The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Cenovus Energy (TSE:CVE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Cenovus Energy

How Fast Is Cenovus Energy Growing Its Earnings Per Share?

Over the last three years, Cenovus Energy has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Impressively, Cenovus Energy's EPS catapulted from CA$0.97 to CA$2.84, over the last year. It's a rarity to see 192% year-on-year growth like that.

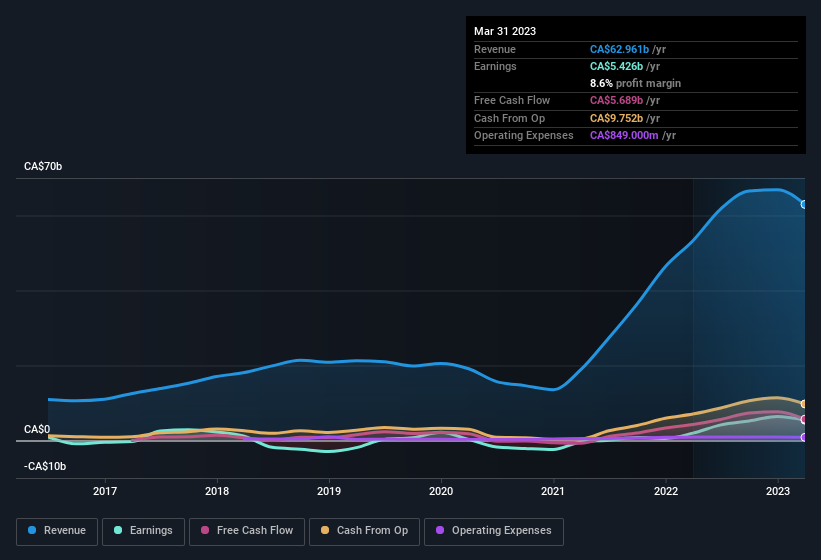

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Cenovus Energy shareholders is that EBIT margins have grown from 10% to 12% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Cenovus Energy's forecast profits?

Are Cenovus Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth CA$2.6m) this was overshadowed by a mountain of buying, totalling CA$10m in just one year. This bodes well for Cenovus Energy as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Executive VP & COO Jonathan McKenzie who made the biggest single purchase, worth CA$1.3m, paying CA$26.07 per share.

On top of the insider buying, it's good to see that Cenovus Energy insiders have a valuable investment in the business. With a whopping CA$90m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

Does Cenovus Energy Deserve A Spot On Your Watchlist?

Cenovus Energy's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Cenovus Energy deserves timely attention. You still need to take note of risks, for example - Cenovus Energy has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

The good news is that Cenovus Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CVE

Cenovus Energy

Develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada, the United States, and China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives