- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Is Consistent Dividend Declaration Altering The Investment Case For Freehold Royalties (TSX:FRU)?

Reviewed by Simply Wall St

- Freehold Royalties Ltd. has declared a cash dividend of C$0.09 per common share, payable on August 15, 2025 to shareholders of record as of July 31, 2025.

- This payout reflects the company's ongoing commitment to returning capital to shareholders through regular dividends.

- We will explore how Freehold Royalties' consistent dividend declaration supports its role as an income-generating investment opportunity.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

What Is Freehold Royalties' Investment Narrative?

To be a shareholder in Freehold Royalties, an investor needs to see long-term value in stable, income-focused energy assets and believe the company can continue to generate reliable cash flows to support its attractive dividend. The newly affirmed C$0.09 dividend and recent slight price increase reinforce Freehold’s image as a steady income provider, rather than dramatically altering the risk or catalyst profile in the near term. For now, the biggest short-term catalysts remain operational delivery against production targets and efficient execution by the refreshed executive team, both of which underpin dividend sustainability. Risks are more connected to forecasted revenue declines, sector comparatives on valuation, and the ongoing need for disciplined capital and acquisition decisions. The latest announcement keeps the company’s pattern of regular payout unchanged, so the risk and catalyst outlook largely remains steady.

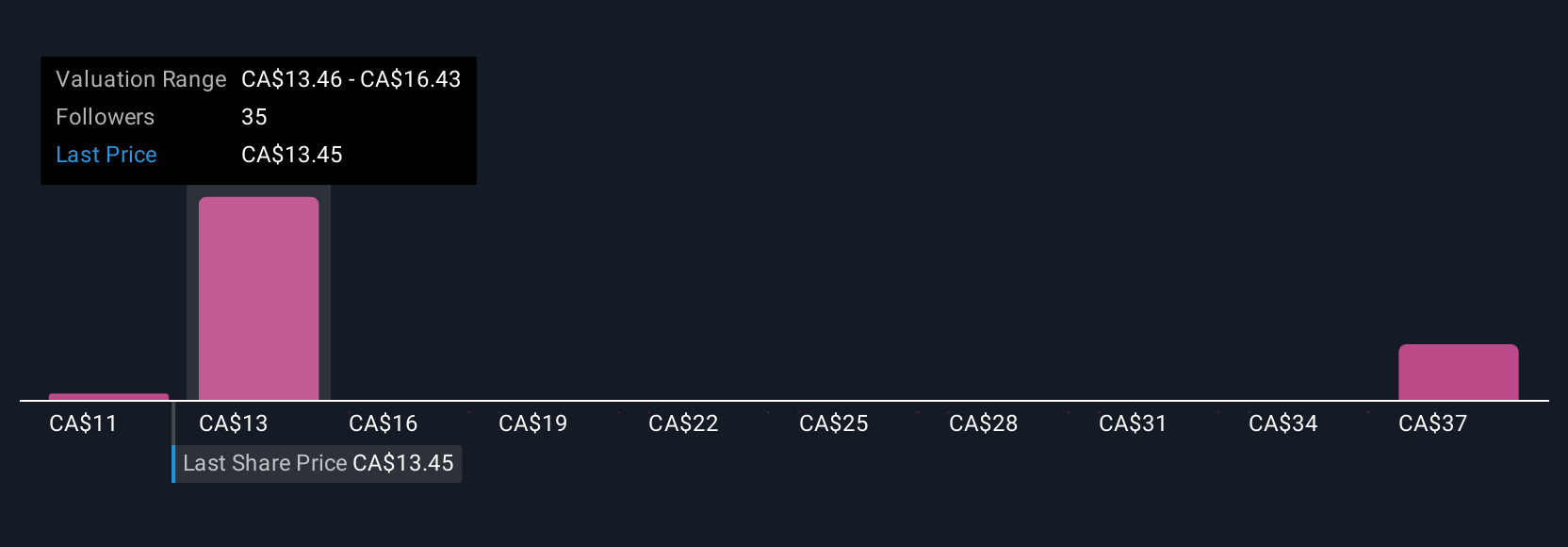

But with production growth estimates facing downward revisions, that’s an evolving risk investors should be aware of. Freehold Royalties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Build Your Own Freehold Royalties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freehold Royalties research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freehold Royalties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freehold Royalties' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives