- Canada

- /

- Oil and Gas

- /

- TSX:IPCO

Is International Petroleum’s (TSX:IPCO) New Buyback the Clearest Signal Yet on Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Earlier this month, International Petroleum Corporation (TSX:IPCO) announced a new normal course issuer bid authorizing the repurchase and cancellation of up to 6,468,077 shares, or about 5.77% of its 112,155,527 outstanding common shares, through to December 4, 2026.

- This move tightens the share count at a time when analysts already expect meaningful reductions in shares outstanding, potentially amplifying future per-share metrics if the company delivers on its growth plans.

- Next, we’ll examine how this newly authorized share repurchase program could shape International Petroleum’s investment narrative and outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

International Petroleum Investment Narrative Recap

To own International Petroleum today, you have to believe that its capital-intensive growth plan, anchored by Blackrod Phase 1, will ultimately translate into stronger per-share results despite recent earnings pressure and higher debt. The newly authorized normal course issuer bid supports that per-share focus, but it does not materially change the near term picture, where execution risk at Blackrod and funding the build-out remain the key swing factors for the story.

The new buyback authorization on December 3, 2025 sits alongside an already active repurchase track record in 2025, where IPCO has been steadily reducing its share count. For investors watching catalysts, this continuity in buybacks may matter most if the company eventually achieves the earnings growth many expect, because sustained cancellations could enhance how much of that future cash flow each remaining share captures.

Yet against this potential, investors should be aware of how heavily the thesis still leans on Blackrod Phase 1 and what happens if...

Read the full narrative on International Petroleum (it's free!)

International Petroleum's narrative projects $1.2 billion revenue and $218.6 million earnings by 2028. This requires 18.7% yearly revenue growth and about a 4.1x earnings increase from $53.4 million today.

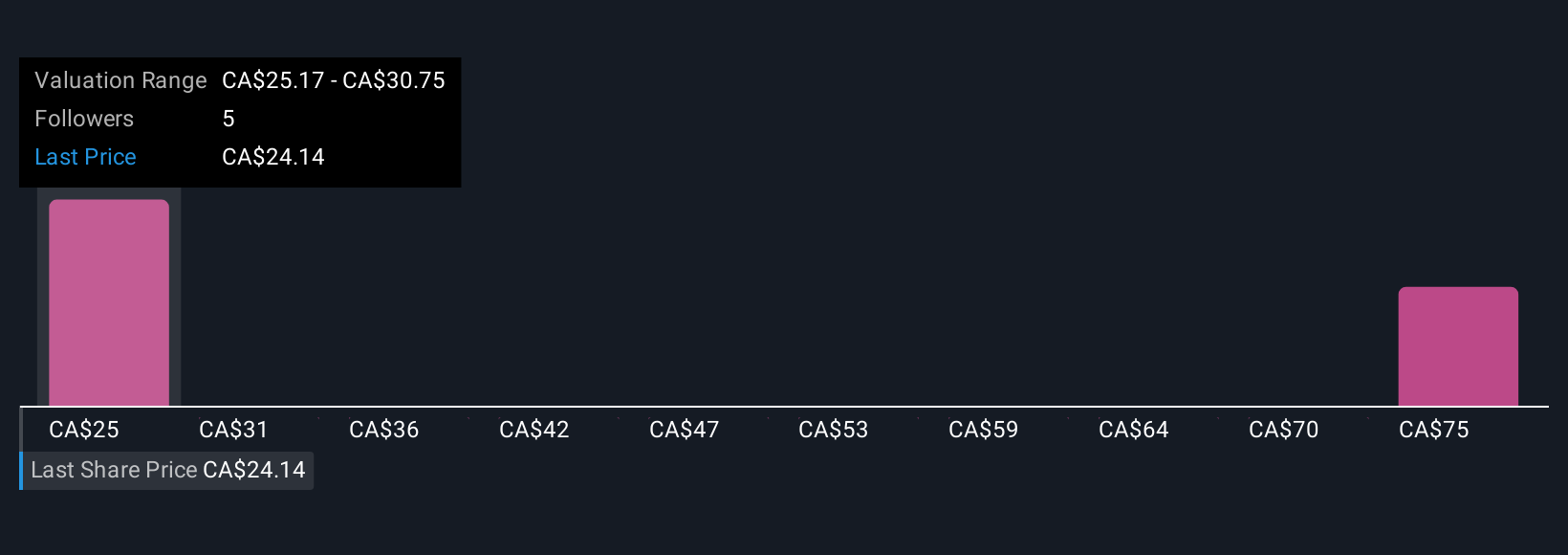

Uncover how International Petroleum's forecasts yield a CA$25.17 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span a wide range, from CA$25.17 to CA$84.47, underscoring how differently people view IPCO’s potential. When you set those views against the central role of Blackrod Phase 1 and the company’s higher near term capital needs, it becomes even more important to compare several perspectives before deciding how this story fits in your portfolio.

Explore 4 other fair value estimates on International Petroleum - why the stock might be worth over 3x more than the current price!

Build Your Own International Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Petroleum research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free International Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Petroleum's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IPCO

International Petroleum

Explores for, develops, and produces oil and gas.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026