- Canada

- /

- Oil and Gas

- /

- TSX:EFR

How Investors May Respond To Energy Fuels (TSX:EFR) Raising $700 Million to Accelerate Rare Earth Expansion

Reviewed by Sasha Jovanovic

- In early October 2025, Energy Fuels Inc. closed an upsized offering of US$700 million in 0.75% Convertible Senior Notes due 2031, following strong investor demand and the full exercise of purchasers' options in a private placement to qualified institutional buyers.

- This capital raise is intended to finance major expansions in rare earth processing, including the White Mesa Mill in the US and the Donald Project in Australia, reflecting the company's ambition to accelerate growth in these high-demand areas.

- We'll examine how this infusion of funding bolsters Energy Fuels' rare earth expansion plans within its investment narrative and future growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Energy Fuels Investment Narrative Recap

To be a shareholder in Energy Fuels, you need confidence in the company’s ability to secure access to rare earth feedstock and convert major capital investments, like the White Mesa Mill and Donald Project, into profitable growth. The recent US$700 million convertible note financing directly supports these expansion plans, but does not fully resolve short-term risks around project execution, feedstock supply, or potential dilution from future equity conversion of notes.

The most directly relevant recent announcement is the final regulatory approval for the Donald Rare Earth and Mineral Sand Project in Australia. This approval paves the way for deploying the new funds raised, tying directly into the catalyst of unlocking new feedstock sources and driving future revenue through scale expansion.

By contrast, investors should be aware that the company’s ability to deliver on rare earth growth still faces challenges around reliable raw material supply and...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' outlook forecasts $553.4 million in revenue and $237.8 million in earnings by 2028. This implies a 104.1% annual revenue growth rate and a $330.9 million increase in earnings from the current level of -$93.1 million.

Uncover how Energy Fuels' forecasts yield a CA$20.85 fair value, a 11% downside to its current price.

Exploring Other Perspectives

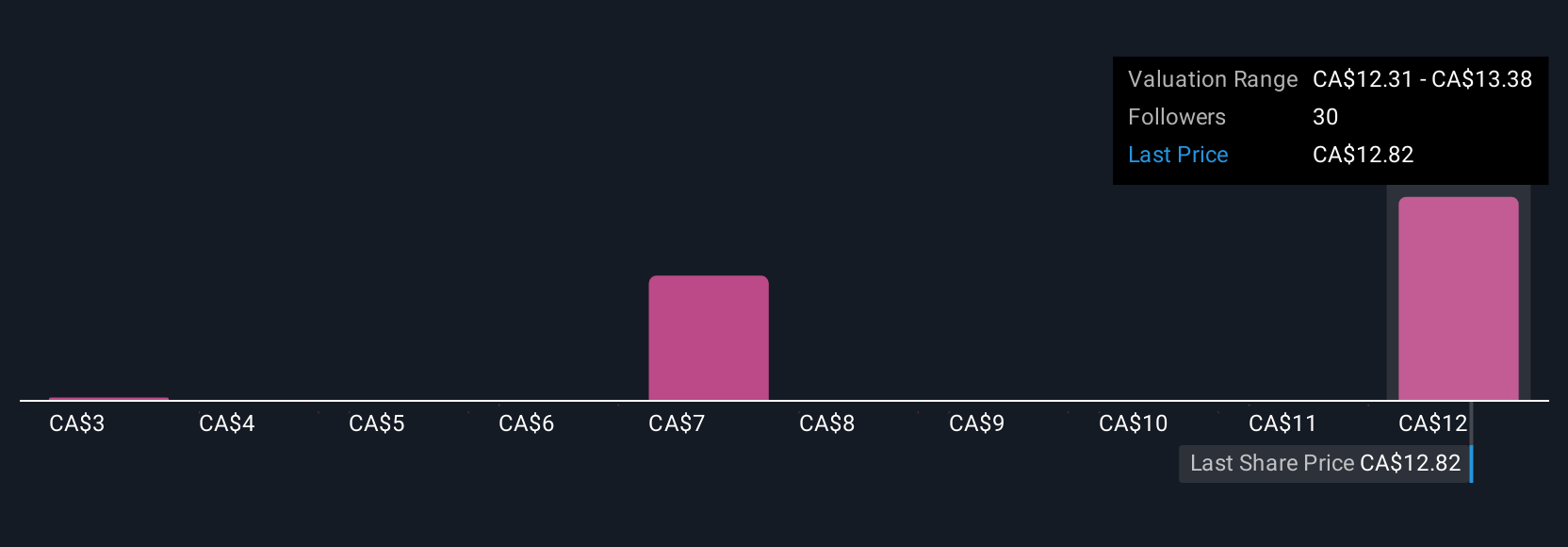

Simply Wall St Community members have shared 12 fair value estimates for Energy Fuels, ranging widely from US$2.57 to US$146.00. While the recent funding supports rare earth expansion, limited guaranteed access to feedstock remains a central factor shaping the company's future performance, see how views differ.

Explore 12 other fair value estimates on Energy Fuels - why the stock might be worth less than half the current price!

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives