- Canada

- /

- Capital Markets

- /

- TSXV:TIE

Coloured Ties Capital Inc.'s (CVE:TIE) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

Coloured Ties Capital Inc. (CVE:TIE) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

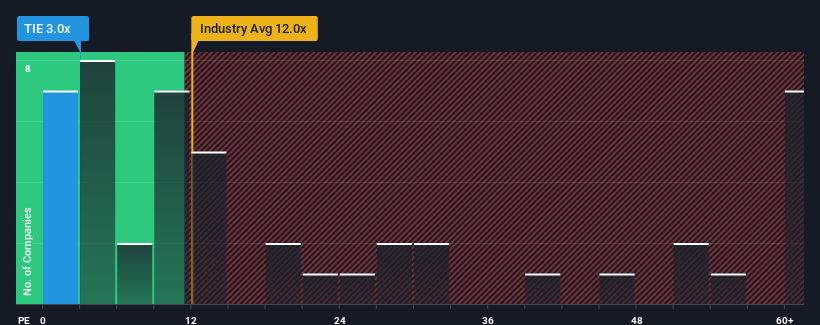

Although its price has surged higher, Coloured Ties Capital's price-to-earnings (or "P/E") ratio of 3x might still make it look like a strong buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 15x and even P/E's above 32x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Coloured Ties Capital's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Coloured Ties Capital

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Coloured Ties Capital's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 20% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Coloured Ties Capital is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in Coloured Ties Capital are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Coloured Ties Capital maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Coloured Ties Capital (1 is potentially serious!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Coloured Ties Capital, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:TIE

Coloured Ties Capital

A venture capital firm specializing in early stage investments.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives