- Canada

- /

- Oil and Gas

- /

- TSX:EFR

US-Made Rare Earth Magnets Could Be a Game Changer for Energy Fuels (TSX:EFR)

Reviewed by Simply Wall St

- Energy Fuels announced that its high-purity neodymium-praseodymium oxide produced at the White Mesa Mill in Utah has been successfully manufactured into commercial-scale rare earth magnets by South Korea's largest EV drive unit motor core producer, passing all quality tests for major automakers globally.

- This achievement marks a crucial step in establishing a China-independent, U.S.-anchored supply chain for rare earth materials essential to electric and hybrid vehicles.

- We'll explore how qualification of Energy Fuels' U.S.-sourced magnet material could reshape the company's outlook amid its rare earth expansion efforts.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Energy Fuels Investment Narrative Recap

If you're considering Energy Fuels as an investment, the essential story to believe in is the company's push to become a major North American supplier of rare earth materials and uranium, capitalizing on growing demand for supply chain security and electrification. The recent qualification of its high-purity NdPr oxide for use in EV magnets strengthens this thesis and encourages confidence in its rare earths ambitions, though the main short-term catalyst, progress toward securing more diversified, long-term feedstock and offtake agreements, remains a work in progress. However, the biggest risk continues to be the company's heavy reliance on a single U.S. feedstock supplier for scaling rare earth oxide production, a bottleneck that could limit near-term revenue growth and delay wider commercial impact if further offtake deals or upstream expansions stall.

Recent production advancements at the White Mesa Mill, including the successful pilot-scale output of high-purity dysprosium oxide in August, directly reinforce the company’s rare earth credentials at a time when successful magnet qualification is in the spotlight. These milestones showcase Energy Fuels’ technical progress, but highlight how unlocking sustained supply and offtake partnerships will be key for transitioning from pilot achievements to commercial revenue streams.

Still, as promising as these breakthroughs are, investors should be aware that without new, guaranteed sources of rare earth feedstock, the company remains exposed to ...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' outlook projects $553.4 million in revenue and $237.8 million in earnings by 2028, based on analysts' forecasts. This scenario assumes 104.1% annual revenue growth and an increase in earnings of $330.9 million from the current -$93.1 million.

Uncover how Energy Fuels' forecasts yield a CA$17.98 fair value, a 3% downside to its current price.

Exploring Other Perspectives

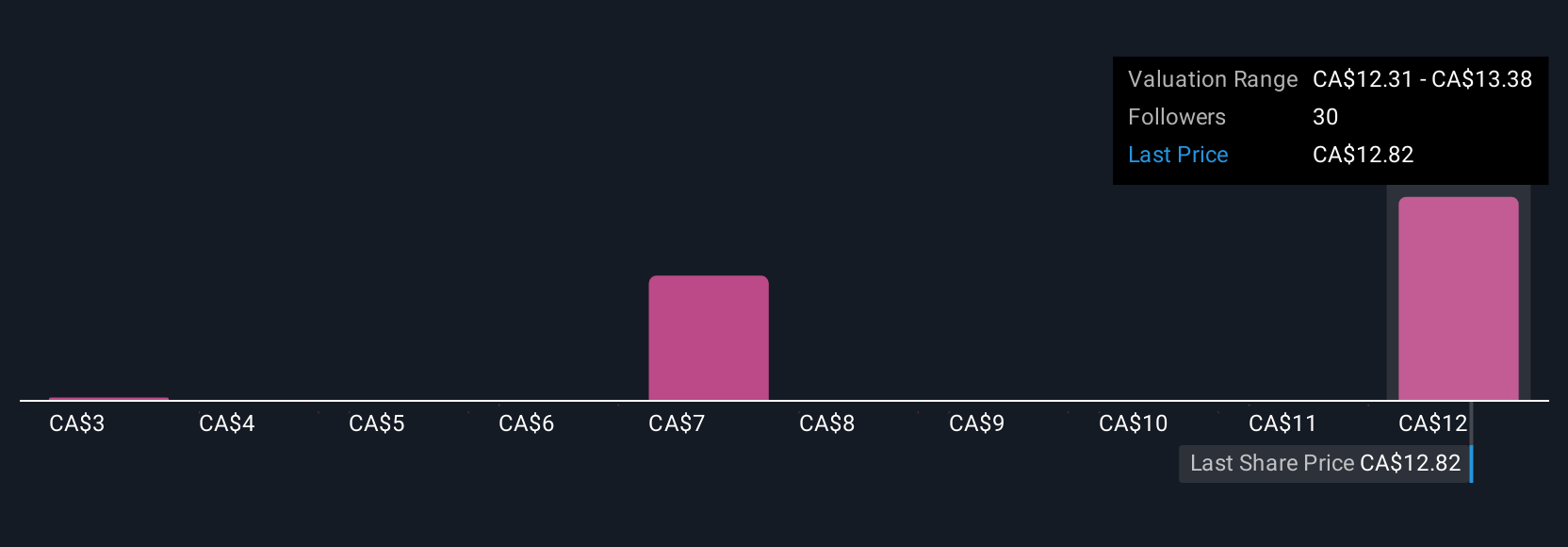

Retail investors in the Simply Wall St Community have shared 11 different fair value estimates for Energy Fuels, spanning from US$2.57 to US$143.62 per share. While views vary widely, many highlight the crucial challenge of securing diversified feedstock for rare earths as a pivotal issue for performance going forward; explore these varied opinions to better inform your own perspective.

Explore 11 other fair value estimates on Energy Fuels - why the stock might be worth less than half the current price!

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives