- Canada

- /

- Capital Markets

- /

- TSX:SII

Is Sprott Still a Smart Investment After an 89% Surge in 2024?

Reviewed by Bailey Pemberton

If you have been watching Sprott’s extraordinary run over the past few months, you might be wondering whether it is finally the right moment to jump in, hold tight, or even take some chips off the table. With the stock closing at $118.82 and posting a 2.5% gain in just the last week, it is easy to see why this company is catching so many investors’ attention. Over the longer haul, Sprott has absolutely crushed it, boasting a year-to-date return of 89.7% and a jaw-dropping 206.3% gain over five years.

What is behind these impressive numbers? There is no single magic bullet, but the company has certainly benefited from broader market developments, especially enthusiasm for natural resources and alternative asset strategies. These themes have reignited interest in companies like Sprott, which specialize in precious metals and related investment vehicles. Investors are recalibrating their expectations, not necessarily because of a sharp reduction in risk but perhaps due to more optimism about Sprott’s positioning in the market.

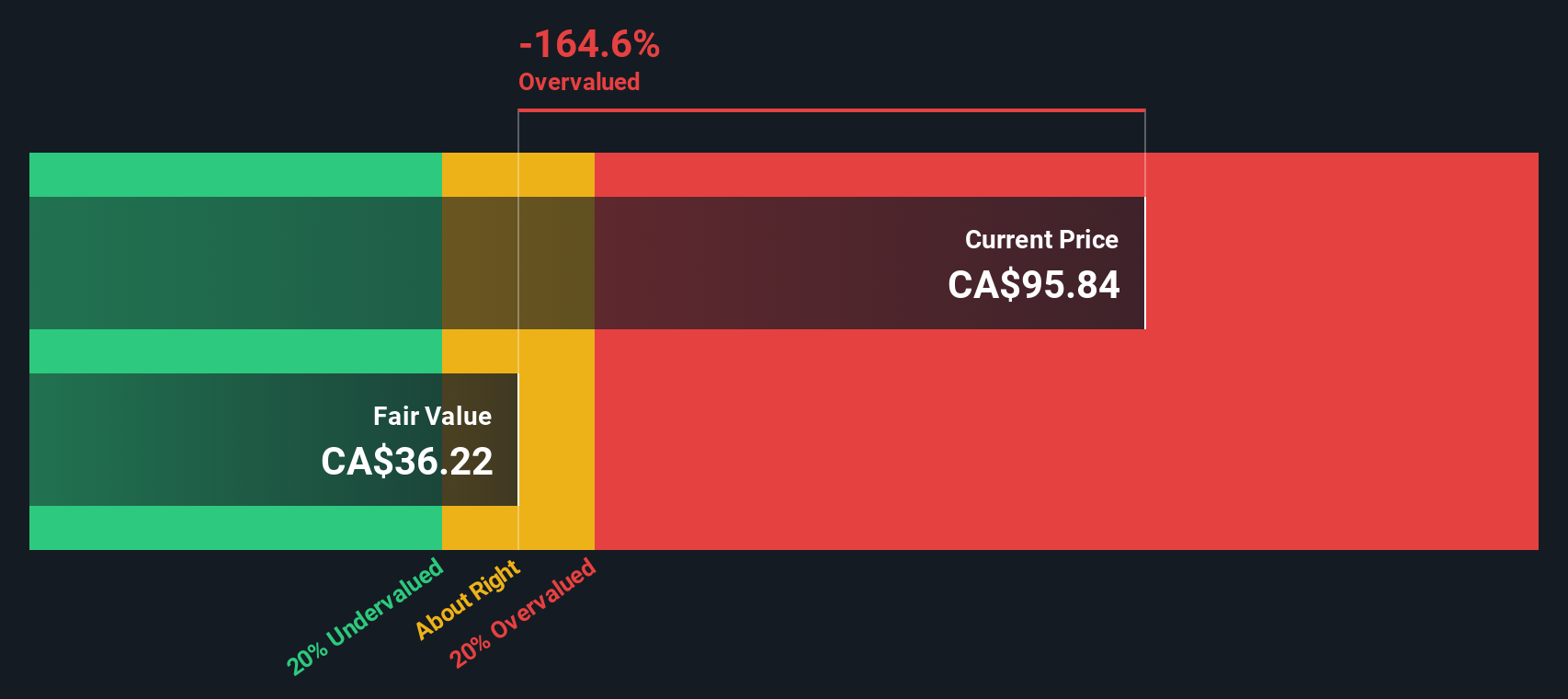

With such striking price growth, the next logical question is whether Sprott still offers value at these levels or if the stock price has already run well ahead of the company’s fundamentals. Looking at a simple value score, where a company gets 1 point for every check as undervalued across six standard criteria, Sprott clocks in at just 0. It is a signal worth pausing on.

Of course, not all valuation approaches are created equal. Let’s walk through the main valuation methods for Sprott, and after that, I will show you a more insightful way to size up whether the stock is truly expensive or potentially still a smart bet.

Sprott scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sprott Excess Returns Analysis

The Excess Returns valuation model evaluates a company by looking at how much return it generates over and above its cost of equity. In simple terms, it calculates how efficiently the business can put its capital to work and whether it consistently earns more than its investors require as compensation for risk.

For Sprott, this model highlights the following:

- Book Value: CA$13.39 per share

- Stable Earnings per Share (EPS): CA$1.55 per share (based on the median return on equity over the past 5 years)

- Cost of Equity: CA$0.85 per share

- Excess Return: CA$0.70 per share

- Average Return on Equity: 12.88%

- Stable Book Value: CA$12.03 per share (sourced from historical median values)

The Excess Returns model concludes that Sprott is generating a positive excess return above its cost of equity, which is generally a good sign. However, when the intrinsic value implied by this model is compared to the stock’s current price of CA$118.82, the picture changes. The Excess Returns analysis estimates that Sprott is 208.1% overvalued at present levels.

Result: OVERVALUED

Our Excess Returns analysis suggests Sprott may be overvalued by 208.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sprott Price vs Earnings

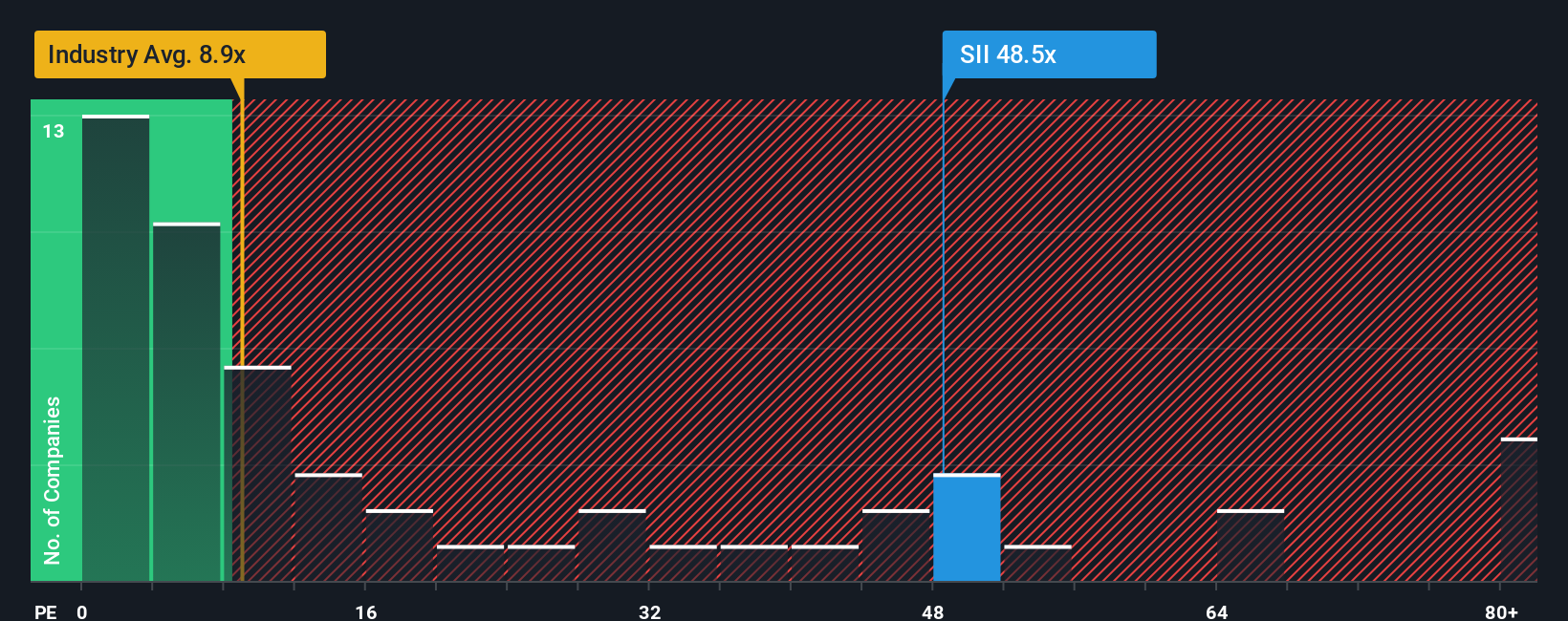

The price-to-earnings (PE) ratio is often the primary valuation metric for profitable companies, as it tells investors how much they are paying for each dollar of earnings. A company's PE gives a quick sense of whether the market views its profits as deserving of a premium or discount compared to others.

Typically, higher growth expectations and lower risk justify a higher PE, while slower growth or higher risk warrant a lower multiple. Sprott is currently trading at a PE ratio of 43.9x, which stands out compared to both its industry average of 10.3x and its peer average of 16.2x. This sizable premium suggests the market expects Sprott’s future earnings to grow at a much faster pace, or that its risks are perceived as unusually low.

Simply Wall St uses a proprietary “Fair Ratio,” which is the PE multiple you would expect after considering key company-specific factors such as earnings growth, market cap, profit margins, and risk profile, along with broader industry conditions. Unlike simple peer or sector comparisons, the Fair Ratio adjusts for Sprott’s unique characteristics and outlook, making it a more accurate benchmark for valuation.

Comparing Sprott’s actual PE to its Fair Ratio suggests the stock is trading well above where a fair value would likely sit, even after accounting for its positive traits and growth opportunities.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sprott Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story about a company. It is how you connect your perspective on where Sprott is headed with numbers like fair value, future revenue, and expected margins.

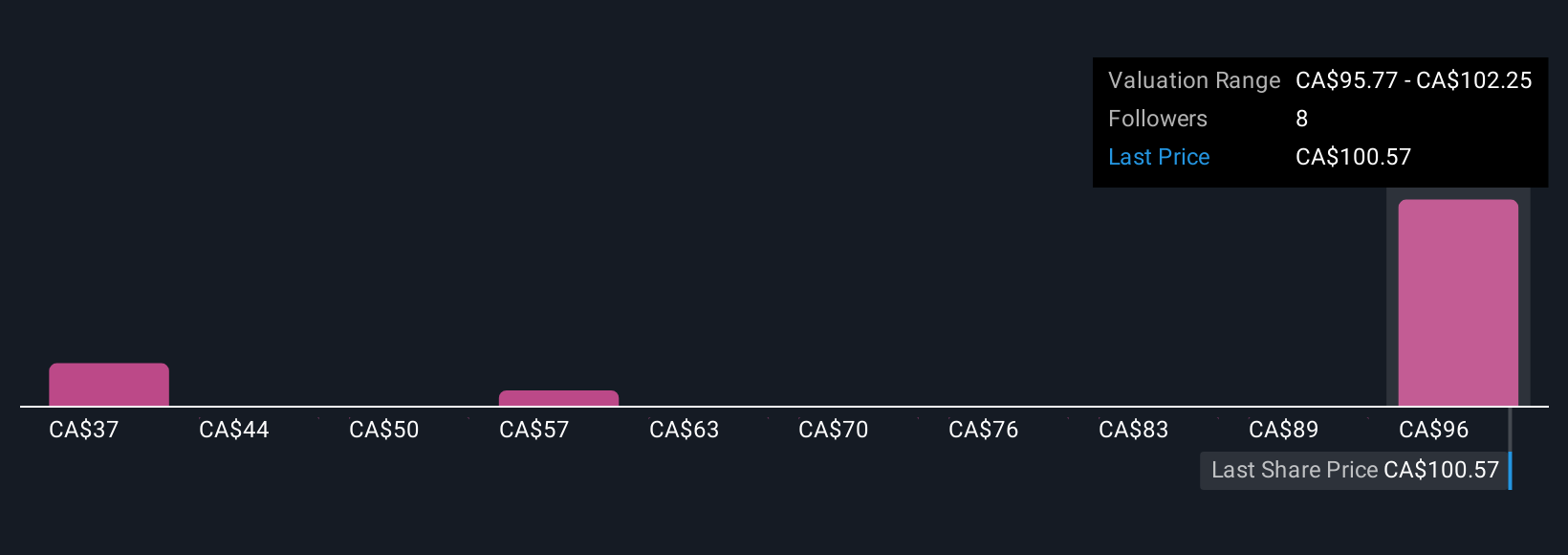

Narratives bridge the gap between a company’s story and its financial forecast, making it easy to link what you believe will happen to actual calculations of value. On Simply Wall St's Community page, used by millions of investors, Narratives are an accessible tool for building and sharing your own outlook on a stock.

By comparing your calculated Fair Value from a Narrative to Sprott’s current price, you can quickly decide if now is the right time to buy, hold, or sell. Plus, Narratives automatically stay up to date with every new piece of news or earnings update, so your perspective adapts as the market changes.

For example, while one investor might see Sprott’s fair value as high as CA$137 by projecting strong future growth, another might have a more cautious view, estimating fair value at just CA$70. This shows how Narratives reflect a wide range of beliefs and strategies.

Do you think there's more to the story for Sprott? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)