- Canada

- /

- Oil and Gas

- /

- TSX:CNE

Canacol Energy Ltd's (TSE:CNE) 26% Dip In Price Shows Sentiment Is Matching Revenues

To the annoyance of some shareholders, Canacol Energy Ltd (TSE:CNE) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

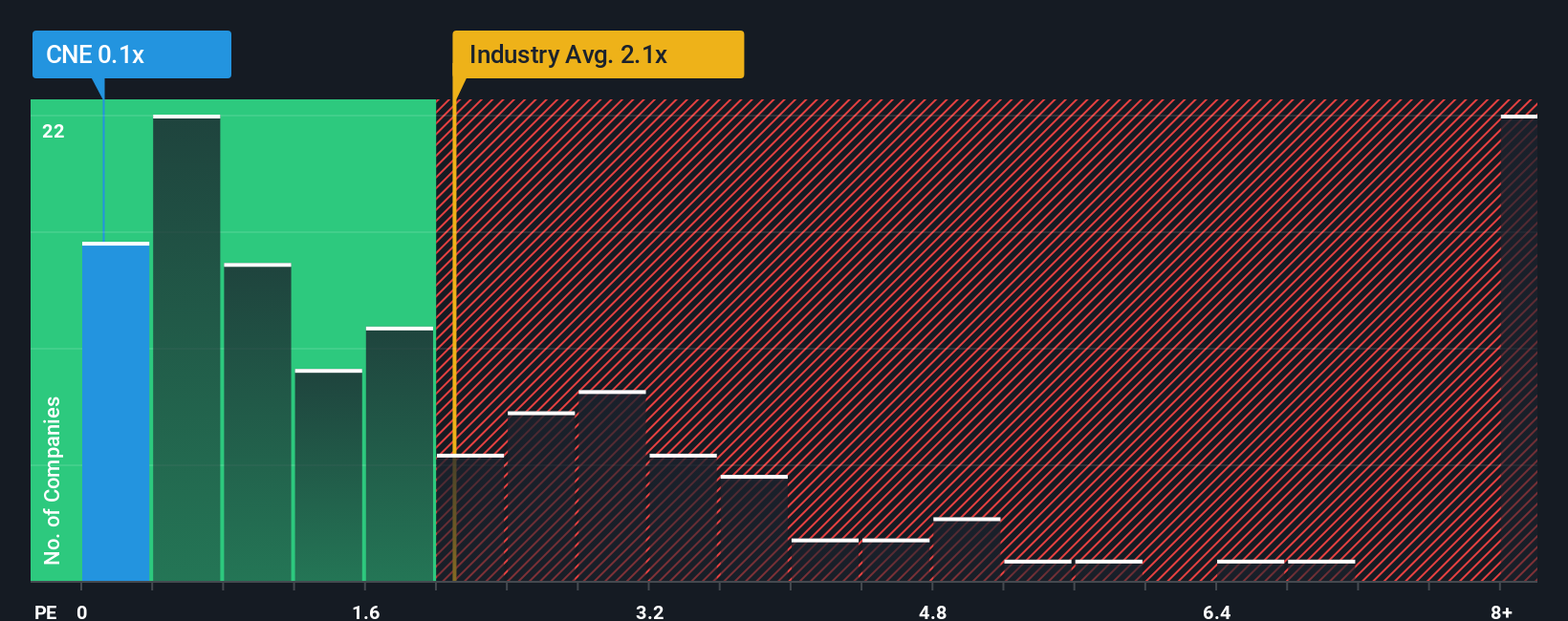

Following the heavy fall in price, Canacol Energy's price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Oil and Gas industry in Canada, where around half of the companies have P/S ratios above 2.1x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Canacol Energy

What Does Canacol Energy's Recent Performance Look Like?

Recent times haven't been great for Canacol Energy as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Canacol Energy will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Canacol Energy?

In order to justify its P/S ratio, Canacol Energy would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 14% as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 5.2%, which paints a poor picture.

With this information, we are not surprised that Canacol Energy is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Canacol Energy's P/S

The southerly movements of Canacol Energy's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Canacol Energy's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Canacol Energy's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Canacol Energy (at least 1 which is concerning), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CNE

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives