- Canada

- /

- Capital Markets

- /

- TSX:X

TMX Group (TSX:X): Exploring Valuation Potential After Recent Underperformance

Reviewed by Kshitija Bhandaru

See our latest analysis for TMX Group.

After a sluggish month, TMX Group’s momentum appears to be fading for now, with a 1-year total shareholder return of just 0.25%. Although there have been some positive signals on annual earnings growth, recent share price returns have been muted. This suggests there is cautious market sentiment around its valuation.

If you’re on the lookout for stocks demonstrating more decisive momentum, take the opportunity to discover fast growing stocks with high insider ownership.

With shares still trading below analyst targets despite a recent stall in momentum, investors now face a key question: Is TMX Group an overlooked bargain, or has the market already factored in its future growth?

Most Popular Narrative: 15.5% Undervalued

According to the most followed narrative, TMX Group’s fair value is set considerably higher than its last closing price, highlighting a notable upside that has caught the market’s attention. This valuation reflects strong expectations about the company’s ability to leverage its global and digital investments for future growth.

TMX's strategic investments in digital platforms (such as post-trade modernization, cloud-based architecture for trading systems, and flexible marketplace technology) directly address the evolving landscape of digital assets and tokenization. These efforts provide a future-ready infrastructure and unlock new sources of transactional and data revenue as adoption of digital securities broadens.

Want the inside story on this bullish price target? Dive into the bold narrative assumptions: transformative platform investments, daring global ambitions, and sky-high expectations for future profitability. The secret? The numbers fueling this call may surprise you.

Result: Fair Value of $61.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as rising competition from global exchanges and the shift toward private funding sources. Both of these factors could challenge future growth assumptions.

Find out about the key risks to this TMX Group narrative.

Another View: Multiples Raise Questions

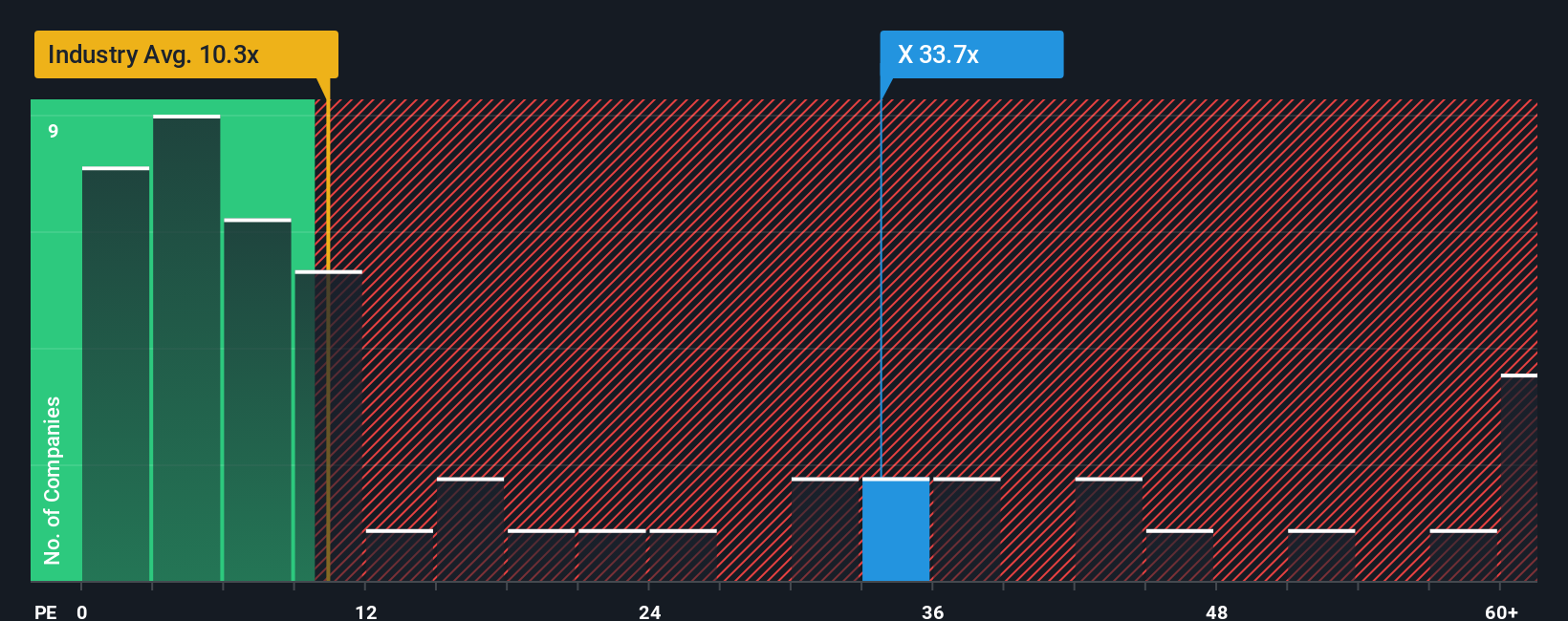

While some see TMX Group as undervalued, looking at its price-to-earnings ratio paints a different picture. At 34.4x, the company's ratio is far above both the Canadian Capital Markets industry average of 10.3x and its peer average of 26.1x. The fair ratio, which the market might gravitate toward, sits at 24.2x. This gap suggests the stock may be trading at a premium and raises important questions about valuation risk. Could the market eventually reprice TMX closer to these benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TMX Group Narrative

If you think the numbers tell a different story, or prefer to dig into the data your own way, you can craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding TMX Group.

Looking for More Investment Ideas?

Why stop here? There is a world of opportunity awaiting savvy investors like you. Jump on the latest trends and find companies that match your goals with these hand-picked routes:

- Seize the chance to spot growth potential by checking out these 3574 penny stocks with strong financials with solid financials in this often-overlooked segment.

- Unlock the next wave of innovation with these 32 healthcare AI stocks, which features pioneers transforming medicine through advanced artificial intelligence and automation.

- Secure reliable streams of passive income by browsing these 19 dividend stocks with yields > 3% offering robust dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:X

TMX Group

Operates exchanges, markets, and clearinghouses primarily for capital markets in Canada, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives