- Canada

- /

- Energy Services

- /

- TSX:CEU

Is CES Energy Solutions’ Share Buyback Program Shaping the Investment Case for CES (TSX:CEU)?

Reviewed by Simply Wall St

- On July 18, 2025, CES Energy Solutions Corp. announced a normal course issuer bid to repurchase up to 18,911,524 common shares, 8.59% of its issued and outstanding shares, by July 21, 2026, with all repurchased shares to be cancelled.

- This buyback initiative indicates management’s confidence in the company’s value and ongoing efforts to enhance shareholder returns through capital management.

- We’ll now examine how this substantial share buyback program could influence CES Energy Solutions’ investment narrative, especially regarding capital allocation.

CES Energy Solutions Investment Narrative Recap

For shareholders of CES Energy Solutions, the core thesis relies on the company’s ability to effectively allocate capital among buybacks, dividends, and disciplined expansion while managing near-term challenges such as margin pressure from shifting rig activity. The newly announced buyback increases financial flexibility, but its near-term effect on the considerable earnings volatility tied to rig counts and currency swings appears modest, with underlying business risks unchanged for now.

A recent highlight ties directly to this buyback: in May 2025, CES Energy Solutions disclosed it had repurchased nearly 5.74 million shares year-to-date, building on significant buybacks since mid-2024. This ongoing focus underscores capital allocation as a persistent catalyst, particularly alongside shareholder return initiatives like the recent dividend increase.

But despite these steps, investors should pay close attention to how fluctuations in drilling activity could ...

Read the full narrative on CES Energy Solutions (it's free!)

CES Energy Solutions is projected to achieve CA$2.6 billion in revenue and CA$206.0 million in earnings by 2028. This outlook assumes a 3.8% annual revenue growth rate and a CA$14.9 million increase in earnings from the current CA$191.1 million.

Exploring Other Perspectives

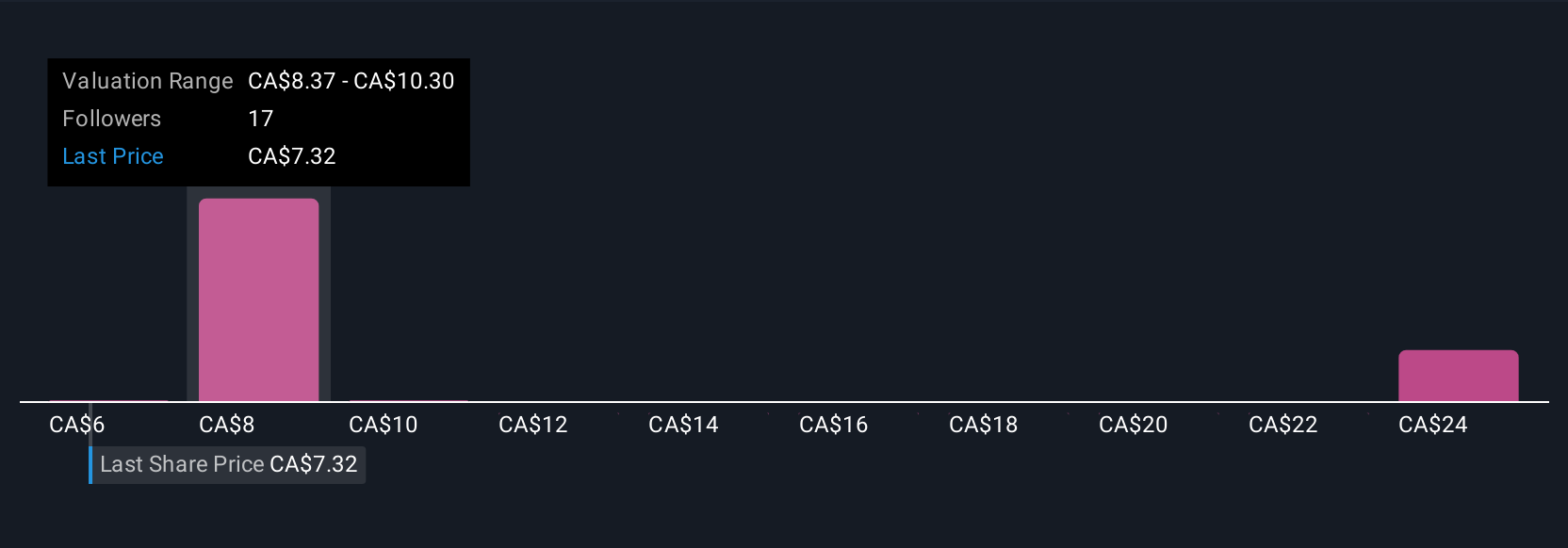

Simply Wall St Community members provide four fair value opinions, from CA$6.43 to CA$22.84 per share, revealing broad disagreement. While shareholders weigh these differences, it’s essential to recognize that short-term rig count volatility continues to influence CES Energy Solutions’ earnings profile and market perception.

Build Your Own CES Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CES Energy Solutions research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CES Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CES Energy Solutions' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CEU

CES Energy Solutions

Engages in the design, implementation, and manufacture of advanced consumable fluids and specialty chemicals in the United States and Canada.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives