- Canada

- /

- Metals and Mining

- /

- TSX:WDO

Exploring 3 Canadian Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As Canadian stocks continue to reach new highs, buoyed by trade optimism and robust corporate earnings, the market presents a fertile ground for discovering promising opportunities. In this environment of easing uncertainty and consistent gains, identifying quality stocks with strong fundamentals becomes crucial for investors seeking to navigate the evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Zoomd Technologies | 8.92% | 10.04% | 44.63% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.22 billion.

Operations: North West generates revenue primarily from its retail operations in food and everyday products, amounting to CA$2.60 billion.

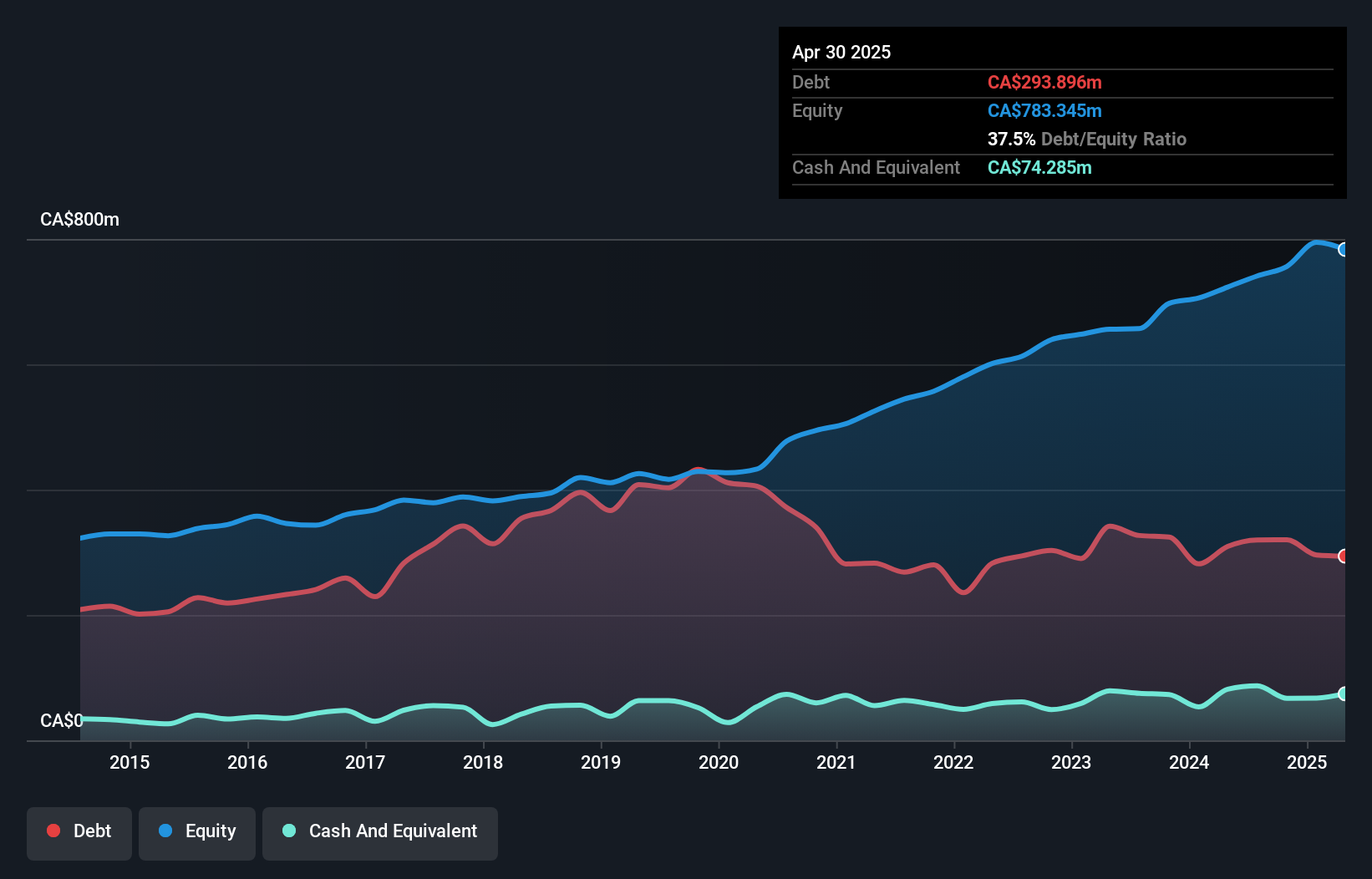

North West Company, a smaller player in the Canadian market, has shown solid financial health with a net debt to equity ratio of 28%, which is considered satisfactory. Over five years, it reduced its debt from 93.7% to 37.5%, reflecting prudent management. The company reported CAD 641 million in sales for Q1 2025, up from CAD 618 million last year, and net income rose slightly to CAD 25.84 million. Earnings per share remained stable at CAD 0.54 basic and diluted at CAD 0.53, indicating steady performance despite no recent share buybacks under their announced program.

Sprott (TSX:SII)

Simply Wall St Value Rating: ★★★★★★

Overview: Sprott Inc. is a publicly owned asset management holding company with a market capitalization of approximately CA$2.51 billion.

Operations: Sprott Inc. generates revenue primarily through Exchange Listed Products, contributing $115.42 million, and Managed Equities at $40.22 million. Private Strategies add another $25.67 million to its revenue stream.

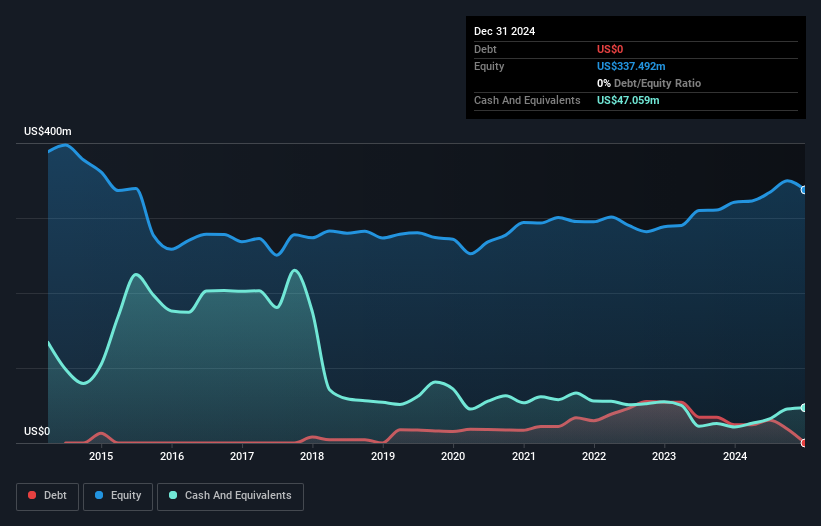

Sprott, a dynamic player in the Canadian market, showcases a robust financial profile with no debt compared to five years ago when its debt-to-equity ratio stood at 7.2%. The company's earnings grew by 8.7% over the past year, outpacing the Capital Markets industry's growth. Recently, Sprott completed a composite units offering worth $200 million, indicating strategic capital moves. In Q1 2025, revenue reached US$43.36 million and net income was US$11.96 million; both figures are slightly up from last year’s results. Despite significant insider selling recently, Sprott maintains high-quality earnings and forecasts steady revenue growth of 9% annually.

- Navigate through the intricacies of Sprott with our comprehensive health report here.

Gain insights into Sprott's historical performance by reviewing our past performance report.

Wesdome Gold Mines (TSX:WDO)

Simply Wall St Value Rating: ★★★★★★

Overview: Wesdome Gold Mines Ltd. is a Canadian company engaged in the mining, development, and exploration of gold and silver deposits, with a market cap of CA$2.57 billion.

Operations: Wesdome Gold Mines generates revenue primarily from its Kiena Mine and Eagle River Mine, with contributions of CA$296.22 million and CA$348.66 million, respectively.

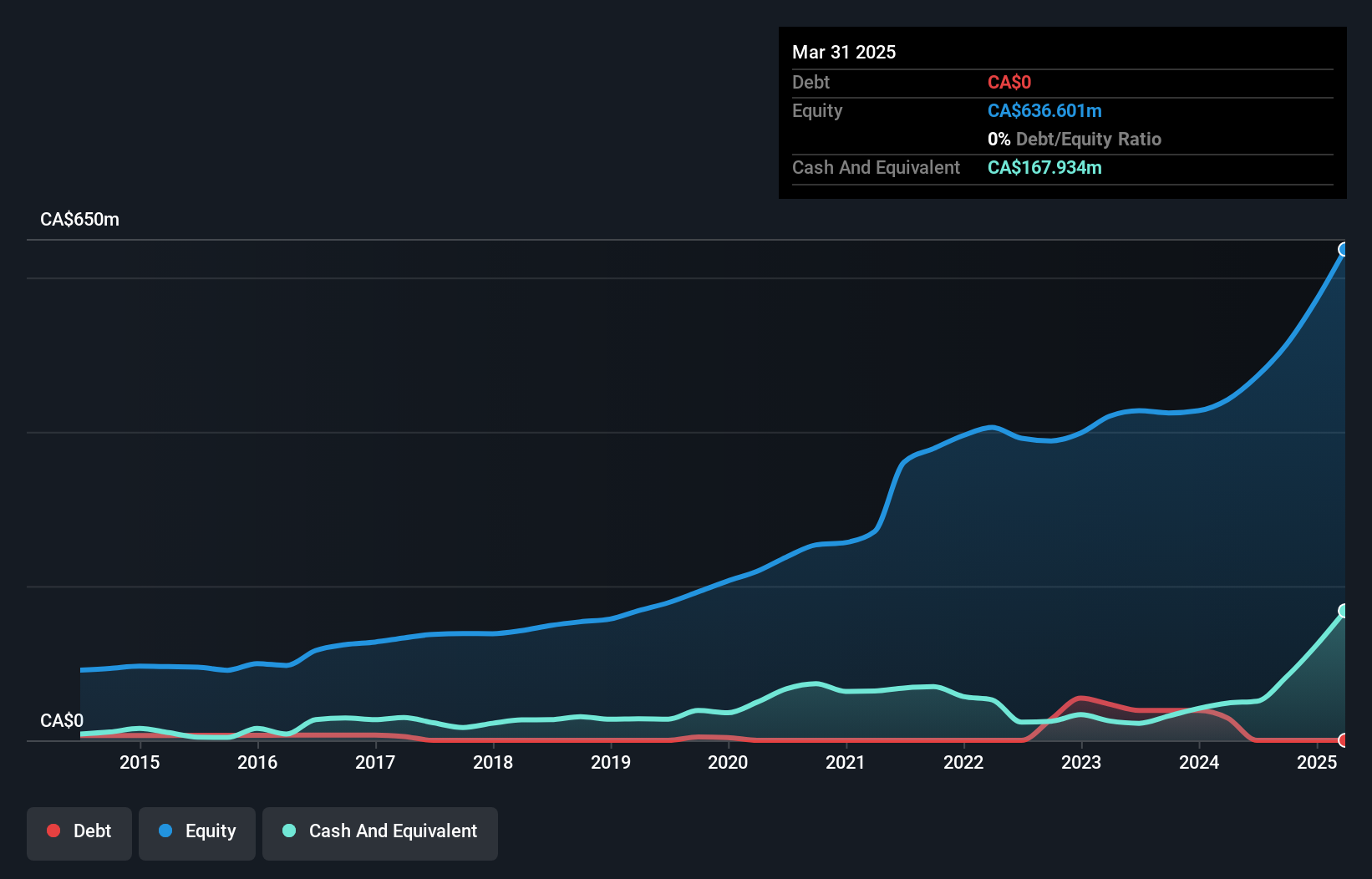

Wesdome Gold Mines, a Canadian gold producer, is making strides with its high-grade underground assets at Eagle River and Kiena. The company reported impressive earnings growth of 3747.8% over the past year, significantly outpacing the industry average of 37.1%. Trading at 75.9% below its fair value estimate, Wesdome presents an attractive valuation for investors seeking potential upside. Recent exploration activities at Kiena have confirmed high-grade mineralization, enhancing confidence in resource estimates and operational flexibility. Despite no debt five years ago and maintaining a debt-free status now, significant insider selling in recent months may concern some stakeholders about internal confidence levels moving forward.

Where To Now?

- Embark on your investment journey to our 49 TSX Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives