- Canada

- /

- Oil and Gas

- /

- TSX:DML

A Look at Denison Mines (TSX:DML) Valuation After Latest Technical Report Filing and Mining Advancements

Reviewed by Kshitija Bhandaru

Denison Mines (TSX:DML) has just filed a new technical report for its Midwest Property in Northern Saskatchewan. This action highlights the company's dedication to transparent reporting and innovative mining techniques. It also draws attention to the evolving approach Denison Mines is taking toward uranium development.

See our latest analysis for Denison Mines.

Denison’s voluntary technical report appears to have reinforced positive sentiment among investors, with momentum picking up pace. Its 30-day share price return sits at an impressive 18.5%, while the one-year total shareholder return has surged to 53.2%. The rally over the last three months suggests growing confidence in Denison’s uranium development plans as market participants respond to credible signs of progress and opportunity.

If you’re watching the wave of renewed interest in uranium, now is an opportune moment to broaden your sights and discover fast growing stocks with high insider ownership

With such a strong rally and firm growth figures in recent months, the question remains: Is Denison Mines stock still trading at a compelling value, or has the market already priced in its next wave of potential growth?

Price-to-Book of 6.7x: Is it justified?

Denison Mines is trading at a price-to-book (P/B) ratio of 6.7x, well above both its industry and peer averages. With its last close at CA$4.03, the current valuation signals the market is willing to pay a substantial premium for Denison’s future prospects compared to similar companies.

The price-to-book ratio measures how much investors are paying for each dollar of Denison’s net assets. In resource sectors like uranium, where tangible assets can play a pivotal role in future project economics, this ratio is especially relevant for assessing intrinsic business value.

At 6.7x, Denison’s P/B ratio is significantly higher than the Canadian Oil and Gas industry average of 1.6x and the peer average of 4.3x. This highlights robust investor enthusiasm and expectations for accelerated growth. However, such a valuation may leave little room for error if projected growth does not materialize as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6.7x (OVERVALUED)

However, current high valuations and Denison's negative net income could quickly challenge optimism if uranium prices weaken or if project execution stumbles.

Find out about the key risks to this Denison Mines narrative.

Another View: Discounted Cash Flow Perspective

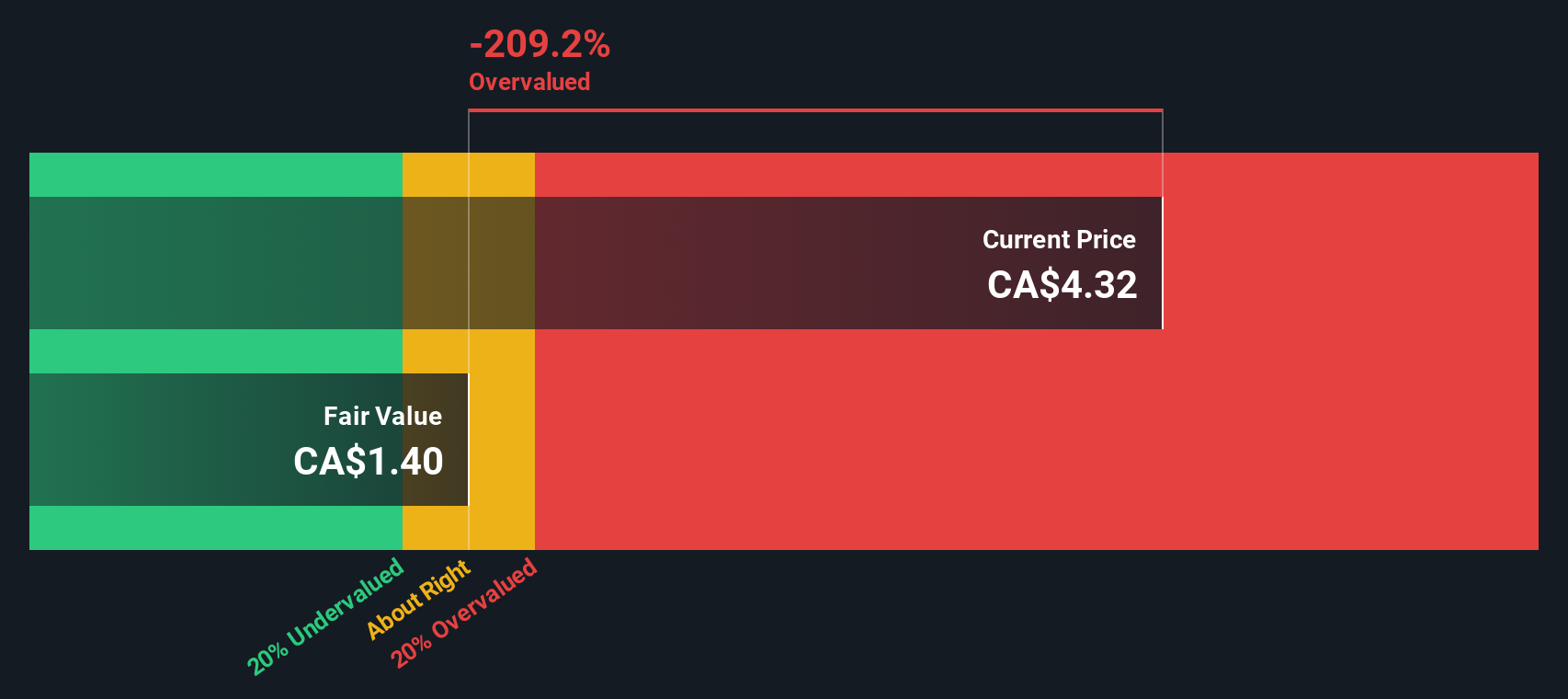

Looking at Denison Mines through the lens of our DCF model, there is a strikingly different conclusion. The current share price of CA$4.03 sits well above the estimated fair value of CA$1.40, implying the stock could be overvalued. This approach, which focuses on future cash flows, suggests a much lower valuation than the market currently assigns. What if the optimism seen in current prices outpaces the company’s long-term earnings potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denison Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denison Mines Narrative

If you have a different perspective or want to reach your own conclusions, you can dig into the numbers and shape your own story in just a few minutes, Do it your way

A great starting point for your Denison Mines research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let this moment pass you by. Give yourself the edge by tapping into other powerful opportunities beyond Denison Mines with these specialized stock lists:

- Supercharge your returns and target strong financials with these 3581 penny stocks with strong financials, which feature resilience and upside potential.

- Capture tomorrow’s breakthroughs by following these 24 AI penny stocks, a selection at the frontier of artificial intelligence innovation.

- Secure compelling yields by checking out these 19 dividend stocks with yields > 3%, a group handpicked for healthy dividend payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DML

Denison Mines

Engages in the acquisition, exploration, and development of uranium bearing properties in Canada.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives