- Canada

- /

- Real Estate

- /

- TSXV:YAK.H

TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As 2025 begins, investors are reflecting on a remarkable 2024, where the TSX gained 18% amid strong economic growth and rising corporate profits. In this landscape of mixed headwinds and tailwinds, penny stocks remain an intriguing area for those seeking value in smaller or newer companies. Despite their vintage moniker, these stocks can offer significant opportunities when backed by solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$3.95 | CA$375.64M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$119.47M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$574.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$241.16M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.18 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.17M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.63 | CA$302.67M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$182.38M | ★★★★★☆ |

Click here to see the full list of 943 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Appia Rare Earths & Uranium (CNSX:API)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Appia Rare Earths & Uranium Corp. focuses on acquiring, exploring, and developing mineral properties in Canada and Brazil with a market cap of CA$12.70 million.

Operations: Appia Rare Earths & Uranium Corp. does not report any revenue segments.

Market Cap: CA$12.7M

Appia Rare Earths & Uranium Corp., with a market cap of CA$12.70 million, remains a pre-revenue entity focused on mineral exploration in Canada and Brazil. Despite being debt-free, the company faces financial challenges with short-term assets of CA$1.1 million insufficient to cover long-term liabilities of CA$2.9 million, though it recently raised capital through private placements totaling over CAD 1 million to extend its cash runway. Recent developments include promising survey results at Alces Lake and participation in Brazil's MAGBRAS initiative for rare earth magnet production, highlighting potential growth areas despite current volatility and shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of Appia Rare Earths & Uranium.

- Assess Appia Rare Earths & Uranium's previous results with our detailed historical performance reports.

Irving Resources (CNSX:IRV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Irving Resources Inc. is a junior exploration stage company focused on acquiring and exploring mineral properties in Canada and Japan, with a market cap of CA$19.56 million.

Operations: Irving Resources Inc. does not report any revenue segments as it is currently focused on the exploration stage of its mineral properties in Canada and Japan.

Market Cap: CA$19.56M

Irving Resources Inc., with a market cap of CA$19.56 million, is a pre-revenue company focused on mineral exploration in Canada and Japan. The firm has no debt but faces financial constraints with less than a year of cash runway. Recent strategic alliances have been formed through a joint venture with Newmont Overseas Exploration Limited and Sumitomo Corporation over the Yamagano and Noto properties, where Irving holds a 27.5% interest. Despite shareholder dilution and high volatility, Irving's experienced management team may leverage these partnerships to navigate its current challenges while reducing losses over the past five years by 18% annually.

- Get an in-depth perspective on Irving Resources' performance by reading our balance sheet health report here.

- Examine Irving Resources' past performance report to understand how it has performed in prior years.

Mongolia Growth Group (TSXV:YAK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mongolia Growth Group Ltd. operates as a merchant bank with real estate investments in Mongolia and has a market cap of CA$33.50 million.

Operations: The company generates revenue through its Subscription Products segment, which accounts for CA$2.72 million, and its Corporate segment, contributing CA$0.11 million.

Market Cap: CA$33.5M

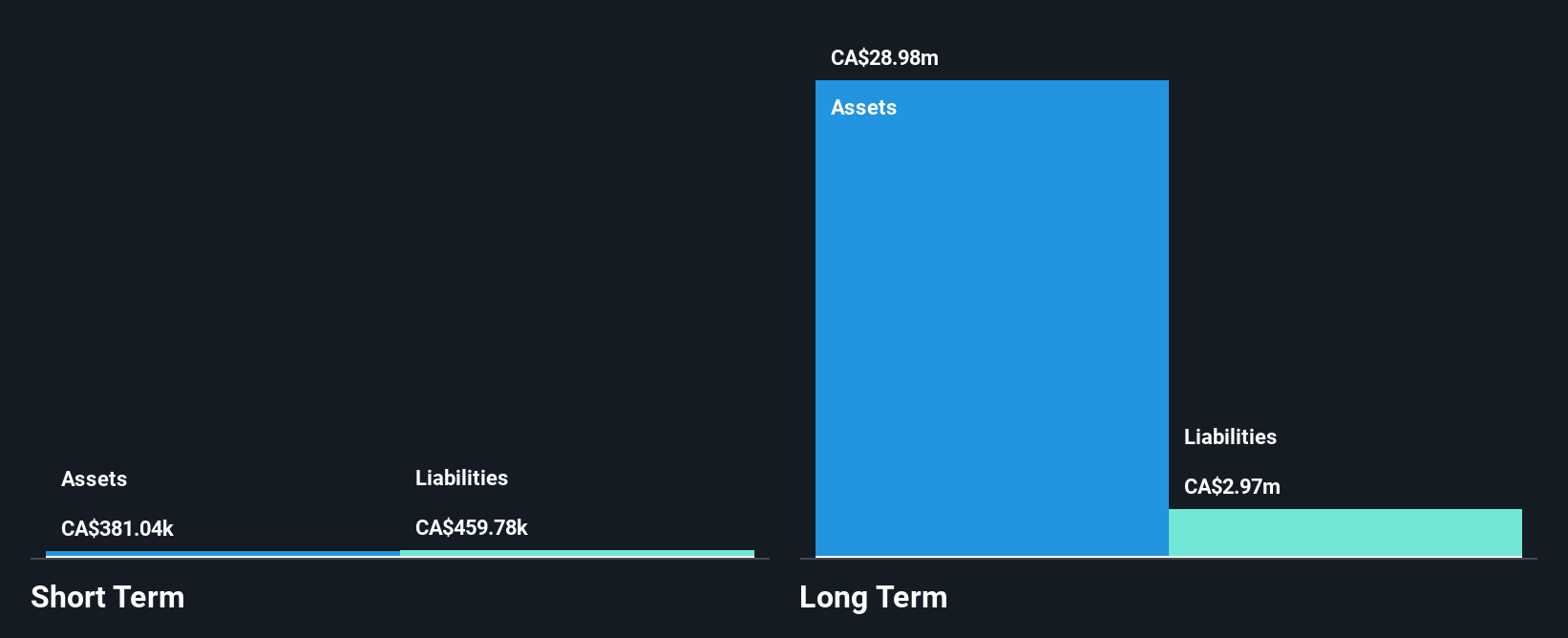

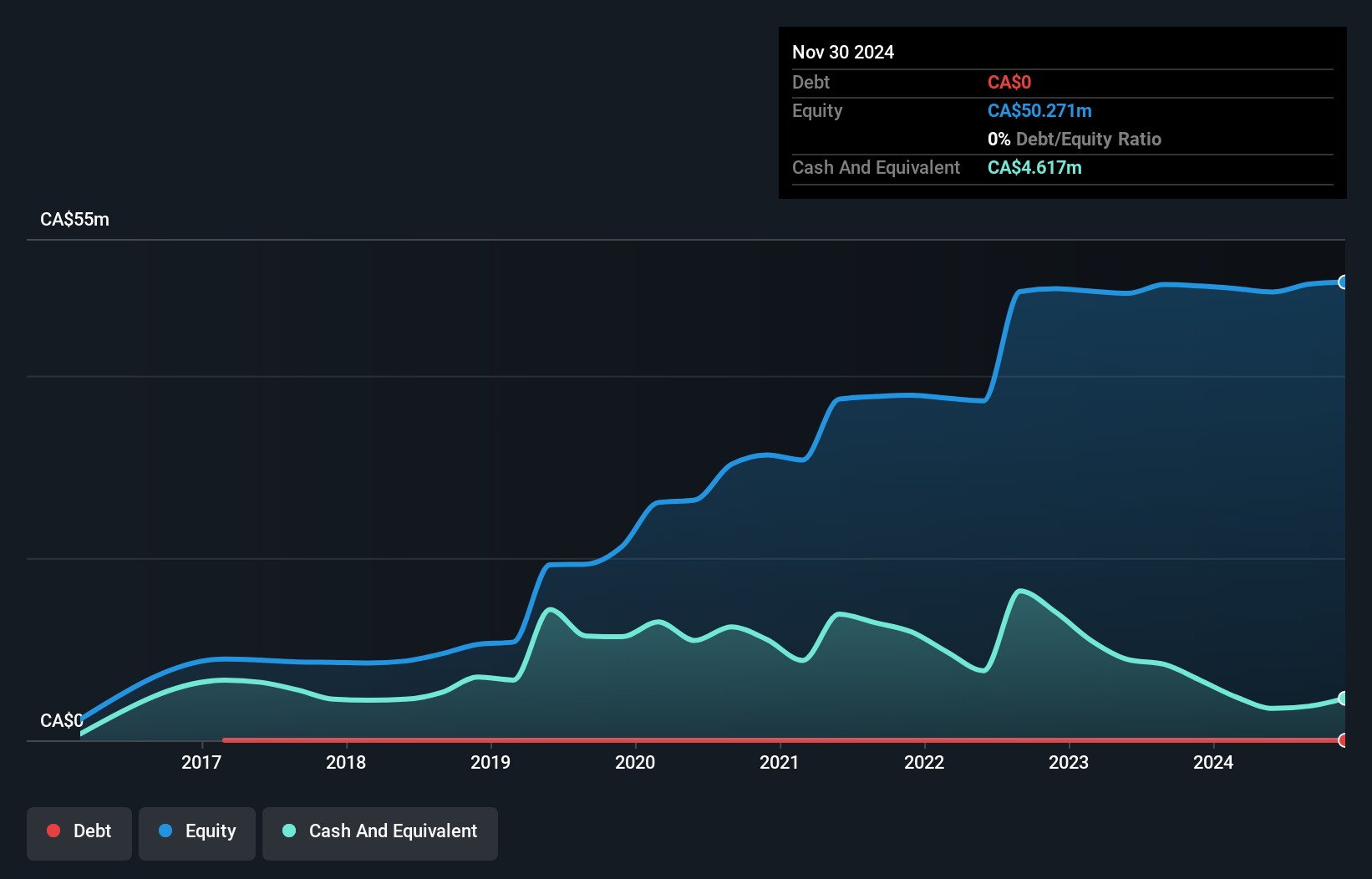

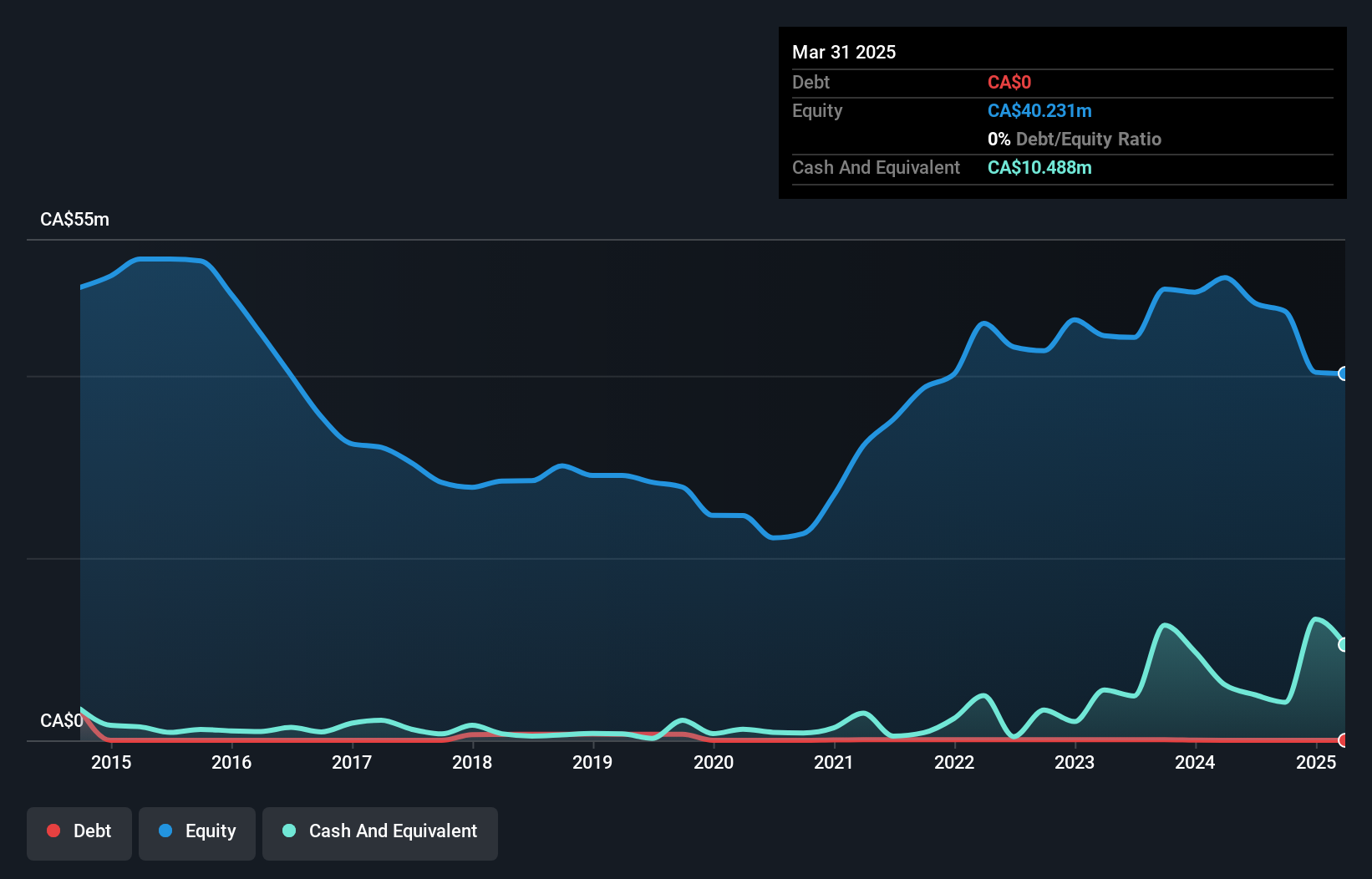

Mongolia Growth Group Ltd., with a market cap of CA$33.50 million, operates without debt and maintains stable weekly volatility at 6%. Despite being unprofitable, the company has reduced losses by 16.8% annually over five years. Recent earnings show a net loss of CA$0.76 million for Q3 2024, with revenue declining to CA$0.66 million from the previous year’s CA$0.75 million. The firm’s short-term assets of CA$4.2 million comfortably cover both short-term and long-term liabilities, while its seasoned board boasts an average tenure of over ten years, providing experienced oversight amid financial challenges.

- Click to explore a detailed breakdown of our findings in Mongolia Growth Group's financial health report.

- Review our historical performance report to gain insights into Mongolia Growth Group's track record.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 940 more companies for you to explore.Click here to unveil our expertly curated list of 943 TSX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:YAK.H

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026