- Canada

- /

- Capital Markets

- /

- TSX:SII

Discovering Canada's Undiscovered Gems in June 2025

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors have shown resilience, with key indices like the TSX experiencing notable gains in May. In this environment of cautious optimism and potential economic adjustments, identifying promising small-cap stocks that can thrive despite external pressures becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Yellow Pages | NA | -11.43% | -17.61% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Westshore Terminals Investment | NA | 0.29% | -6.35% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sprott (TSX:SII)

Simply Wall St Value Rating: ★★★★★★

Overview: Sprott Inc. is a publicly owned asset management holding company with a market cap of CA$2.15 billion.

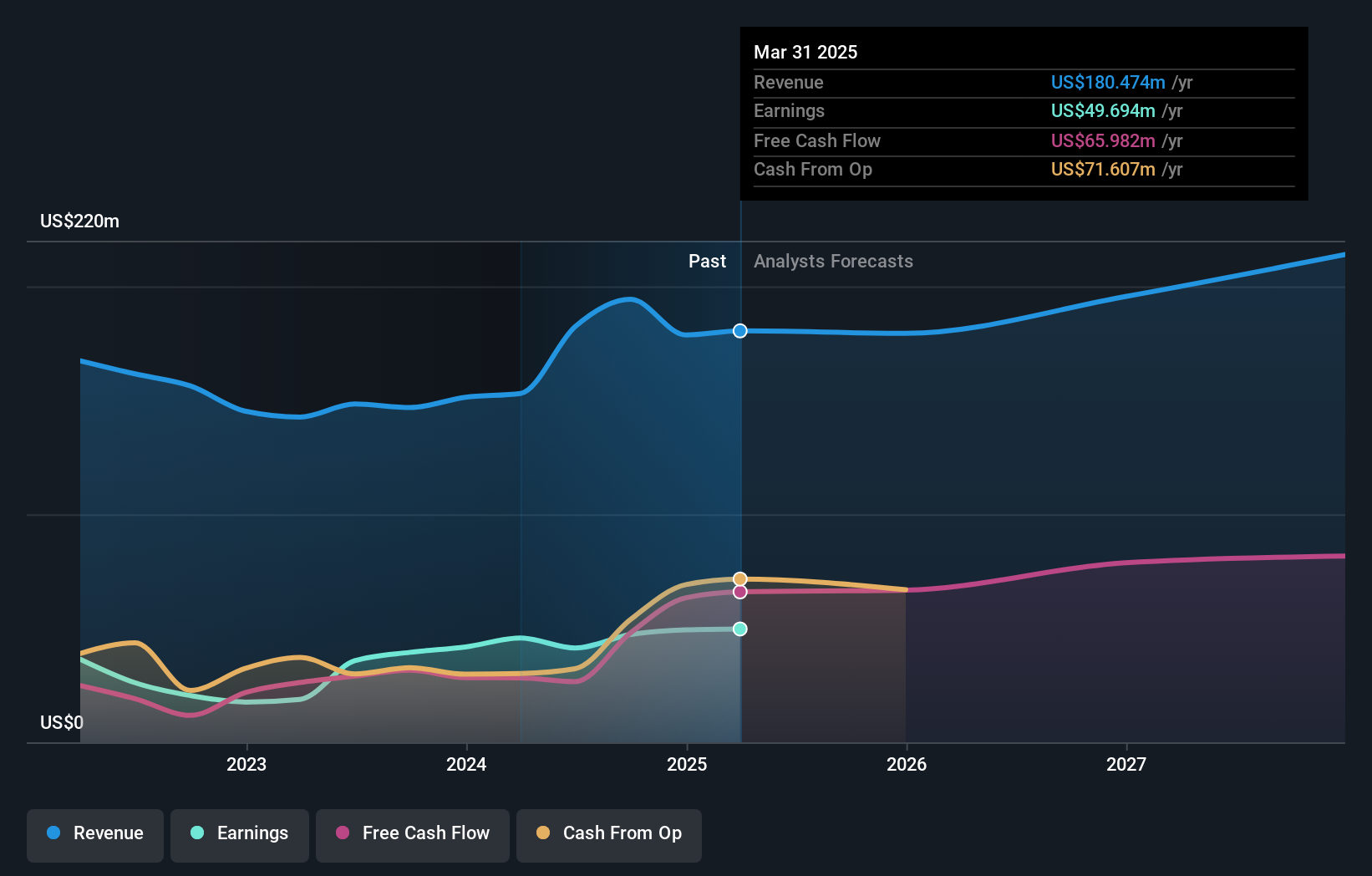

Operations: The company generates revenue primarily from Exchange Listed Products at $115.42 million and Managed Equities at $40.22 million, with Private Strategies contributing $25.67 million. The net profit margin is a key metric to consider for understanding profitability trends over time.

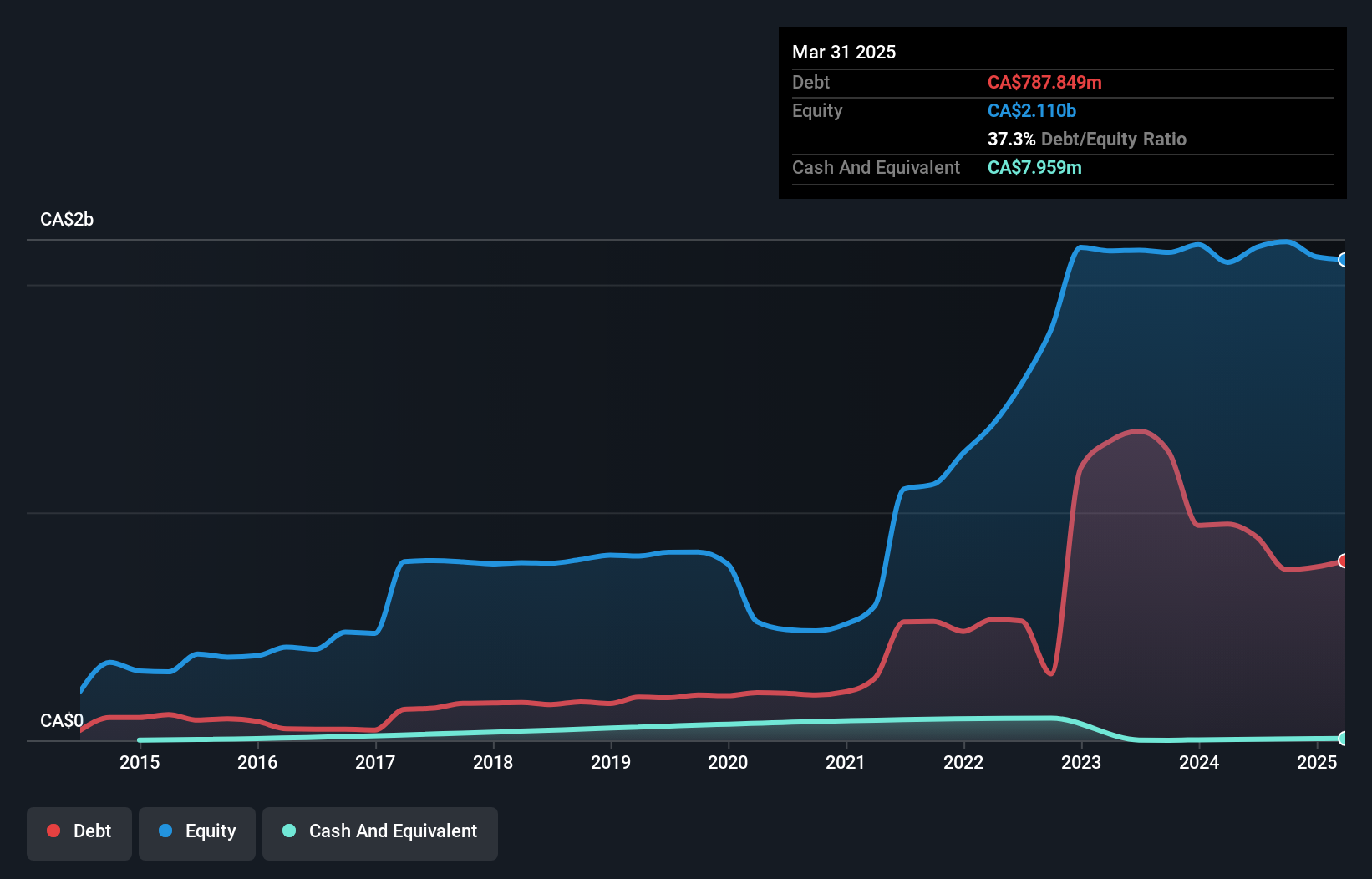

Sprott, a nimble player in the Canadian market, showcases robust financial health with its debt-free status and an impressive earnings growth of 8.7% over the past year, outpacing the Capital Markets industry average of 3.1%. The company reported Q1 2025 revenue at US$43.36 million and net income at US$11.96 million, reflecting solid performance compared to last year. A recent share repurchase program saw Sprott buy back 49,706 shares for CAD2.66 million, indicating confidence in its value proposition while maintaining high-quality earnings that contribute to its promising outlook amidst significant insider selling activity recently observed.

- Dive into the specifics of Sprott here with our thorough health report.

Review our historical performance report to gain insights into Sprott's's past performance.

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tamarack Valley Energy Ltd. operates in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids within the Western Canadian sedimentary basin and has a market cap of approximately CA$2.25 billion.

Operations: Tamarack Valley Energy generates revenue primarily from its oil and gas exploration and production activities, amounting to CA$1.44 billion. The company's financial performance is reflected in its net profit margin, which stands at 12.5%.

Tamarack Valley Energy, a Canadian energy player, has shown impressive earnings growth of 339.8% over the past year, outpacing the industry average of 3.9%. Trading at 31.3% below its estimated fair value, Tamarack seems to be an attractive proposition despite some challenges ahead with a forecasted earnings decline of 32.8% annually over the next three years. The company’s net debt to equity ratio stands at a satisfactory 37%, and it recently repurchased shares worth CAD 145.13 million (7.26%). However, it faces regulatory scrutiny with a CAD 25,500 penalty from the Alberta Energy Regulator for compliance issues in production data recording.

- Unlock comprehensive insights into our analysis of Tamarack Valley Energy stock in this health report.

Assess Tamarack Valley Energy's past performance with our detailed historical performance reports.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, and operation of mineral properties in Latin America, with a market capitalization of CA$359.41 million.

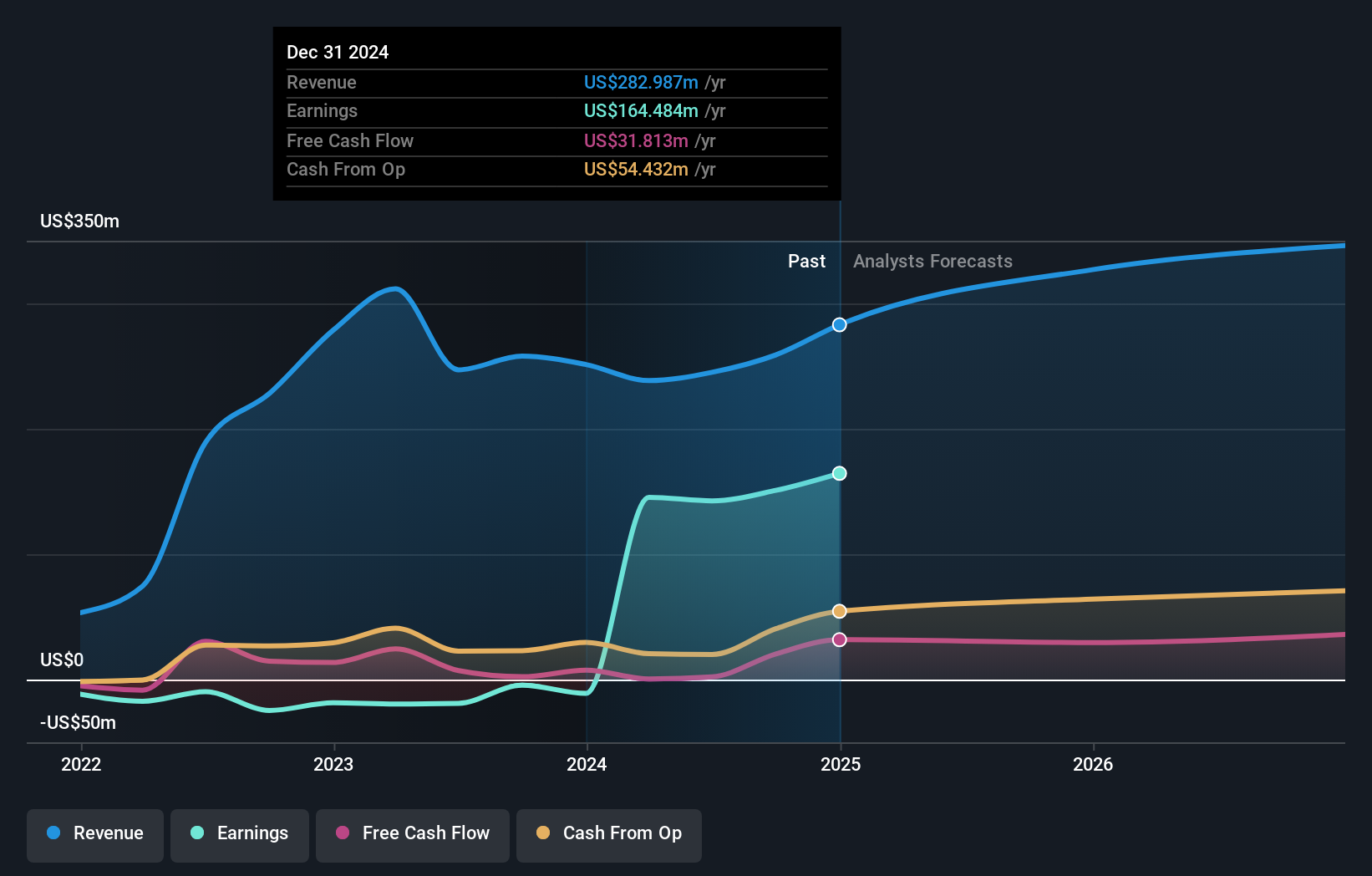

Operations: Santacruz generates revenue primarily from its mineral properties, with significant contributions from the Bolivar ($84.16 million) and Zimapan ($81.69 million) segments. The company's net profit margin shows notable variation, reflecting the financial dynamics of its operations across different regions.

Santacruz Silver Mining, a nimble player in the mining sector, has recently turned profitable with net income hitting US$164.48 million for 2024, a stark contrast to last year's US$11.01 million loss. The company's earnings per share from continuing operations jumped to US$0.46 from a loss of US$0.03 previously, highlighting its financial turnaround aided by strategic asset acquisitions and operational efficiencies. Despite its volatile share price over recent months, Santacruz trades at 77.9% below estimated fair value, suggesting potential upside for investors as it continues to cover interest payments comfortably with EBIT at 17.7 times coverage and maintains positive free cash flow status.

- Delve into the full analysis health report here for a deeper understanding of Santacruz Silver Mining.

Gain insights into Santacruz Silver Mining's past trends and performance with our Past report.

Seize The Opportunity

- Click here to access our complete index of 42 TSX Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026