- Canada

- /

- Oil and Gas

- /

- TSX:ELEF

Investors might be losing patience for Silver Elephant Mining's (TSE:ELEF) increasing losses, as stock sheds 46% over the past week

It's possible to achieve returns close to the market-weighted average return by buying an index fund. But even in a market-beating portfolio, some stocks will lag the market. The Silver Elephant Mining Corp. (TSE:ELEF) stock price is down 95% over five years, but the total shareholder return is 210% once you include the dividend. And that total return actually beats the market return of 69%. And some of the more recent buyers are probably worried, too, with the stock falling 40% in the last year. The falls have accelerated recently, with the share price down 74% in the last three months. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

With the stock having lost 46% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Silver Elephant Mining

Silver Elephant Mining hasn't yet reported any revenue, so it's as much a business idea as an actual business. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Silver Elephant Mining finds fossil fuels with an exploration program, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Silver Elephant Mining has already given some investors a taste of the bitter losses that high risk investing can cause.

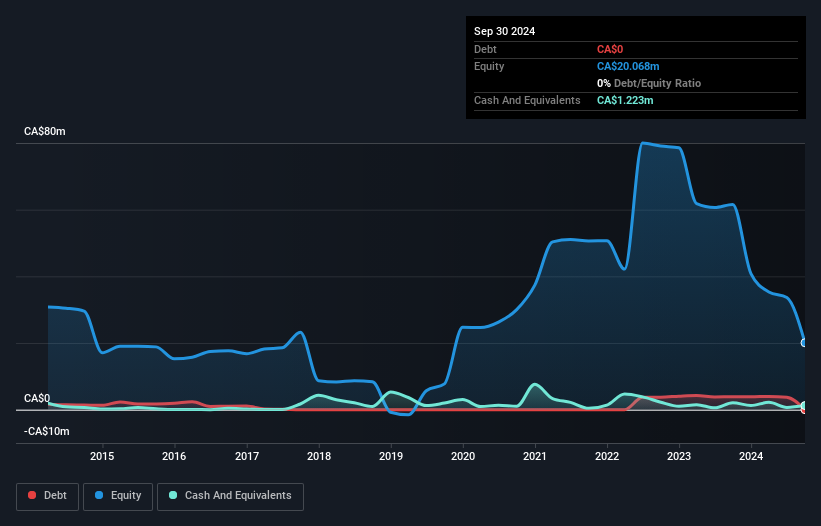

Silver Elephant Mining had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. But with the share price diving 14% per year, over 5 years , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can click on the image below to see (in greater detail) how Silver Elephant Mining's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

What About The Total Shareholder Return (TSR)?

We've already covered Silver Elephant Mining's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Silver Elephant Mining's TSR, at 210% is higher than its share price return of -95%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in Silver Elephant Mining had a tough year, with a total loss of 40%, against a market gain of about 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 25% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Silver Elephant Mining (including 3 which can't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELEF

Silver Elephant Mining

A mineral exploration stage company, engages in the acquisition, exploration, and development of mineral properties in the United States, Canada, Bolivia, and Mongolia.

Medium-low with adequate balance sheet.