3 TSX Penny Stocks With Market Caps Over CA$100M To Consider

Reviewed by Simply Wall St

As the Canadian market navigates a period of softened growth outlooks, diversification has emerged as a key strategy for investors seeking stability amidst volatility. Penny stocks, though often considered speculative, can still offer intriguing opportunities when backed by strong financial health and solid fundamentals. In this article, we explore several Canadian penny stocks that stand out for their potential to deliver growth while maintaining financial strength.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$168.17M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.91 | CA$461.09M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.88 | CA$79.25M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.04 | CA$38.4M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$604.82M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.92 | CA$79.37M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$29.55M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$411.57M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$168M | ★★★★★☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies as alternatives to synthetic, petrochemical-based products across global markets, with a market cap of CA$261.63 million.

Operations: The company's revenue is generated from its Biopolymer Nanosphere Technology Platform, which amounts to $18.54 million.

Market Cap: CA$261.63M

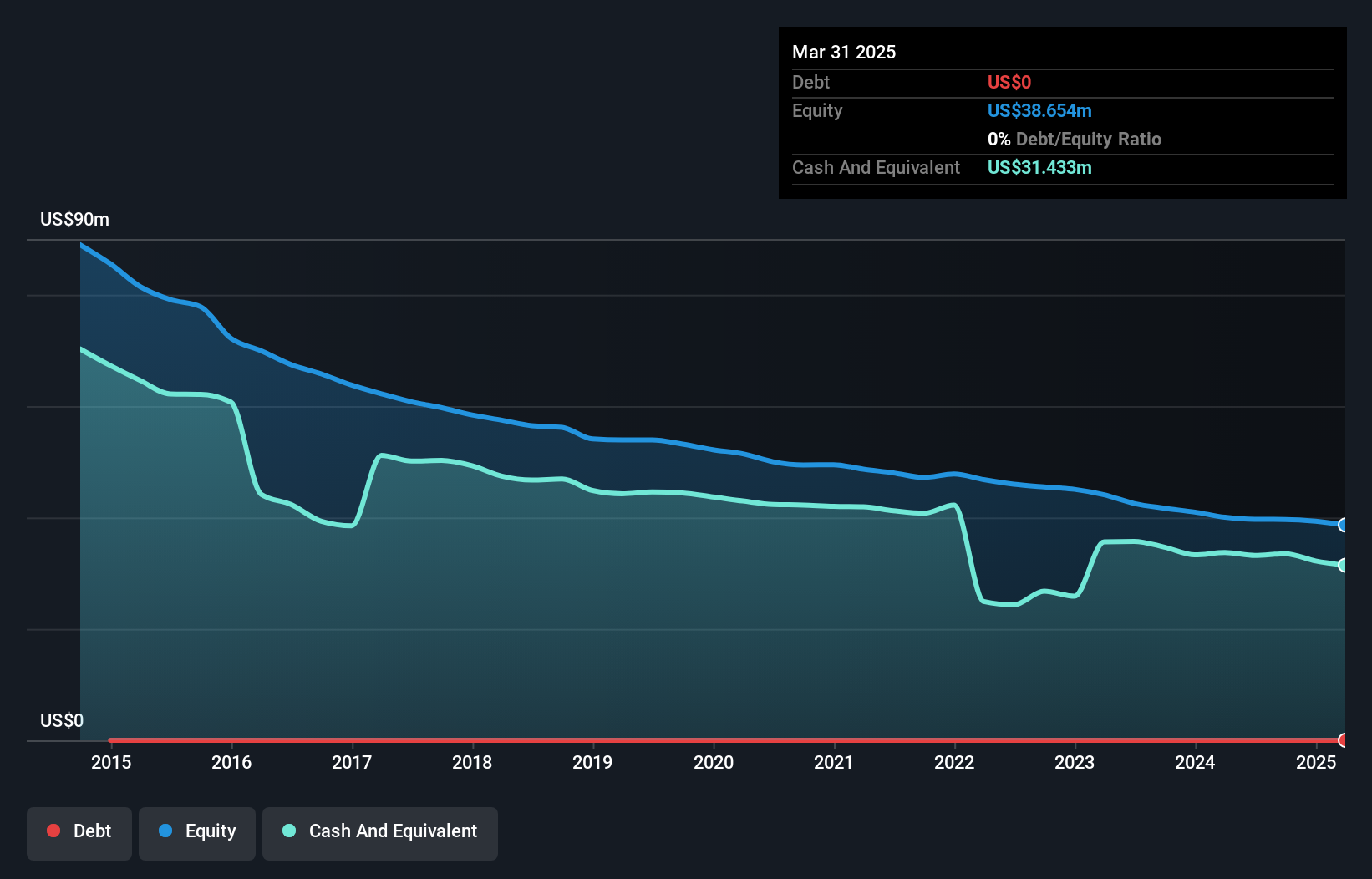

EcoSynthetix Inc., a renewable chemicals company, reported sales of US$18.54 million for 2024, up from US$12.66 million the previous year, with a net loss reduction to US$1.37 million. The company remains unprofitable but boasts no debt and has sufficient cash runway exceeding three years due to positive free cash flow. Recent developments include securing a commercial account with a global pulp manufacturer for its SurfLock product worth $1.1 million in 2025, highlighting potential growth in the billion-dollar pulp and packaging market. Shareholder dilution was minimal last year, and management is experienced with an average tenure of 16.9 years.

- Unlock comprehensive insights into our analysis of EcoSynthetix stock in this financial health report.

- Evaluate EcoSynthetix's historical performance by accessing our past performance report.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally with a market cap of CA$281.53 million.

Operations: The company's revenue is generated from two primary segments: E-commerce, contributing CA$37.86 million, and Bricks and Mortar, accounting for CA$484.44 million.

Market Cap: CA$281.53M

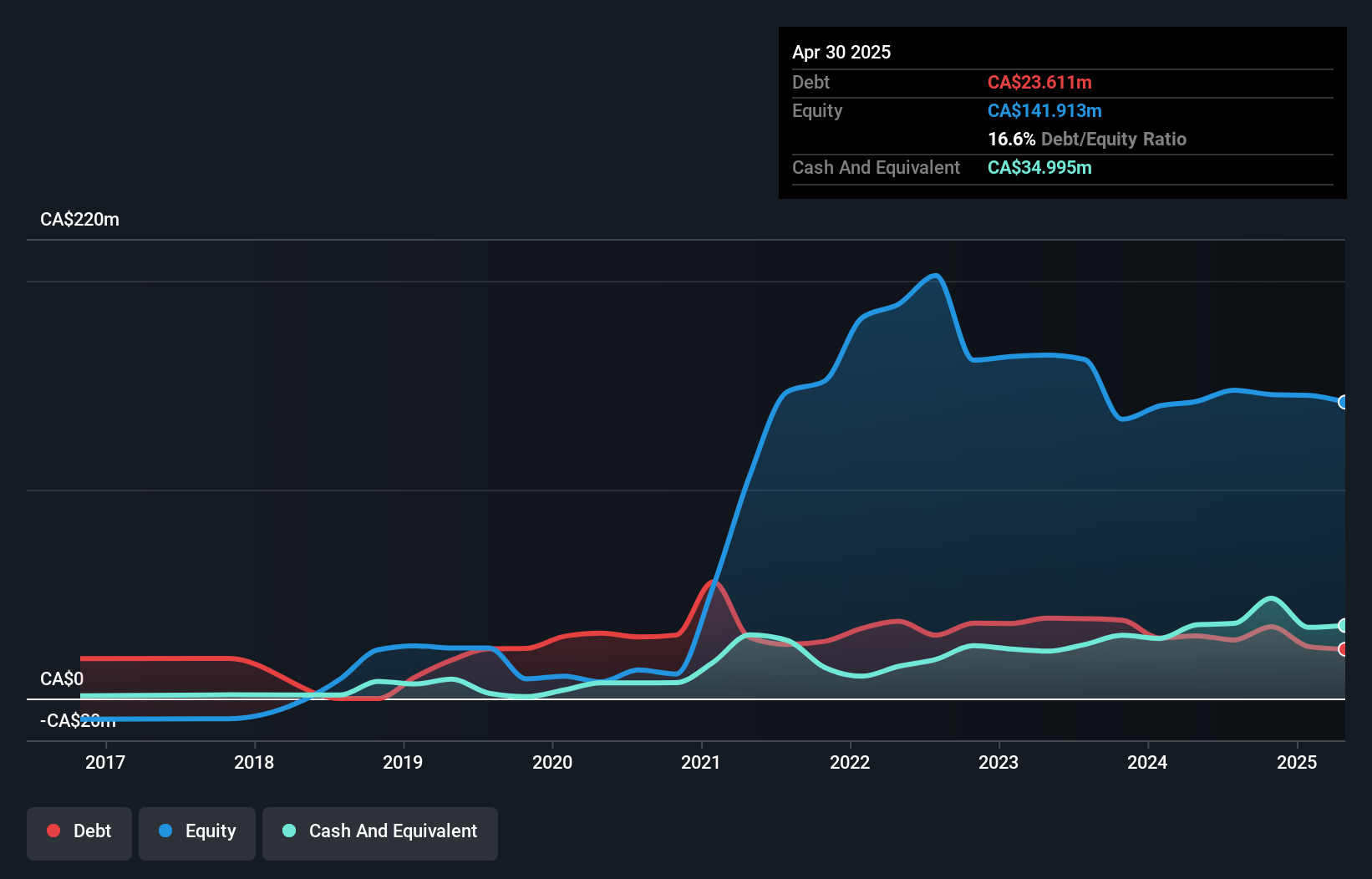

High Tide Inc. operates within the cannabis retail sector, boasting a market cap of CA$281.53 million with significant revenue streams from its Bricks and Mortar segment at CA$484.44 million and E-commerce at CA$37.86 million. Despite being unprofitable, the company has improved its financial stability by reducing its debt to equity ratio significantly over five years and maintaining more cash than total debt, ensuring a robust cash runway for over three years due to positive free cash flow growth. Recent expansions include opening new Canna Cabana locations in high-traffic areas across Ontario, enhancing its retail footprint strategically.

- Click to explore a detailed breakdown of our findings in High Tide's financial health report.

- Examine High Tide's earnings growth report to understand how analysts expect it to perform.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WonderFi Technologies Inc. focuses on developing and acquiring technology platforms for digital asset investments, with a market cap of CA$125.37 million.

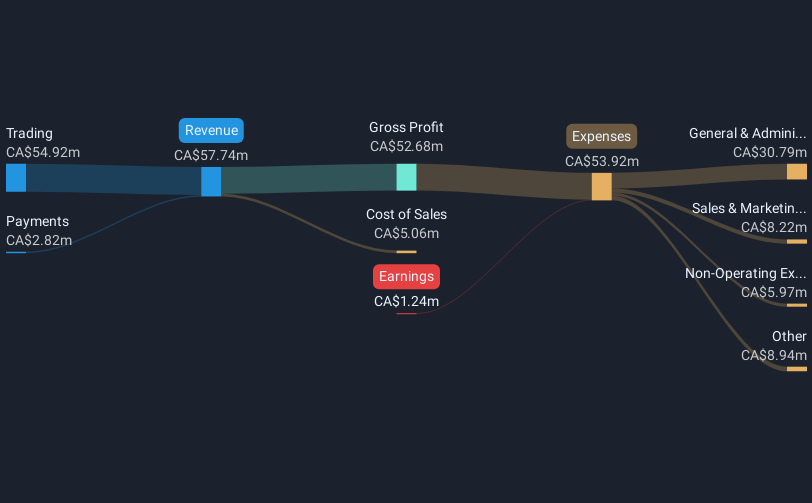

Operations: The company's revenue is primarily derived from its Trading segment, which generated CA$46.69 million, and its Payments segment, contributing CA$3.95 million.

Market Cap: CA$125.37M

WonderFi Technologies Inc., with a market cap of CA$125.37 million, has recently turned profitable, yet its Return on Equity remains low at 2.6%. The company is expanding its digital asset investment platforms through strategic partnerships and technological innovations. It announced a partnership with Eightcap to offer CFDs on Bitbuy and Coinsquare, enhancing trading flexibility. Additionally, WonderFi launched a Layer-2 blockchain via ZKsync's Elastic Network and Bitcoin.ca for Canadian Bitcoin education and services. Despite negative operating cash flow, WonderFi's short-term assets cover liabilities well, positioning it for potential growth in the evolving crypto space.

- Dive into the specifics of WonderFi Technologies here with our thorough balance sheet health report.

- Explore WonderFi Technologies' analyst forecasts in our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 934 TSX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade High Tide, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if High Tide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HITI

High Tide

Engages in the cannabis retail business in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives