- Canada

- /

- Oil and Gas

- /

- TSX:KEY

It Might Not Be A Great Idea To Buy Keyera Corp. (TSE:KEY) For Its Next Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Keyera Corp. (TSE:KEY) is about to trade ex-dividend in the next four days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, Keyera investors that purchase the stock on or after the 21st of October will not receive the dividend, which will be paid on the 15th of November.

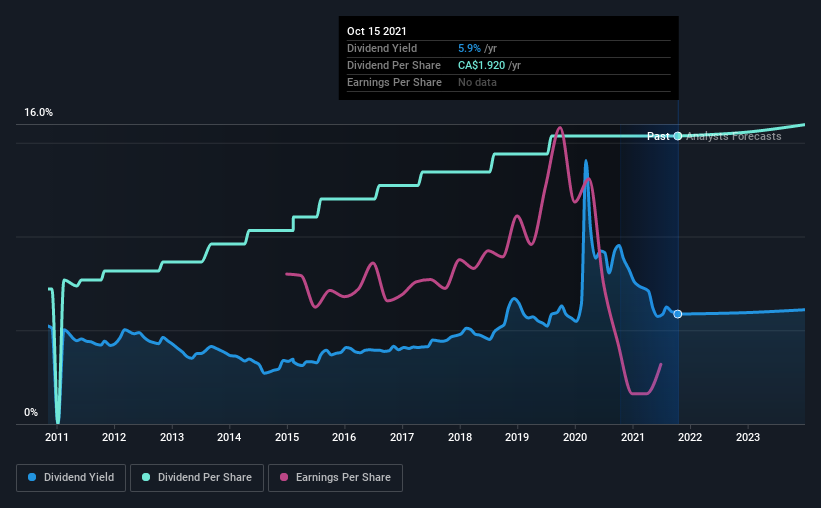

The company's next dividend payment will be CA$0.16 per share, on the back of last year when the company paid a total of CA$1.92 to shareholders. Calculating the last year's worth of payments shows that Keyera has a trailing yield of 5.9% on the current share price of CA$32.75. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Keyera

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Keyera paid out a disturbingly high 345% of its profit as dividends last year, which makes us concerned there's something we don't fully understand in the business. A useful secondary check can be to evaluate whether Keyera generated enough free cash flow to afford its dividend. It paid out an unsustainably high 227% of its free cash flow as dividends over the past 12 months, which is worrying. Unless there were something in the business we're not grasping, this could signal a risk that the dividend may have to be cut in the future.

Cash is slightly more important than profit from a dividend perspective, but given Keyera's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Keyera's earnings per share have fallen at approximately 14% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Keyera has increased its dividend at approximately 7.9% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Keyera is already paying out 345% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

The Bottom Line

From a dividend perspective, should investors buy or avoid Keyera? It's looking like an unattractive opportunity, with its earnings per share declining, while, paying out an uncomfortably high percentage of both its profits (345%) and cash flow as dividends. This is a clearly suboptimal combination that usually suggests the dividend is at risk of being cut. If not now, then perhaps in the future. Bottom line: Keyera has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

With that in mind though, if the poor dividend characteristics of Keyera don't faze you, it's worth being mindful of the risks involved with this business. For example, Keyera has 5 warning signs (and 1 which is a bit concerning) we think you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

Valuation is complex, but we're here to simplify it.

Discover if Keyera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:KEY

Keyera

Engages in the gathering and processing of natural gas; and the transportation, storage, and marketing of natural gas liquids (NGLs) in Canada and the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026