- Canada

- /

- Oil and Gas

- /

- TSX:AAV

Has Advantage Energy Run Too Far After a 23% Annual Surge?

Reviewed by Bailey Pemberton

- Ever wonder if Advantage Energy is actually a bargain, or if the share price has already run ahead of itself? You're not alone, and that question has never been more relevant for investors watching this space.

- The stock has delivered an impressive 23.3% return over the past year, adding to its eye-catching 404.6% gain over five years. However, there has been a recent dip of 2.5% in the past week.

- Much of this momentum comes on the back of renewed optimism around Canadian energy markets and talk of potential pipeline expansions to boost exports. In recent weeks, sector-wide movements and government policy updates have added fuel to the discussion, sparking shifts in trader sentiment.

- When it comes to traditional valuation checks, Advantage Energy scores 3 out of 6, which is a decent showing but not a slam dunk. Next, we'll dig into what those numbers really mean and reveal an even smarter way to look at valuation that many investors overlook.

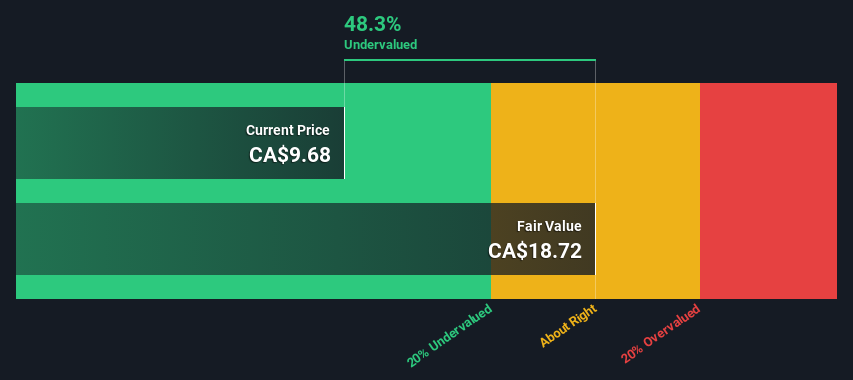

Approach 1: Advantage Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach offers a forward-looking view and can help investors assess whether a stock is truly a bargain, based on its core financial performance.

For Advantage Energy, the current last twelve months (LTM) Free Cash Flow stands at negative CA$4.6 million. However, analysts forecast significant improvements, projecting Free Cash Flow to climb to CA$244 million by 2028. These projections rely on detailed analyst estimates for the next five years, with the following years extrapolated to provide a ten-year outlook.

According to the DCF analysis, the estimated intrinsic value per share comes in at CA$31.53. As of today, this suggests the stock is trading at about a 65% discount compared to its calculated fair value.

Because of the wide gap between the intrinsic value and the current share price, the DCF model points toward compelling undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advantage Energy is undervalued by 65.0%. Track this in your watchlist or portfolio, or discover 852 more undervalued stocks based on cash flows.

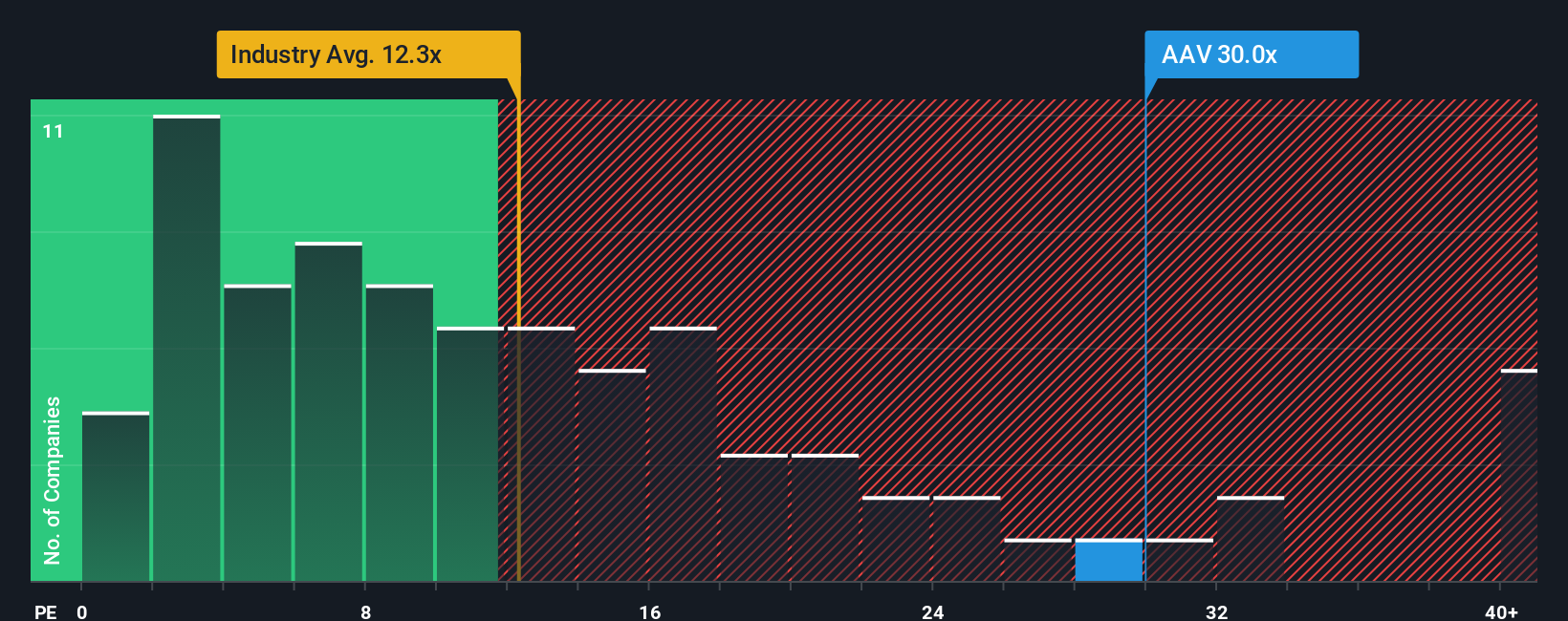

Approach 2: Advantage Energy Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it tells investors how much they are paying for each dollar of earnings. It is particularly helpful in comparing companies across the same sector, as it reflects the market’s expectations of a company’s future prospects and profitability.

Growth expectations and perceived risk play a big part in what the “right” PE ratio should be. Companies with faster earnings growth and lower risk profiles tend to command higher PE ratios, while those with slower growth or higher risks are typically valued at lower multiples.

Currently, Advantage Energy trades at a PE ratio of 34.1x. This is higher than both the industry average of 12.2x and the average PE of its peer group, which sits at 19.0x. At first glance, this suggests the stock looks expensive in traditional terms.

However, Simply Wall St’s “Fair Ratio” adds another layer of insight. The Fair Ratio, at 22.5x for Advantage Energy, reflects what investors should reasonably be willing to pay after weighing up earnings growth, industry factors, profit margins, company size, and risk profile. Unlike the mechanical industry and peer comparisons, this approach delivers a more nuanced and accurate valuation view by adjusting for the things that matter most to each business.

Comparing the Fair Ratio to the actual PE, Advantage Energy’s 34.1x is significantly above its fair value multiple of 22.5x, indicating the stock is overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

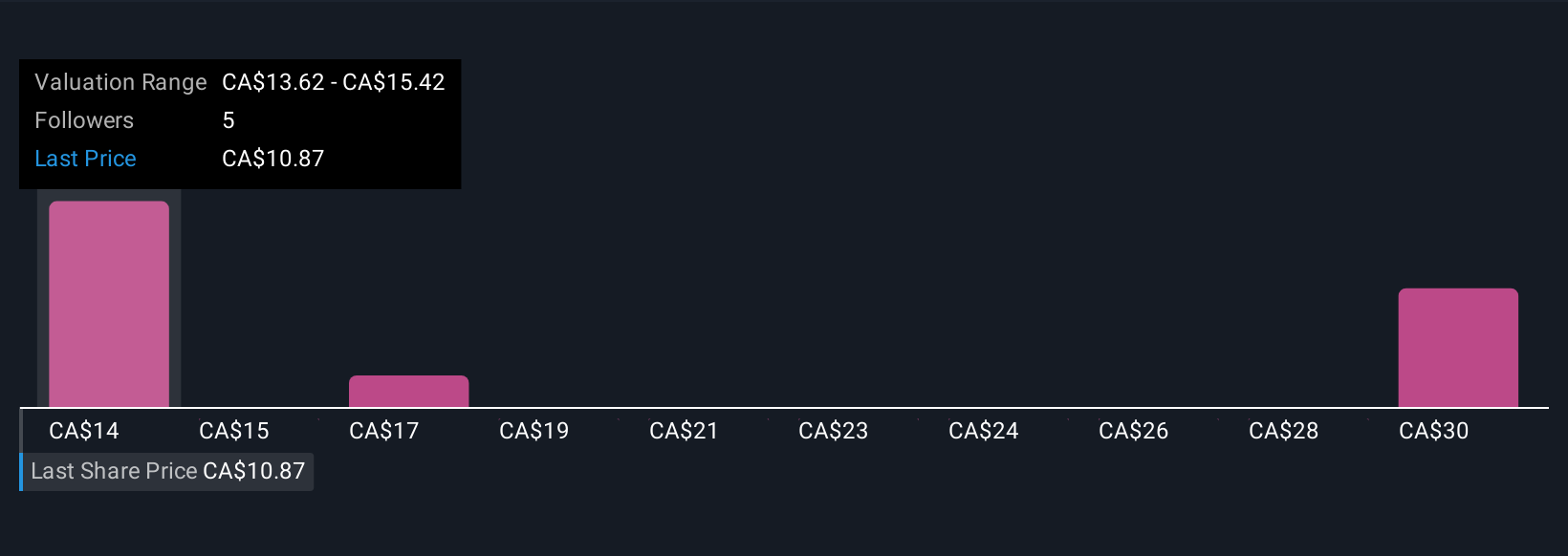

Upgrade Your Decision Making: Choose your Advantage Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy, dynamic method that goes beyond the numbers to help you form your own investment story about Advantage Energy.

A Narrative is a simple, structured way for investors to connect what they know and believe about a company’s business, industry, and future prospects with a tailored financial forecast and an estimated fair value per share.

Available on Simply Wall St’s Community page and used by millions of investors, Narratives help you see how your outlook on growth, earnings, or margins translates into a fair value and empowers your own buy or sell decision by clearly showing how your valuation compares to the current market price.

Narratives are updated in real time whenever new news, financial results, or industry events emerge, so your perspective keeps pace with the market without spreadsheets or complex models required.

For example, one investor might build a bullish Narrative for Advantage Energy, forecasting strong cash flow growth and targeting a CA$20.00 per share fair value, while another, more cautious, expects lower margins and sets a fair value closer to CA$12.00. Both can instantly see how those stories measure up against the current price.

Do you think there's more to the story for Advantage Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAV

Advantage Energy

Engages in the acquisition, exploitation, development, and production natural gas, crude oil, and natural gas liquids (NGLs) in the Province of Alberta, Canada.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)