- Canada

- /

- Oil and Gas

- /

- TSX:DML

Will Regulatory Approval and New Technical Reports Reshape Denison Mines' (TSX:DML) Uranium Development Narrative?

Reviewed by Sasha Jovanovic

- Denison Mines recently secured regulatory approval for its Wheeler River uranium project, commenced early test mining, and voluntarily filed a technical report detailing a preliminary economic assessment for its Midwest Property in Saskatchewan, Canada.

- These advances highlight the company’s efforts to increase transparency and operational progress as it continues to expand its uranium exploration and development activities in the Athabasca Basin.

- We'll explore how securing regulatory approval for Wheeler River could influence Denison Mines' investment narrative and future uranium development outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Denison Mines' Investment Narrative?

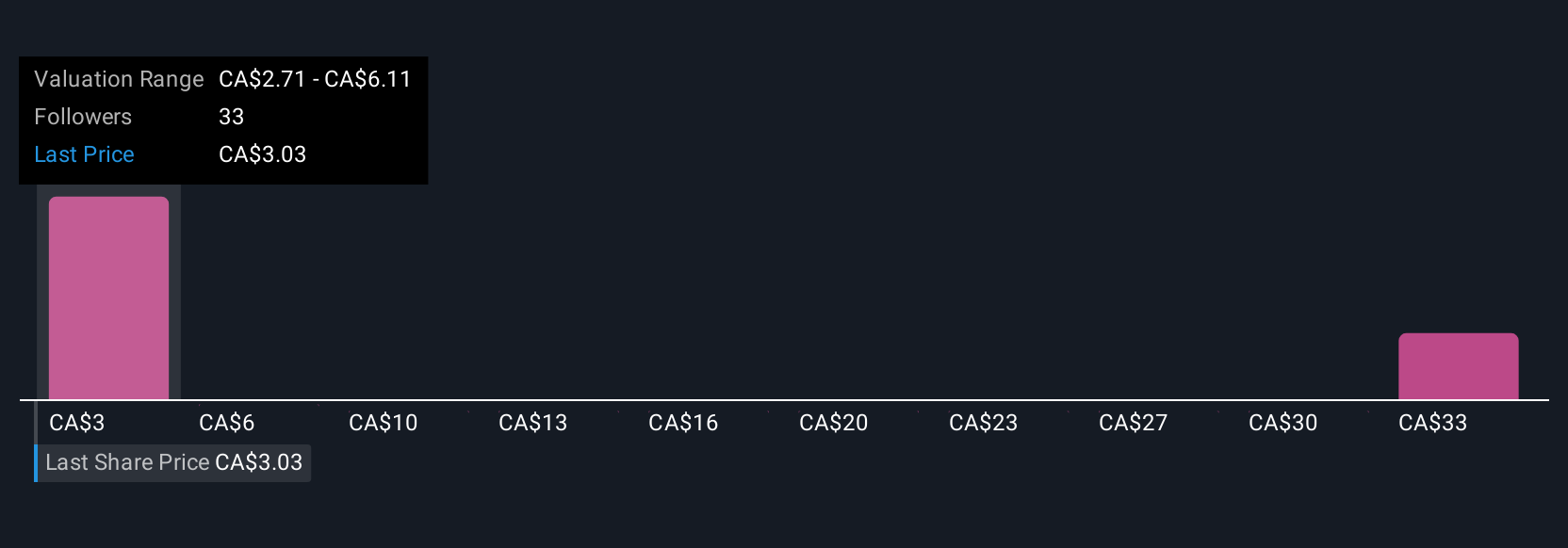

If you’re following Denison Mines, the recent regulatory win for the Wheeler River project is a major step that could shift the narrative around short-term catalysts. Investors focused on Denison’s core uranium assets have long faced risks tied to regulatory delays and execution challenges, and the new approval reduces what had been a key overhang. The early test mining and voluntary technical report on Midwest also underscore a push for operational transparency, which might boost market confidence in management’s execution. That said, the company’s weak financials, unprofitability, high valuation multiples relative to peers, and limited cash runway still frame the biggest near-term risks. The recent surge in share price hints that a good portion of the positive news may already be reflected in valuations, and future catalysts will likely depend on continued project milestones or changes in uranium market conditions. How these new developments will reshape profitability timelines and Denison’s capital needs remains a crucial question for shareholders.

On the other hand, Denison’s limited cash runway and ongoing losses cannot be overlooked. Denison Mines' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 9 other fair value estimates on Denison Mines - why the stock might be worth as much as 24% more than the current price!

Build Your Own Denison Mines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denison Mines research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Denison Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denison Mines' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DML

Denison Mines

Engages in the acquisition, exploration, and development of uranium bearing properties in Canada.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives