- Canada

- /

- Oil and Gas

- /

- TSX:IMO

Are Imperial Oil's (TSX:IMO) Efficiency Gains Quietly Reframing Its Long-Term Risk Profile?

Reviewed by Sasha Jovanovic

- In recent days, Imperial Oil reported strong upstream production gains and operational improvements across its integrated Canadian energy operations, spanning crude oil production, refining, and distribution.

- This production uplift, underpinned by technology-driven processes and efficiency enhancements, appears to be reinforcing confidence in the company’s ability to execute and optimize its asset base.

- We’ll now explore how these upstream production gains and efficiency improvements may influence Imperial Oil’s existing investment narrative and risk outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Imperial Oil Investment Narrative Recap

To own Imperial Oil, you need to believe its integrated model and cost efficiencies can offset commodity volatility and long term decarbonization pressures. The latest upstream production gains support the near term margin expansion catalyst but do little to reduce core exposure to oil sands policy and energy transition risk, which remains the biggest overhang for the business.

Among recent announcements, the reaffirmed quarterly dividend of CA$0.72 per share through late 2025 stands out, as it signals management’s confidence in cash generation supported by higher production and efficiency improvements. For investors focused on income, this dividend profile sits alongside the company’s capital intensive oil sands footprint and ongoing buybacks, shaping expectations around capital returns and reinvestment capacity in the face of evolving demand for hydrocarbons and lower emission fuels.

Yet against these strengths, investors should also be aware that Imperial’s heavy oil sands exposure could become a bigger problem if...

Read the full narrative on Imperial Oil (it's free!)

Imperial Oil's narrative projects CA$51.8 billion revenue and CA$3.9 billion earnings by 2028. This requires 1.5% yearly revenue growth and a CA$0.8 billion earnings decrease from CA$4.7 billion today.

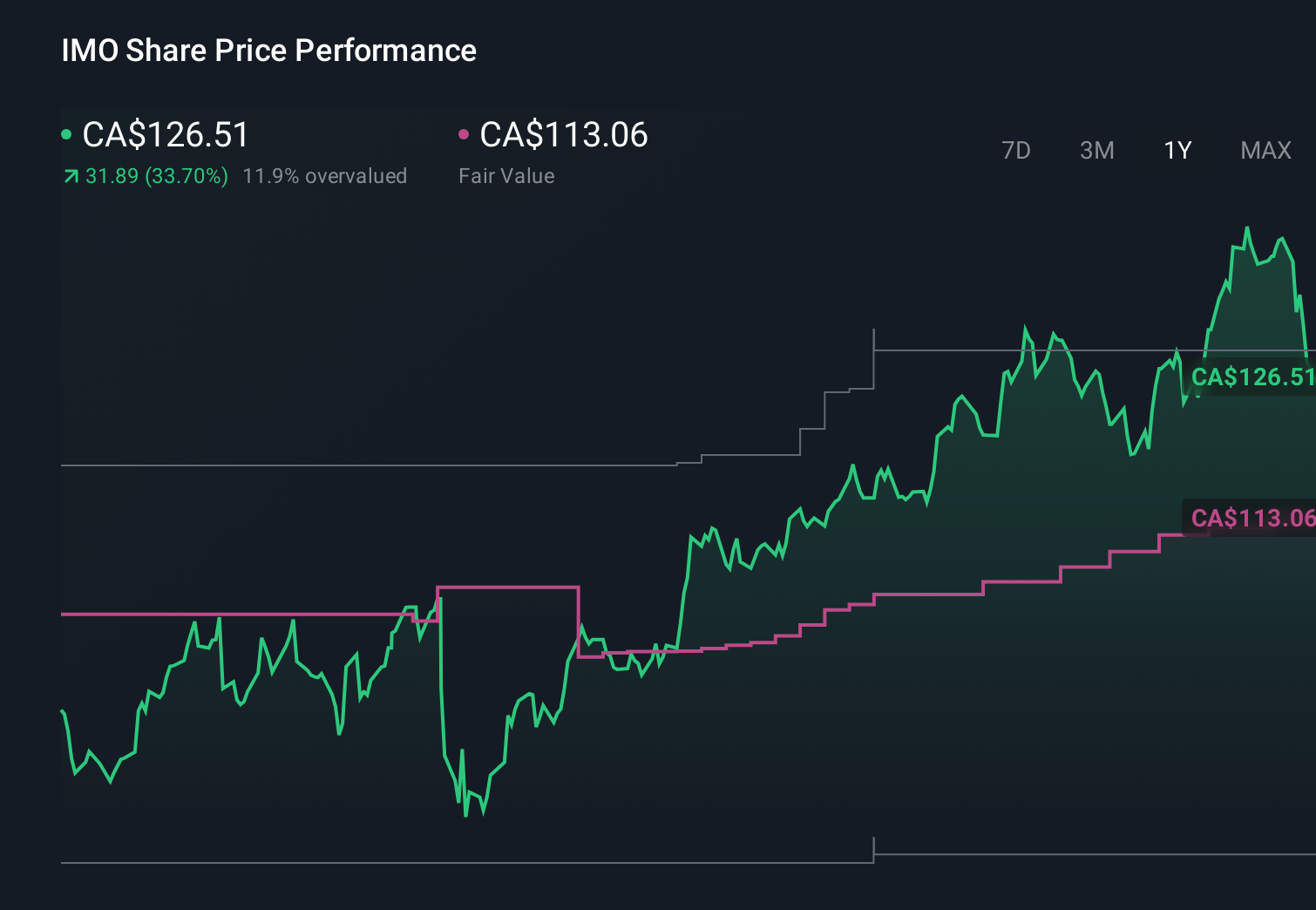

Uncover how Imperial Oil's forecasts yield a CA$113.06 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Imperial Oil span roughly CA$113 to CA$275, showing how far apart individual views can be. When you set those side by side with the company’s dependence on carbon intensive oil sands assets, it becomes even more important to understand how different investors weigh transition risk and long term earnings resilience.

Explore 3 other fair value estimates on Imperial Oil - why the stock might be worth 11% less than the current price!

Build Your Own Imperial Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Imperial Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Imperial Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Imperial Oil's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026