- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Assessing Canadian Natural Resources After Oil Price Rally and Strong Cash Flow Projections

Reviewed by Bailey Pemberton

If you are keeping an eye on Canadian Natural Resources, you are in good company. Many investors are weighing whether to hold, buy, or trim their stake, especially with energy markets constantly in flux. The stock just closed at $45.55, and it has delivered a tidy 2.9% return over the past week alone. Zoom out, and you will spot more interesting trends: a strong 8.8% gain over the last month, but only up 0.8% for the year to date, and actually down 4.2% over the last twelve months. On the other hand, long-term holders have seen the benefits, with a massive 45.2% total return over three years and an eye-popping 396.2% over five years.

Part of the recent growth story can be attributed to shifting global energy dynamics, with investors cycling back toward established producers as commodity prices recover. Canadian Natural Resources, with its diversified asset base and resilient cost structure, has benefited from rising optimism and a recalibration of risk in the sector. As a result, many are wondering if the current price truly reflects the company's underlying value, or if there is still plenty of room to run.

Valuation is at the heart of this debate. Looking at a standard set of six valuation checks, Canadian Natural Resources scores a 5, meaning it is considered undervalued in five out of six key metrics. This suggests substantial upside based on traditional valuation models. But before you rush to conclusions, let us break down these valuation approaches to see what they are capturing, and hint at a smarter, perhaps more holistic way to gauge real value by the end of our discussion.

Why Canadian Natural Resources is lagging behind its peers

Approach 1: Canadian Natural Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is one of the most widely used methods for valuing a company's stock, particularly in the energy sector. A DCF model estimates a company's future cash flows and then discounts them back to today’s value using a required rate of return. This process helps investors gauge what a stock should be worth if future projections are met.

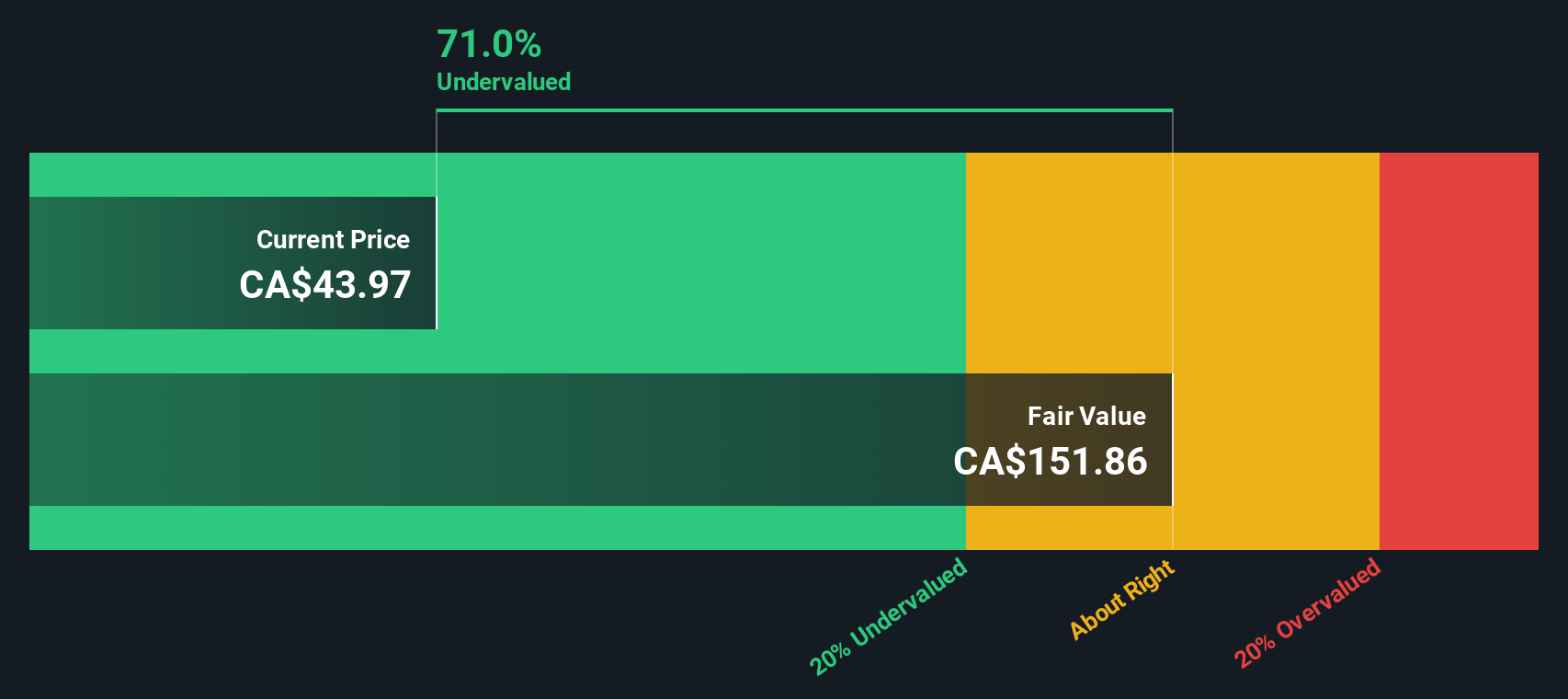

For Canadian Natural Resources, the latest reported Free Cash Flow stands at CA$8.4 billion. Analyst estimates extend up to 2029, with Free Cash Flow projected to rise to CA$11.5 billion. Beyond that, Simply Wall St extrapolates further growth, bringing the ten-year projection close to CA$14.4 billion by 2035. All figures are in Canadian dollars and indicate a trajectory of consistent cash generation.

Using these figures in a two-stage Free Cash Flow to Equity model, the calculated intrinsic value for the stock comes to CA$151.69 per share. Since the recent share price is CA$45.55, the DCF suggests the stock is trading at nearly a 70% discount to its estimated fair value. Based on this analysis, Canadian Natural Resources appears undervalued by a considerable margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canadian Natural Resources is undervalued by 70.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Canadian Natural Resources Price vs Earnings

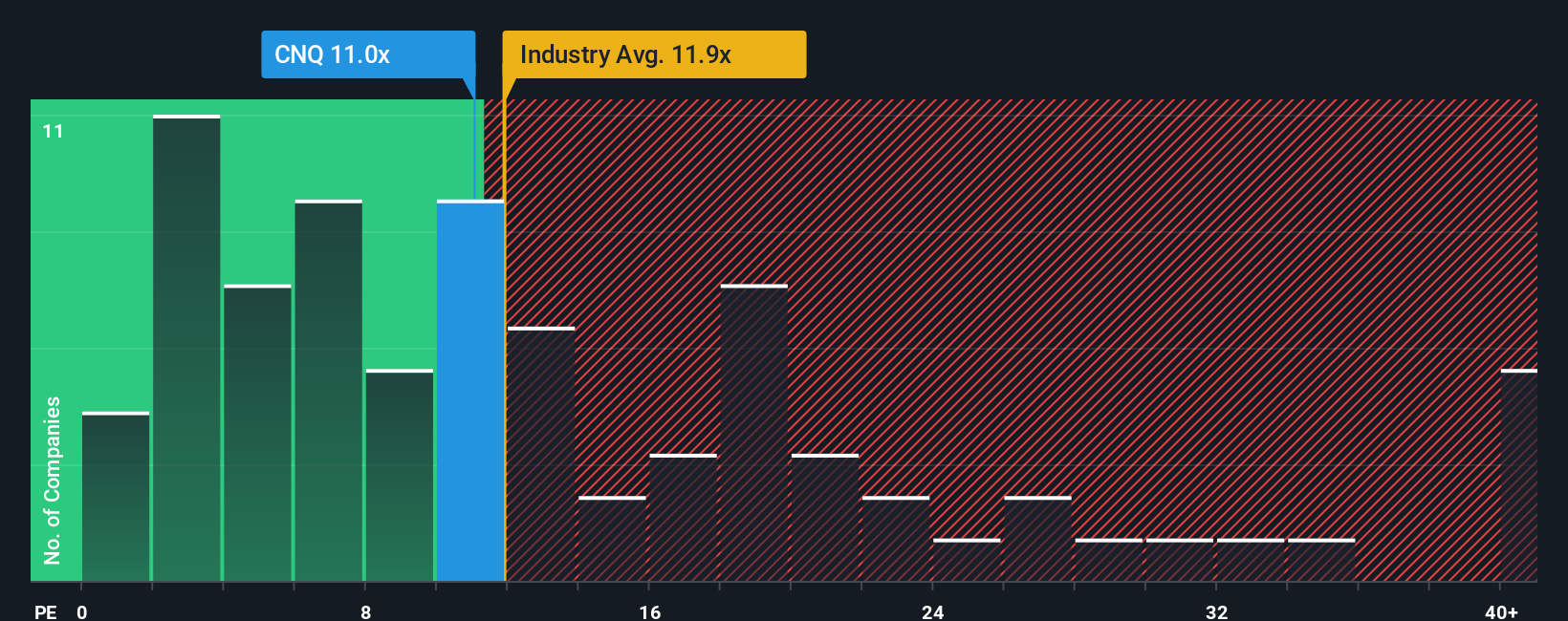

The Price-to-Earnings (PE) ratio is a popular metric for assessing companies that consistently generate profits, like Canadian Natural Resources. By comparing a company’s current share price to its earnings per share, investors get a quick snapshot of how the market values those earnings today. A lower PE can signal a bargain, while a higher one may suggest the company is expected to deliver stronger growth or carries less perceived risk.

Growth prospects and risk profile are crucial in determining what constitutes a “normal” or “fair” PE ratio for any stock. Generally, companies with higher expected earnings growth or more stable operations can justify higher PEs, whereas slower-growing or riskier businesses will have lower benchmarks. For Canadian Natural Resources, the current PE sits at 11.43x. This compares favorably to the industry average of 12.72x and the peer average of 13.18x. This suggests the stock is at the lower end of the valuation range for its sector.

Simply Wall St’s proprietary "Fair Ratio" takes this analysis a step further. Unlike standard industry or peer comparisons, the Fair Ratio factors in Canadian Natural Resources’ unique growth outlook, profit margins, industry risks, market capitalisation, and other attributes. The Fair Ratio for the company is 15.54x, noticeably above the current PE. This suggests that, when accounting for all relevant company-specific and industry variables, the stock should trade at a higher multiple than it does today and indicates undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian Natural Resources Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more dynamic approach to evaluating any company. A Narrative is simply your story for a stock, connecting the “why” behind your expectations (such as the company’s future growth, margins, or strategic moves) to a detailed financial forecast and, ultimately, an estimated fair value. Rather than relying solely on static metrics, Narratives encourage you to consider how events, trends, and your perspective shape your outlook on Canadian Natural Resources.

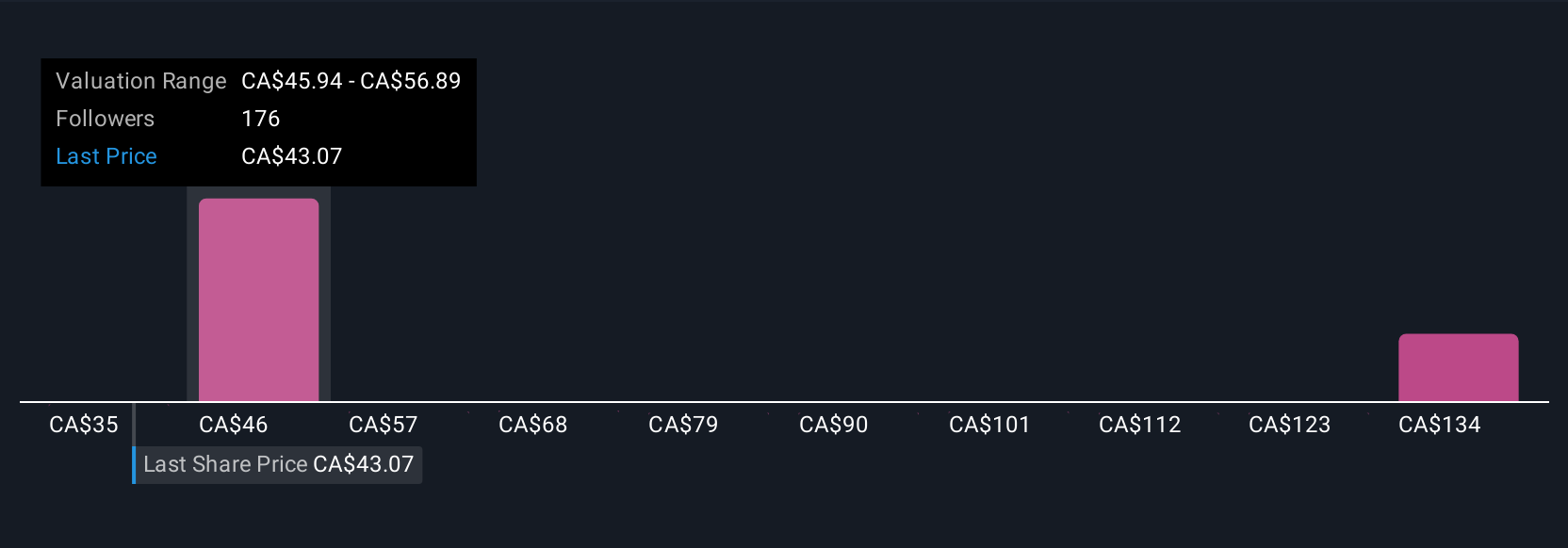

Available to everyone on Simply Wall St’s Community page (and already used by millions of investors), the Narratives feature makes it easy to build, update, and share your forecasts, linking them directly to a fair value in just a few clicks. It helps you decide when to buy or sell by always comparing your Narrative’s fair value to the latest market price. It refreshes automatically as new news or earnings data come in, ensuring your view stays relevant and actionable.

For example, one investor might build a Narrative around major acquisitions and cost savings, estimating a fair value as high as CA$62.00 per share. Another, focusing on industry challenges and regulatory pressures, could arrive at a more cautious value near CA$45.00. This way, you can quickly see the full spectrum of possible outlooks.

Do you think there's more to the story for Canadian Natural Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives