November 2024's Leading Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

In the wake of a significant political shift in the United States, global markets have been buoyed by expectations of economic growth and tax reforms, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. Amidst these developments, identifying stocks that are trading below their intrinsic value can offer investors potential opportunities to capitalize on market optimism while maintaining a focus on fundamental strengths.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$177.94 | CA$354.07 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$155.50 | NT$310.76 | 50% |

| KMC (Kuei Meng) International (TWSE:5306) | NT$125.50 | NT$250.05 | 49.8% |

| XPEL (NasdaqCM:XPEL) | US$45.67 | US$91.12 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.35 | CN¥22.56 | 49.7% |

| GRCS (TSE:9250) | ¥1511.00 | ¥3000.50 | 49.6% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3920.00 | ¥7808.63 | 49.8% |

| QuinStreet (NasdaqGS:QNST) | US$23.42 | US$46.52 | 49.7% |

| Delixi New Energy Technology (SHSE:603032) | CN¥17.95 | CN¥35.80 | 49.9% |

Let's review some notable picks from our screened stocks.

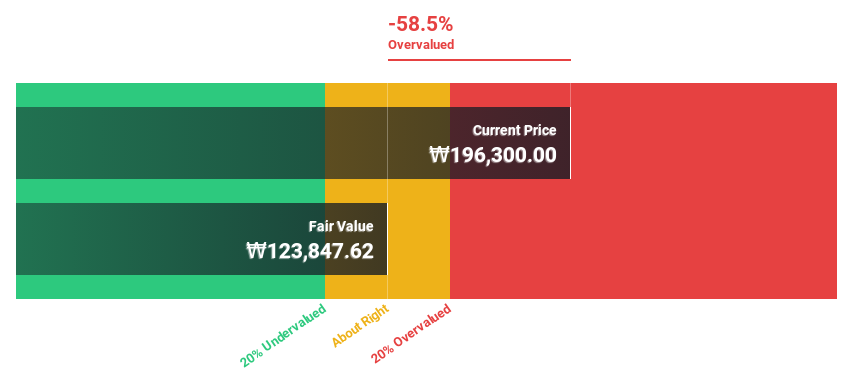

LIG Nex1 (KOSE:A079550)

Overview: LIG Nex1 Co., Ltd. develops and produces various weapon systems worldwide, with a market cap of ₩5.80 trillion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling ₩2.58 billion.

Estimated Discount To Fair Value: 31.1%

LIG Nex1 is trading at ₩258,000, significantly below its estimated fair value of ₩374,692.65, representing a potential undervaluation based on discounted cash flow analysis. Despite earnings growing 37.5% annually over the past five years and forecasted to grow 20% per year, this growth is slower than the broader KR market's expectations. However, revenue growth of 15.6% per year outpaces the KR market average of 10.1%, highlighting strong operational performance amidst valuation concerns.

- Upon reviewing our latest growth report, LIG Nex1's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of LIG Nex1 stock in this financial health report.

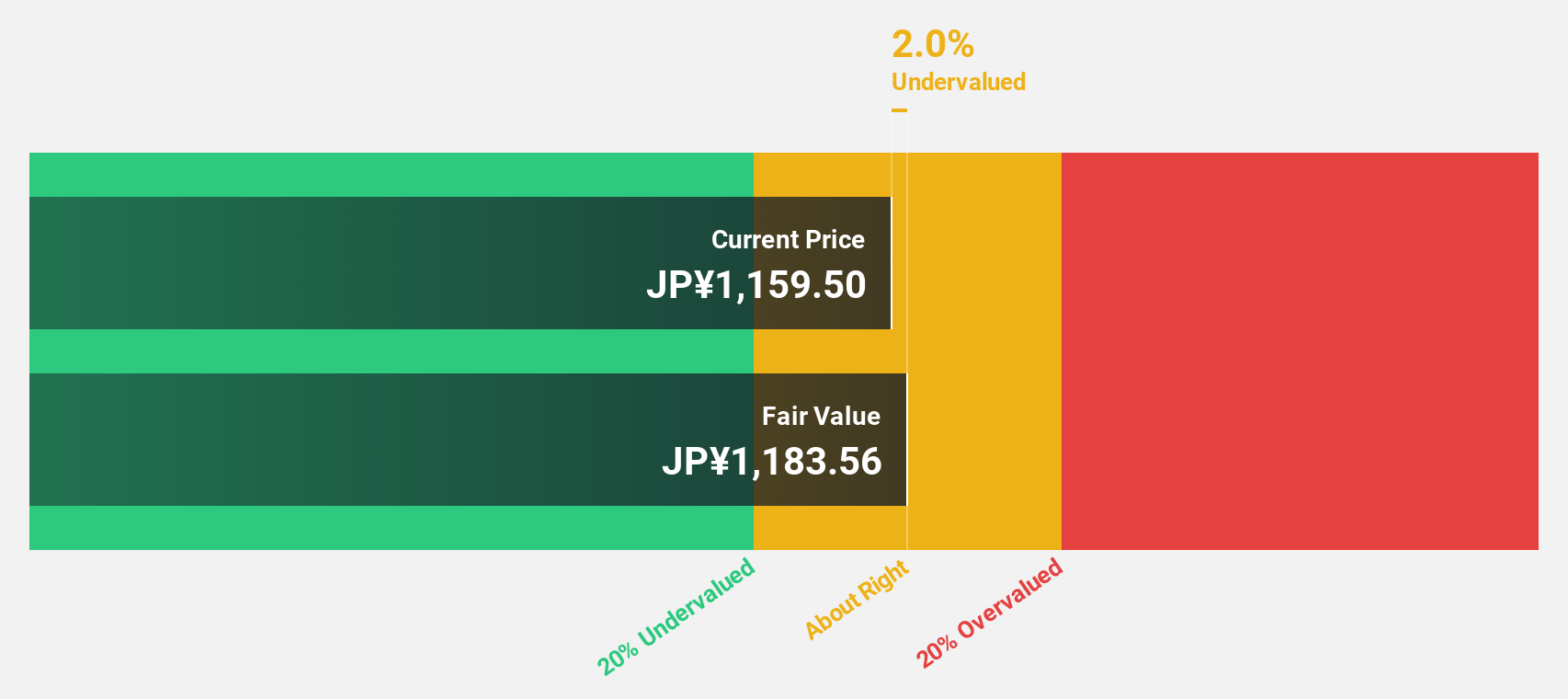

Gunma Bank (TSE:8334)

Overview: The Gunma Bank, Ltd. offers a range of banking and financial products and services in Japan with a market cap of ¥371.60 billion.

Operations: The company's revenue is primarily derived from its banking segment, which accounts for ¥168.72 billion, followed by the lease segment at ¥29.70 billion.

Estimated Discount To Fair Value: 29.4%

Gunma Bank is trading at ¥1,040, significantly below its estimated fair value of ¥1,472.16, suggesting potential undervaluation based on discounted cash flow analysis. The bank's revenue is forecast to grow 26.9% annually, outpacing the JP market's 4.2%, while earnings are expected to rise by 9.19% per year. Recent buybacks totaling ¥4,999.91 million enhance shareholder returns and capital efficiency following revised profit guidance for fiscal year ending March 2025.

- Our earnings growth report unveils the potential for significant increases in Gunma Bank's future results.

- Take a closer look at Gunma Bank's balance sheet health here in our report.

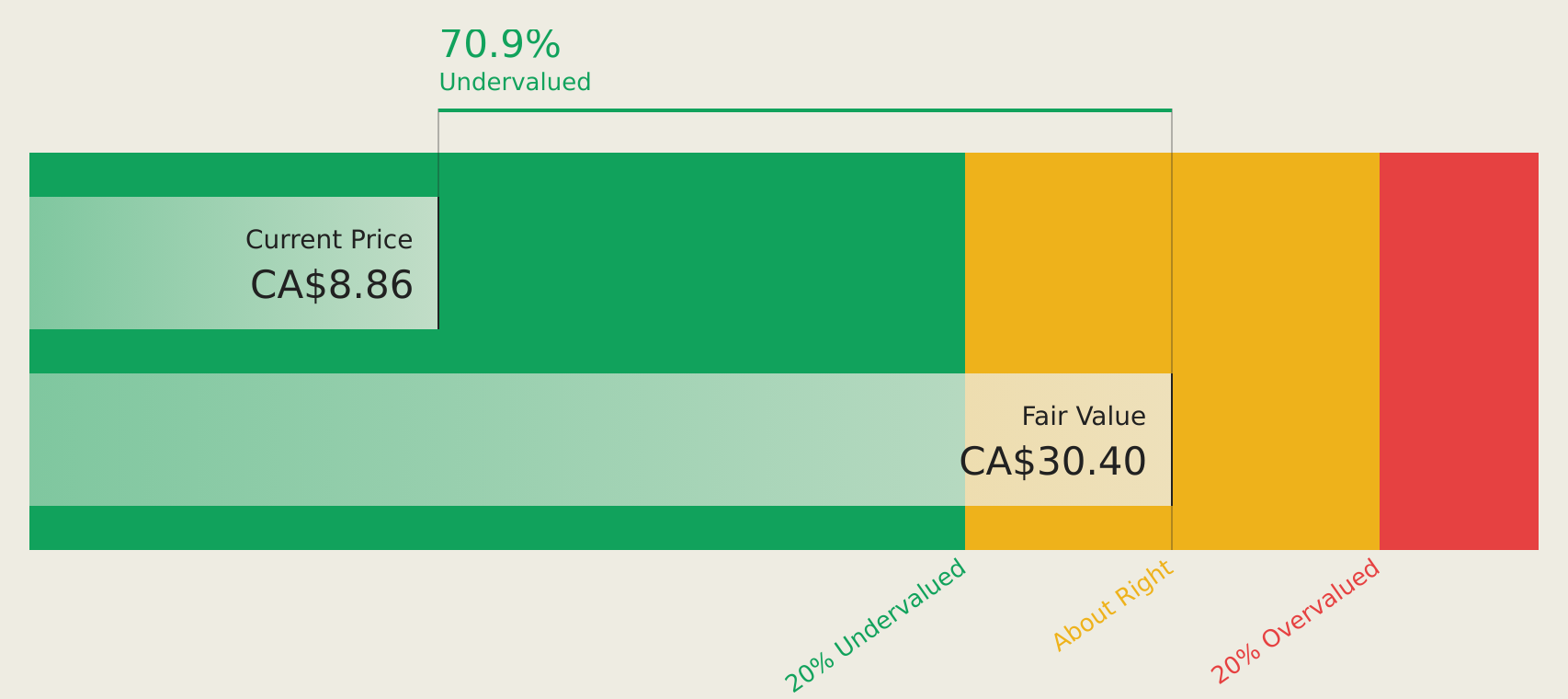

Mattr (TSX:MATR)

Overview: Mattr Corp. is a material technology company serving diverse markets including transportation, communication, water management, energy and electrification across multiple regions worldwide, with a market cap of CA$1 billion.

Operations: The company's revenue segments include Composite Technologies at CA$524.41 million and Connection Technologies at CA$340.26 million.

Estimated Discount To Fair Value: 49.4%

Mattr is trading at CA$16.1, significantly below its estimated fair value of CA$31.81, highlighting potential undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 8.3% to 3.5%, earnings are projected to grow substantially by 54.48% annually, outpacing the Canadian market's growth rate of 16.6%. Recent M&A discussions and strategic presentations may further influence its financial trajectory and investor perception.

- Insights from our recent growth report point to a promising forecast for Mattr's business outlook.

- Get an in-depth perspective on Mattr's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 896 companies within our Undervalued Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8334

Gunma Bank

Provides various banking and financial products and services in Japan.

Solid track record with excellent balance sheet and pays a dividend.