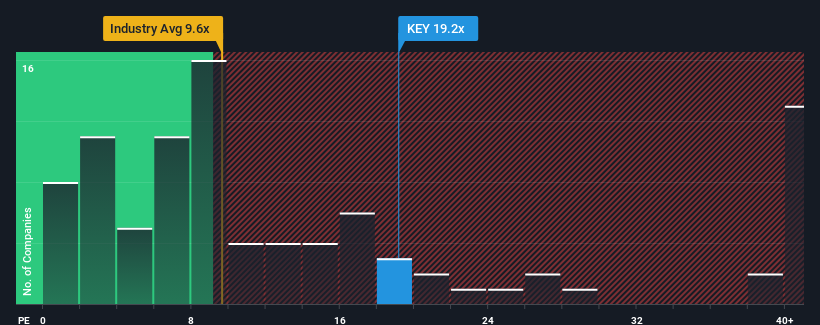

When close to half the companies in Canada have price-to-earnings ratios (or "P/E's") below 13x, you may consider Keyera Corp. (TSE:KEY) as a stock to potentially avoid with its 19.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Keyera certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Keyera

Is There Enough Growth For Keyera?

There's an inherent assumption that a company should outperform the market for P/E ratios like Keyera's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. The strong recent performance means it was also able to grow EPS by 558% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 7.9% per year growth forecast for the broader market.

With this information, we can see why Keyera is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Keyera's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Keyera's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Keyera (1 is potentially serious!) that you should be aware of.

Of course, you might also be able to find a better stock than Keyera. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Keyera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KEY

Keyera

Engages in the gathering and processing of natural gas; and transportation, storage, and marketing of natural gas liquids (NGLs) in Canada and the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives