- Canada

- /

- Oil and Gas

- /

- TSX:BTE

Baytex Energy (TSX:BTE): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Baytex Energy (TSX:BTE) has quietly pushed higher over the past month, outpacing many Canadian energy peers as investors refocus on cash flow strength, heavy oil leverage, and its cross-border Eagle Ford exposure.

See our latest analysis for Baytex Energy.

At around CA$4.44, Baytex’s strong 30 day and 90 day share price returns suggest momentum is building again, even though the three year total shareholder return still reflects the hangover from past volatility.

If you like the idea of turning commodity swings into opportunity, this could be a good moment to widen your watchlist with fast growing stocks with high insider ownership.

With Baytex trading below consensus price targets despite a mixed growth profile and volatile three year returns, the real question is whether this rebound still offers upside or if the market already reflects its future potential.

Most Popular Narrative Narrative: 12% Undervalued

Compared to Baytex’s last close at CA$4.44, the most followed narrative sees upside to a fair value near CA$5.03, implying further room for rerating.

The analysts have a consensus price target of CA$3.95 for Baytex Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.0, and the most bearish reporting a price target of just CA$2.5.

Want to see why a shrinking earnings base still supports a richer valuation multiple and buybacks driven share count decline? The core assumptions might surprise you.

Result: Fair Value of $5.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends heavily on crude prices and tariff outcomes, with a prolonged oil slump or harsher U.S. trade policy quickly undermining the thesis.

Find out about the key risks to this Baytex Energy narrative.

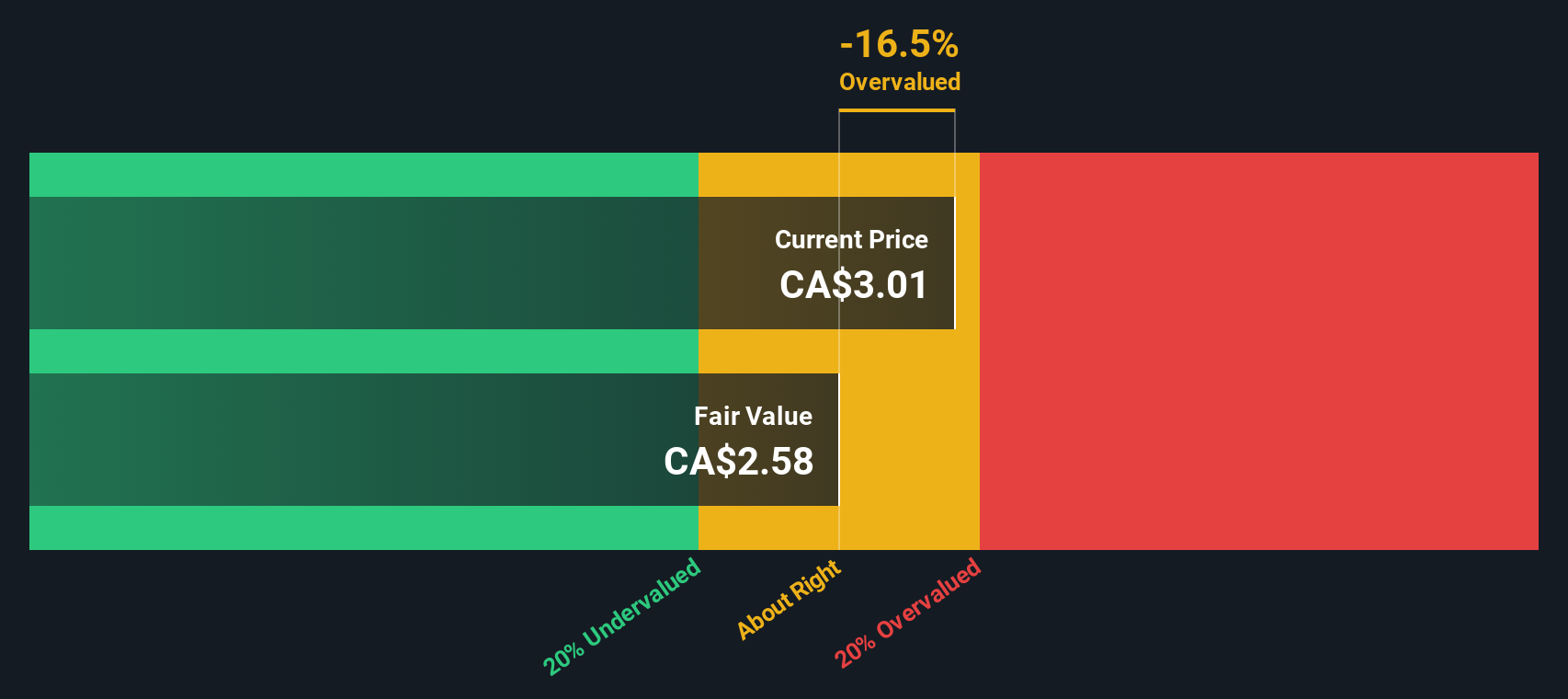

Another View on Valuation

While the narrative suggests Baytex is about 12% undervalued versus a CA$5.03 fair value, our SWS DCF model is far more conservative, putting fair value closer to CA$1.81. This implies the shares may actually be overvalued at current levels.

Look into how the SWS DCF model arrives at its fair value.

That gap between story driven upside and cash flow based downside is wide. Which lens do you trust more when crude and capital allocation plans inevitably change?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Baytex Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 935 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Baytex Energy Narrative

If you see the numbers differently or simply want to dig into the data yourself, you can build a fresh narrative in minutes, Do it your way.

A great starting point for your Baytex Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover fresh, data driven opportunities beyond Baytex.

- Explore potential mispriced opportunities by targeting companies trading below intrinsic value through these 935 undervalued stocks based on cash flows that highlight strong cash flow characteristics.

- Review trends in automation and machine learning by scanning these 25 AI penny stocks that are associated with AI adoption.

- Support an income-focused approach by looking at companies with consistent payouts using these 14 dividend stocks with yields > 3% that combine yield with underlying business strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026