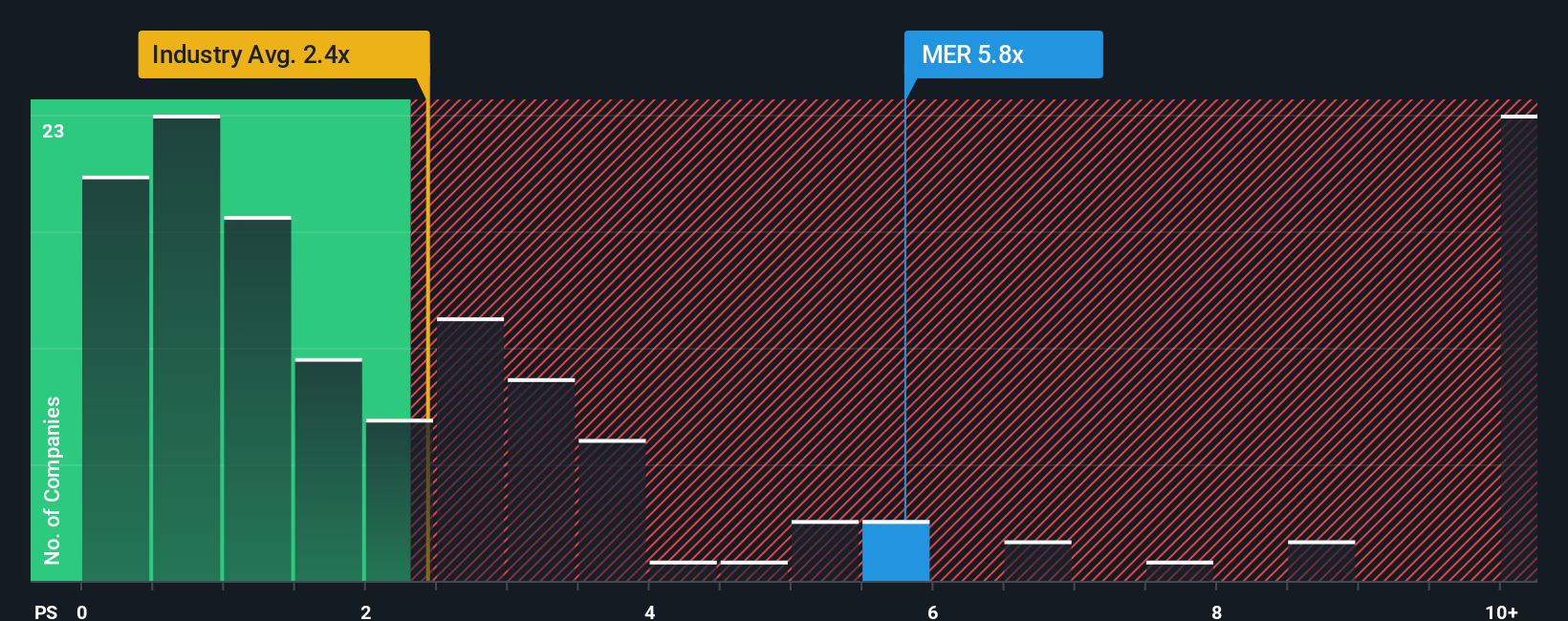

Looking beyond ambitious growth forecasts, the current market price gives Meren Energy a sales multiple of 5.8, which stands well above both industry peers and the broader Canadian oil and gas average. While this shows high expectations are already baked in, it also spotlights the risk. If results fall short, could the share price swiftly correct?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meren Energy Narrative

If you want to dig into the numbers yourself or come to a different conclusion, you can build your perspective in just a few minutes. Do it your way

A great starting point for your Meren Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move by seizing the opportunities most investors overlook. The Simply Wall Street Screener opens up a world of investment possibilities just waiting for you to capture them.

- Uncover high-potential opportunities by checking out these 891 undervalued stocks based on cash flows, where undervalued stocks might offer strong upside before the crowd catches on.

- Fuel your portfolio with passive income by exploring these 19 dividend stocks with yields > 3%, which spotlights robust yields and sustainable payouts above 3%.

- Stay ahead of tomorrow’s tech wave when you browse these 24 AI penny stocks, focused on companies driving breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MER

Meren Energy

Operates as an oil and gas exploration and production company in Nigeria, Namibia, South Africa, and Equatorial Guinea.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)