- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Has Cameco’s Huge Multi Year Surge Already Priced In the Nuclear Power Revival?

Reviewed by Bailey Pemberton

- Wondering if Cameco is still a smart buy after its huge run, or if the easy money has already been made? You are not alone, and this article will unpack what the current price really implies.

- The stock has climbed 72.2% year to date and 58.3% over the past year, with a massive 661.3% gain over five years hinting at a powerful long term rerating. This comes even though the last 30 days saw a modest 2.1% pullback after a 3.6% increase this week.

- Those moves have come against a backdrop of renewed enthusiasm for nuclear power as a low carbon baseload option, with governments revisiting energy security plans and extending or expanding reactor fleets worldwide. At the same time, uranium supply concerns and long term contracting activity have kept investors focused on Cameco as one of the key companies in a tighter market.

- Despite that optimism, Cameco currently scores just 0/6 on our valuation checks. This suggests the market may already be pricing in a lot of good news. Next, we will walk through different valuation approaches, then finish with a more holistic way to think about what the stock may be worth.

Cameco scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cameco Discounted Cash Flow (DCF) Analysis

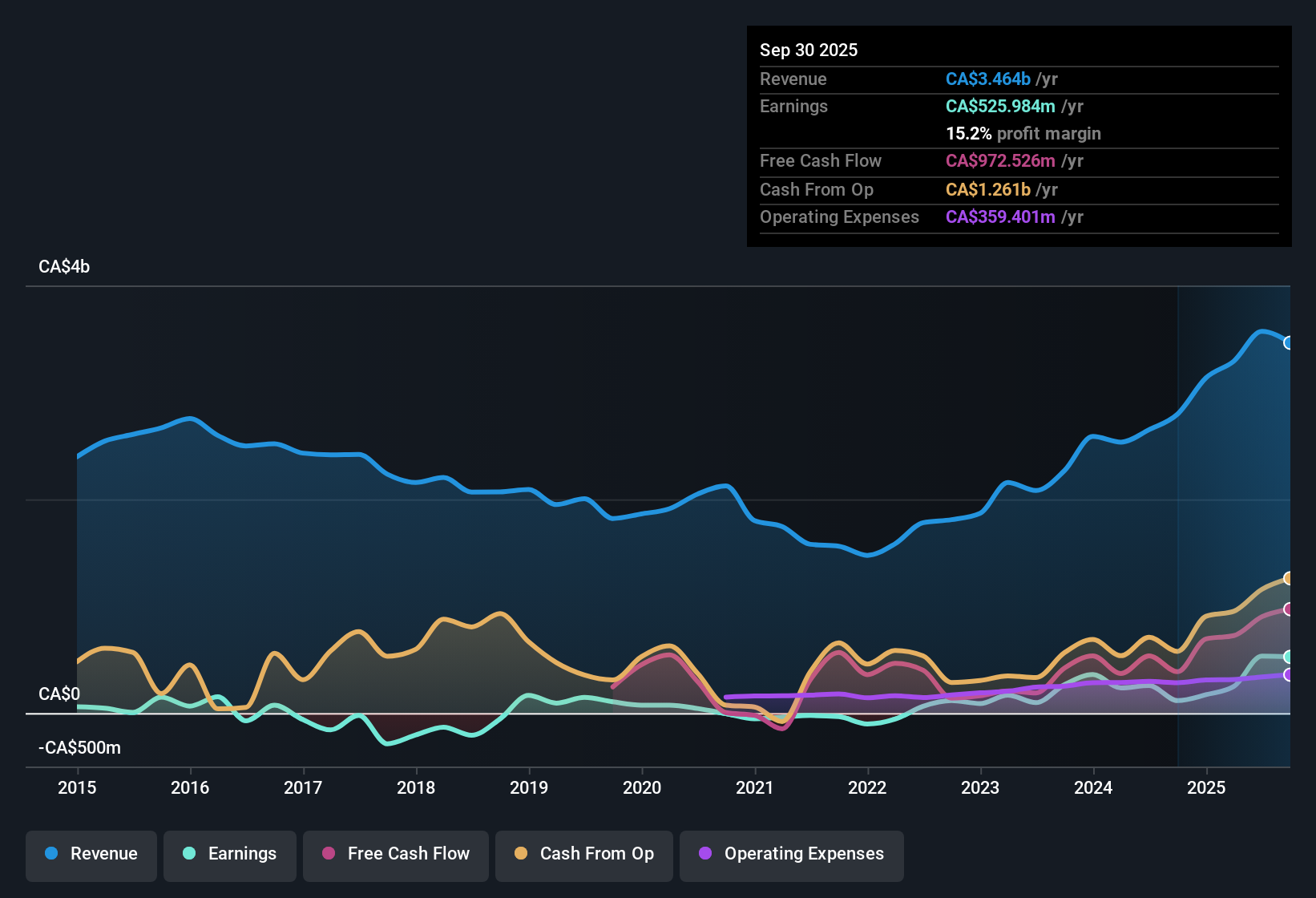

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Cameco, the 2 Stage Free Cash Flow to Equity model starts from last twelve months free cash flow of about CA$1.01 billion, then uses analyst forecasts for the next few years and extrapolates further out.

Analysts see free cash flow rising to roughly CA$1.14 billion by 2029, with interim projections stepping up through 2026 to 2028 before moderating in the early 2030s as growth slows. Simply Wall St discounts each of these annual cash flows back to present value, then adds a longer term estimate to arrive at an intrinsic value of about CA$50.81 per share.

Compared with the current market price, this implies the shares are roughly 154.5% overvalued on a pure cash flow basis, meaning investors today are paying far above what the model suggests is reasonable based on projected cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cameco may be overvalued by 154.5%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

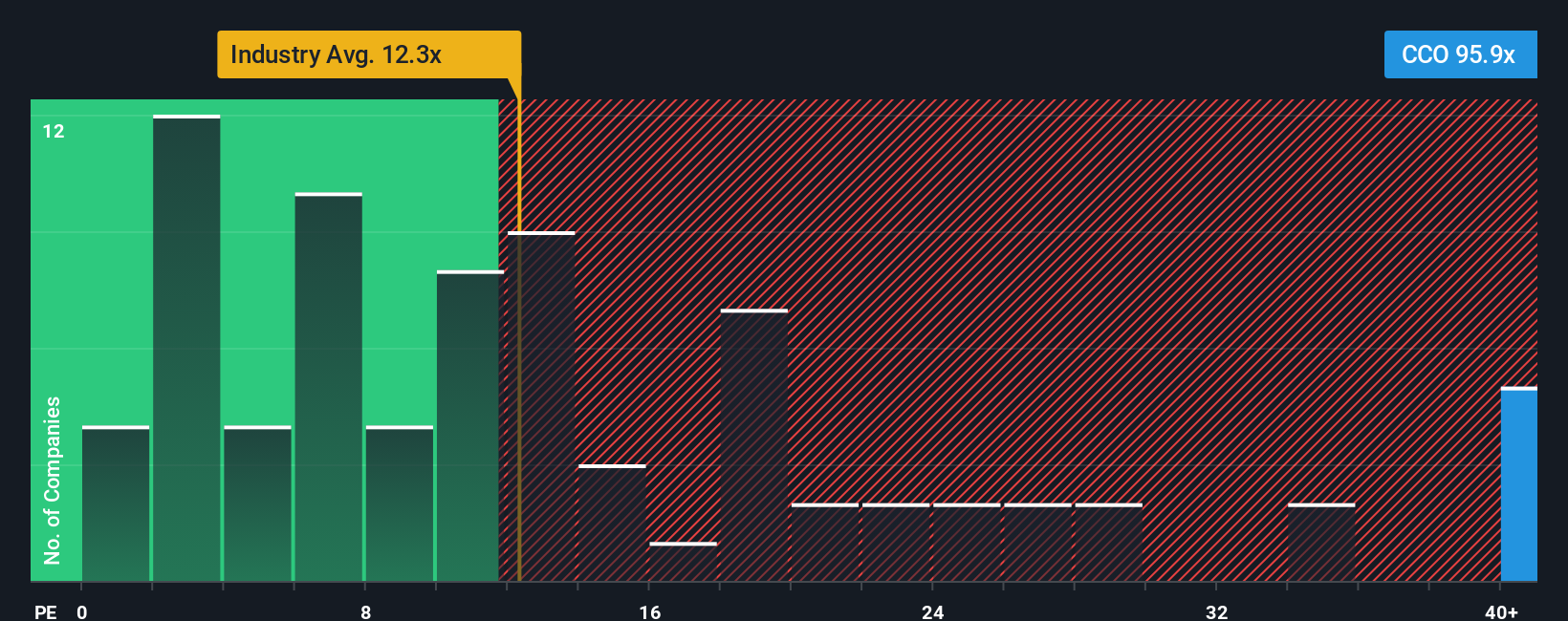

Approach 2: Cameco Price vs Earnings

For profitable companies like Cameco, the price to earnings (PE) ratio is a useful way to see how much investors are willing to pay today for each dollar of current earnings. A higher PE can be associated with expectations of stronger growth or a perception of lower risk, while slower growth or higher uncertainty usually correspond to a lower, more conservative PE.

Cameco currently trades on a PE of about 107.1x, which is far above the Oil and Gas industry average of roughly 14.9x and the broader peer average of about 16.1x. To give a more tailored view, Simply Wall St calculates a Fair Ratio of 20.8x for Cameco. This is a proprietary estimate of what its PE might be once factors like expected earnings growth, profit margins, risk profile, industry dynamics, and market cap are all taken into account. This can be more informative than simple peer comparisons because it adjusts for the company’s specific characteristics instead of assuming all energy stocks warrant the same multiple.

Comparing Cameco’s actual 107.1x PE to the 20.8x Fair Ratio indicates that the shares are trading well above the level suggested by these fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

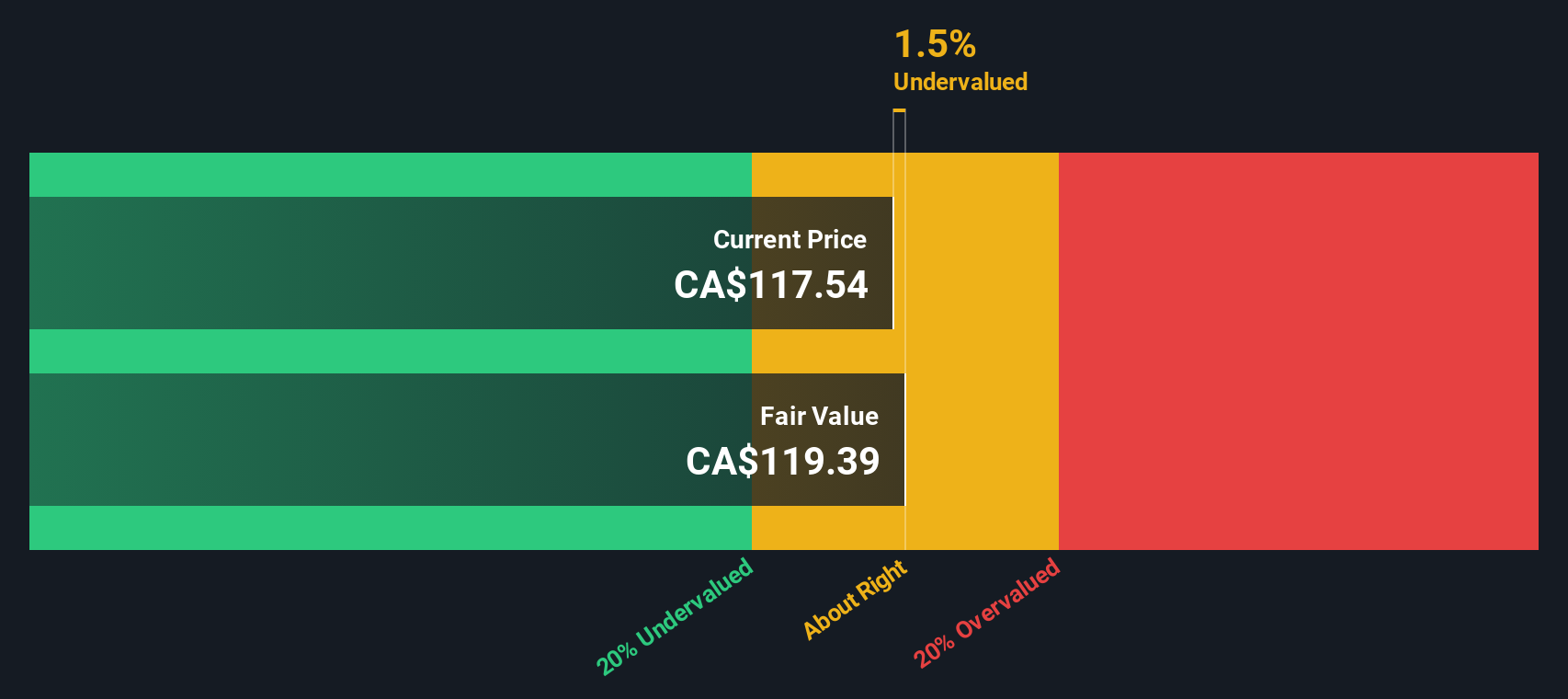

Upgrade Your Decision Making: Choose your Cameco Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Here you combine your view of Cameco’s story with your own assumptions for future revenue, earnings and margins, and the Simply Wall St platform (via the Community page used by millions of investors) turns that story into a full forecast and fair value. It then keeps that forecast dynamically updated as new news and earnings arrive, helping you decide when to buy or sell by comparing your Narrative Fair Value to today’s price. This applies whether you are a cautious investor who sees limited contracting progress and execution risks and therefore sets a lower fair value closer to the most bearish community estimates, or an optimistic investor who believes in accelerating nuclear demand, higher long term uranium prices and expanding margins and therefore lands nearer the highest fair value estimates around CA$150.81. Both perspectives are expressed clearly as living, updateable Narratives instead of static one off spreadsheets.

Do you think there's more to the story for Cameco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026