- Canada

- /

- Trade Distributors

- /

- TSX:DBM

3 TSX Stocks That May Be Undervalued In October 2024

Reviewed by Simply Wall St

As we head into the fourth quarter, the Canadian TSX has seen a strong performance with a 14% rise, although recent market volatility has been influenced by uncertainties surrounding the U.S. labor market, geopolitical tensions in the Middle East, and an upcoming U.S. presidential election. Despite these challenges, solid economic fundamentals and potential interest rate cuts present opportunities for investors to identify undervalued stocks that may offer value in this complex environment.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.74 | CA$21.97 | 46.6% |

| goeasy (TSX:GSY) | CA$182.52 | CA$361.53 | 49.5% |

| Endeavour Mining (TSX:EDV) | CA$30.29 | CA$55.32 | 45.2% |

| Kinaxis (TSX:KXS) | CA$161.70 | CA$282.35 | 42.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Bragg Gaming Group (TSX:BRAG) | CA$7.00 | CA$10.66 | 34.3% |

| Blackline Safety (TSX:BLN) | CA$6.10 | CA$11.03 | 44.7% |

| Lithium Royalty (TSX:LIRC) | CA$5.60 | CA$8.83 | 36.6% |

| Boyd Group Services (TSX:BYD) | CA$211.45 | CA$341.19 | 38% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Underneath we present a selection of stocks filtered out by our screen.

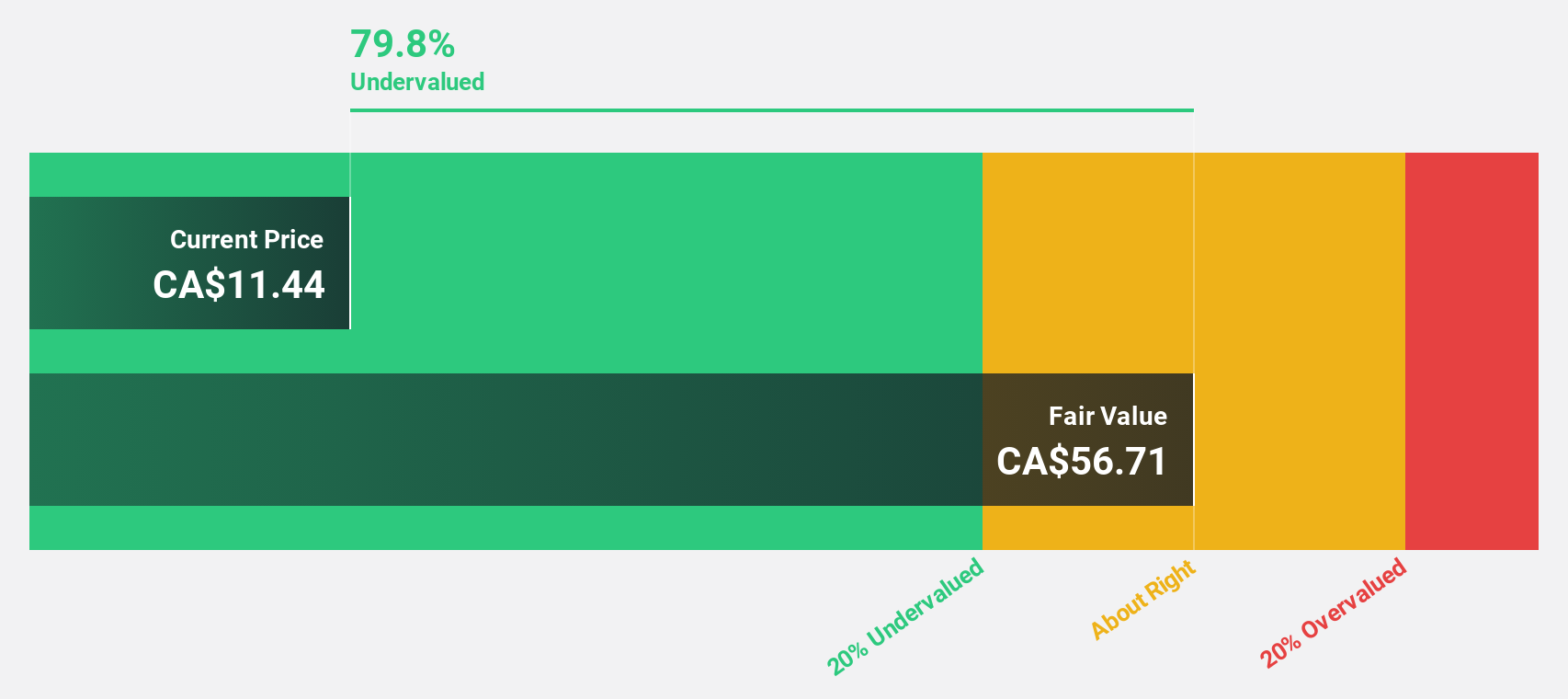

Advantage Energy (TSX:AAV)

Overview: Advantage Energy Ltd. operates in the acquisition, exploitation, development, and production of natural gas, crude oil, and natural gas liquids in Alberta, Canada with a market cap of CA$1.64 billion.

Operations: The company's revenue segment includes CA$501.15 million from Advantage Oil & Gas Ltd.

Estimated Discount To Fair Value: 10.9%

Advantage Energy is trading at CA$9.25, slightly below its estimated fair value of CA$10.38, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue growth of 20.9% annually and earnings growth of 28%, high debt levels and declining profit margins from 29% to 16% pose risks. Recent production guidance indicates stable output for 2024, while new board member David G. Smith brings extensive industry experience to the company’s strategic direction.

- The growth report we've compiled suggests that Advantage Energy's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Advantage Energy.

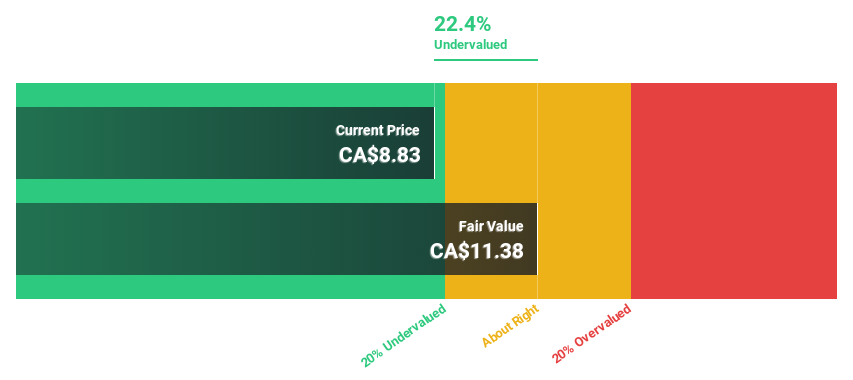

Doman Building Materials Group (TSX:DBM)

Overview: Doman Building Materials Group Ltd. operates through its subsidiaries to distribute building materials and home renovation products wholesale in the United States and Canada, with a market cap of CA$775.09 million.

Operations: The company's revenue primarily comes from the building materials segment, which generated CA$2.43 billion.

Estimated Discount To Fair Value: 22.4%

Doman Building Materials Group, trading at CA$8.83, is valued below its fair value estimate of CA$11.38, indicating potential undervaluation based on cash flows. Despite forecasted earnings growth of 36.4% annually outpacing the Canadian market, the dividend yield of 6.34% is not well covered by free cash flows and interest payments exceed earnings coverage. Recent debt financing raised CA$265 million to optimize its balance sheet and support future acquisitions amidst volatile markets.

- Our comprehensive growth report raises the possibility that Doman Building Materials Group is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Doman Building Materials Group's balance sheet health report.

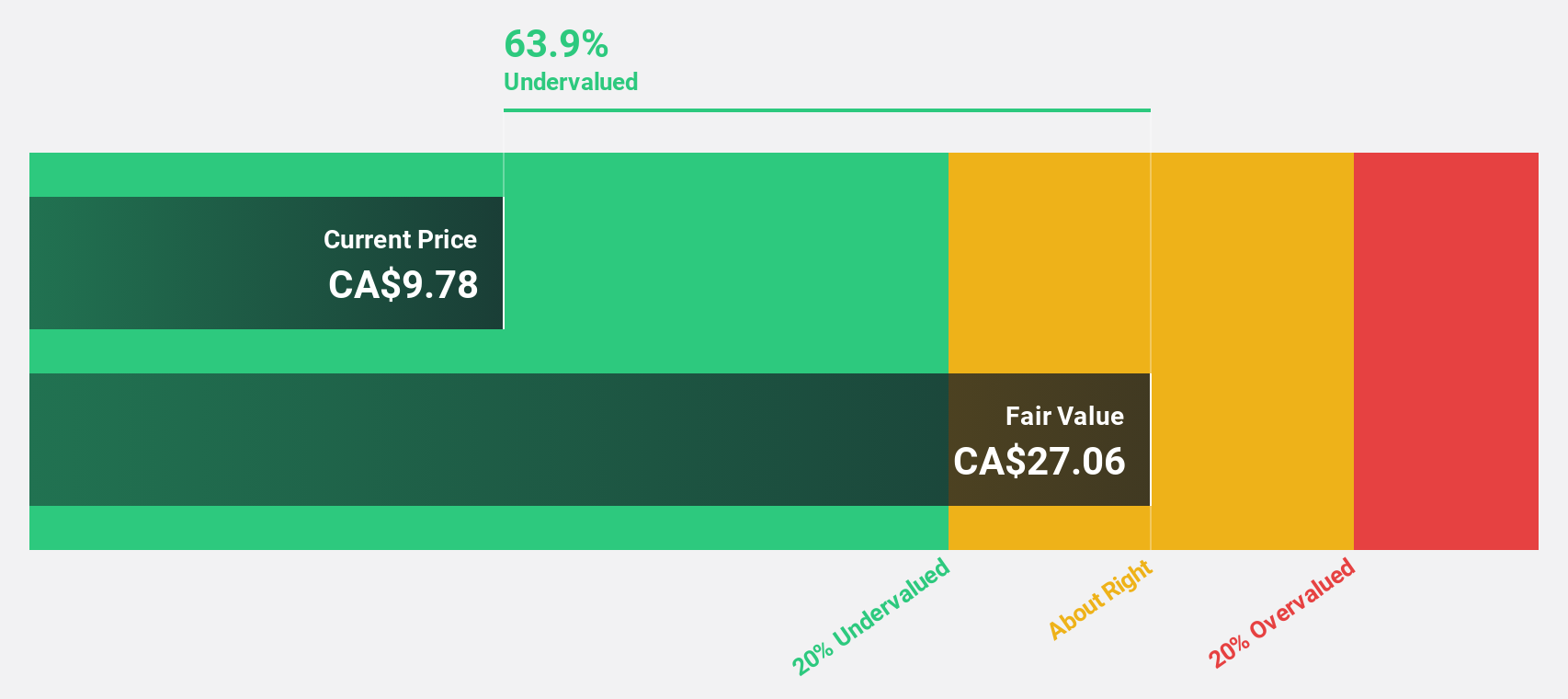

5N Plus (TSX:VNP)

Overview: 5N Plus Inc. is a company that produces and sells specialty metals and chemicals across North America, Europe, and Asia, with a market capitalization of CA$596.59 million.

Operations: The company generates revenue from two main segments: Performance Materials, contributing $82.69 million, and Specialty Semiconductors, accounting for $184.92 million.

Estimated Discount To Fair Value: 15.1%

5N Plus, currently trading at CA$6.83, is below its fair value estimate of CA$8.05, suggesting undervaluation based on cash flows. The company expects annual earnings growth of 36.37%, surpassing the Canadian market average of 14.5%. Despite a revenue increase to US$74.58 million in Q2 2024, net income declined compared to the previous year due to large one-off items impacting results and significant insider selling over the past quarter raises concerns about internal confidence.

- The analysis detailed in our 5N Plus growth report hints at robust future financial performance.

- Dive into the specifics of 5N Plus here with our thorough financial health report.

Seize The Opportunity

- Gain an insight into the universe of 24 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DBM

Doman Building Materials Group

Through its subsidiaries, engages in the wholesale distribution of building materials and home renovation products in the United States and Canada.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives