- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Freehold Royalties (TSX:FRU): Valuation Insights After Latest Steady Dividend Declaration

Reviewed by Kshitija Bhandaru

Freehold Royalties (TSX:FRU) just announced its latest monthly dividend of CAD 0.09 per share, payable in November. This move highlights management’s confidence in steady income for shareholders and continued operational strength.

See our latest analysis for Freehold Royalties.

After reaffirming its monthly dividend, Freehold Royalties has seen steady momentum, with its share price closing recently at $13.55. While its 1-year total shareholder return stands at a modest 5.5%, the stock is coming off a robust five-year total return of 373%, which highlights the company’s long-term value creation. Recent events, such as ongoing conference presentations and stability in income distribution, suggest the company is focused on reinforcing investor confidence and sustaining yields over time.

If you're curious to see what other income-focused or rapidly growing companies are attracting attention, now’s a great moment to expand your search and discover fast growing stocks with high insider ownership

With the stock trading below analyst targets and offering a steady dividend, investors may be wondering whether Freehold Royalties is undervalued or if its recent gains mean the market has already factored in the company’s future growth prospects.

Price-to-Earnings of 18.6x: Is it justified?

Freehold Royalties trades at a price-to-earnings ratio of 18.6x, notably above the Canadian Oil and Gas industry average of 12x. Its last close was CA$13.55, suggesting investors are willing to pay a premium for the company's earnings profile.

The price-to-earnings (P/E) ratio shows how much investors are paying for each dollar of earnings and is a key metric for profitability-focused sectors like oil and gas. A higher P/E compared to peers may indicate confidence in durable earnings, future cash flows, or a perception of lower risk relative to industry counterparts.

Despite its high-quality earnings, this elevated multiple signals the market expects either resilience or growth that matches or outpaces industry trends, even as recent financial performance has moderated. Companies in mature resource sectors often see such premiums only if their business models or management teams are seen as especially robust.

Compared to the industry and peer averages, Freehold’s ratio stands out as expensive. Investors seem to be pricing in more than immediate results. Without clear upside from rapid earnings growth or multiple expansion, this could leave the stock vulnerable to a re-rating if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 18.6x (OVERVALUED)

However, slow annual revenue growth and the stock’s premium valuation could challenge the bullish outlook if industry dynamics or earnings momentum weaken further.

Find out about the key risks to this Freehold Royalties narrative.

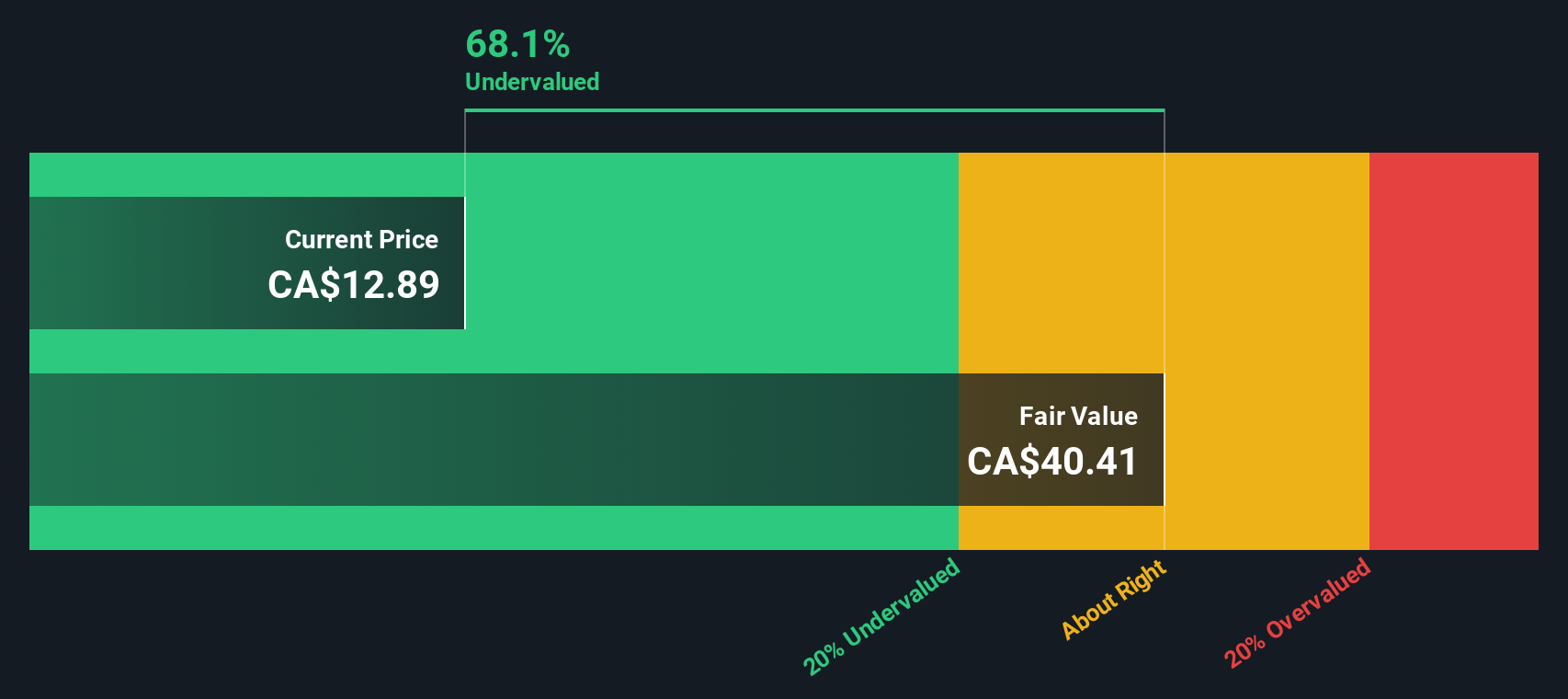

Another View: SWS DCF Model Shows Major Discount

Looking at Freehold Royalties through our DCF model gives a very different result. The SWS DCF model estimates the fair value at CA$42.22 per share. With the current price at CA$13.55, the stock is trading at a discount of nearly 68 percent. Could the stock be dramatically undervalued, or does this signal caution is needed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Freehold Royalties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Freehold Royalties Narrative

If you want to dig deeper or chart your own course through the data, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your Freehold Royalties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio's potential and stay ahead of the curve. Don't miss standout opportunities in sectors set for rapid growth and steady returns with these powerful tools:

- Tap into the momentum of tech-driven innovation by checking out these 24 AI penny stocks, where the next AI trailblazers are shaping whole industries.

- Capture income from resilient businesses by reviewing these 18 dividend stocks with yields > 3%, loaded with companies offering solid yields above 3 percent.

- Position yourself for tomorrow’s breakthroughs by uncovering market disruptors in quantum computing with these 26 quantum computing stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives