The board of Baytex Energy Corp. (TSE:BTE) has announced that it will pay a dividend of CA$0.0225 per share on the 2nd of January. This payment means the dividend yield will be 2.3%, which is below the average for the industry.

Check out our latest analysis for Baytex Energy

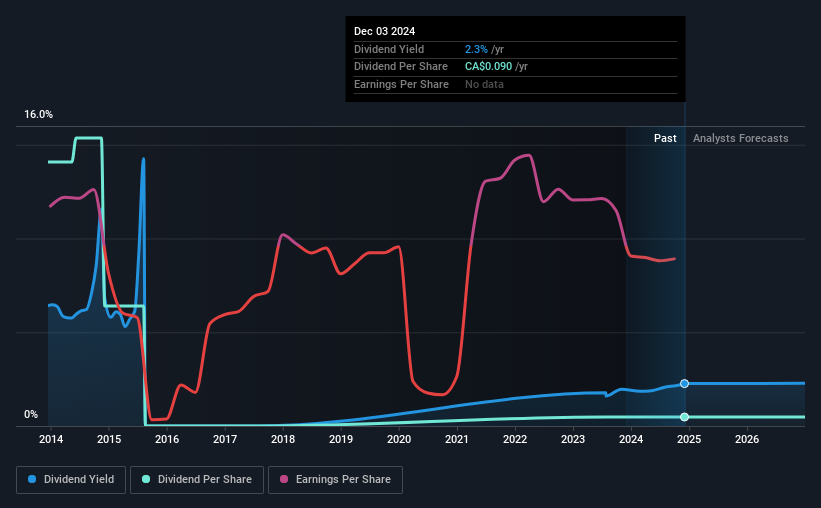

Baytex Energy's Long-term Dividend Outlook appears Promising

Even a low dividend yield can be attractive if it is sustained for years on end. Baytex Energy is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Over the next year, EPS is forecast to expand by 152.1%. Assuming the dividend continues along recent trends, we think the payout ratio could be 32% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the annual payment back then was CA$2.64, compared to the most recent full-year payment of CA$0.09. This works out to a decline of approximately 97% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Company Could Face Some Challenges Growing The Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Baytex Energy has impressed us by growing EPS at 35% per year over the past five years. The company hasn't been turning a profit, but it running in the right direction. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Baytex Energy that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives