- Canada

- /

- Capital Markets

- /

- TSX:SEC

Undiscovered Gems In Canada Featuring Senvest Capital And Two Promising Small Caps

Reviewed by Simply Wall St

As the Canadian market navigates through economic uncertainties, including a stronger-than-expected labor report and shifting expectations for interest rate cuts by the Bank of Canada, small-cap stocks have shown resilience amid broader market dynamics. In this environment, identifying promising investments involves looking at companies with strong fundamentals and growth potential that can thrive despite macroeconomic challenges. This article will explore three such undiscovered gems in Canada: Senvest Capital and two other promising small-cap stocks poised to capture investor interest.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Senvest Capital | 63.10% | -24.28% | -25.94% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Senvest Capital (TSX:SEC)

Simply Wall St Value Rating: ★★★★★★

Overview: Senvest Capital Inc. is a privately owned hedge fund sponsor with a market capitalization of CA$874.77 million.

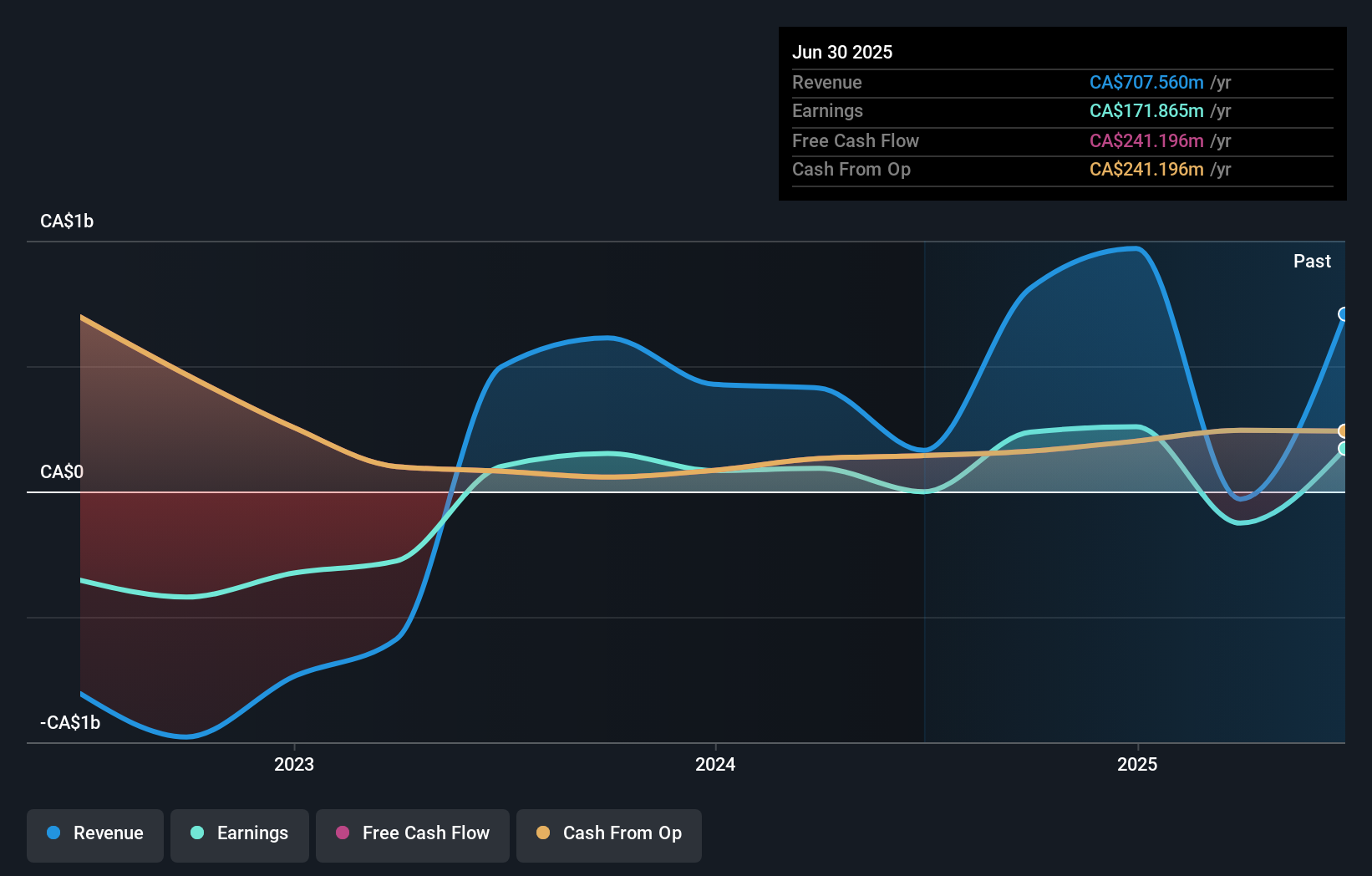

Operations: The primary revenue stream for Senvest Capital comes from managing its own investments and those of the funds, generating CA$707.56 million.

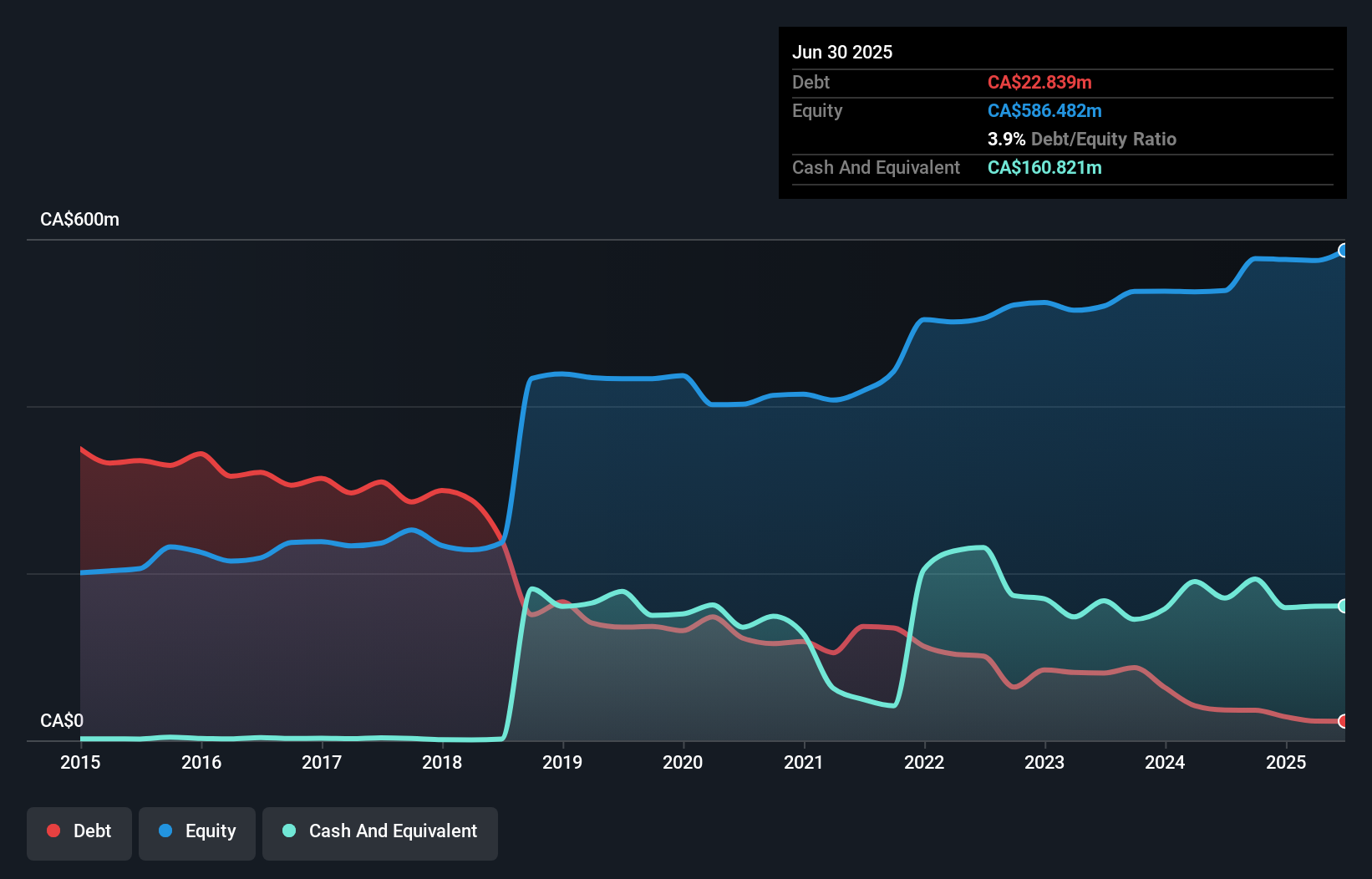

Senvest Capital, a niche player in the Canadian market, showcases intriguing aspects for potential investors. Its recent profitability stands out with net income reaching C$226 million for Q2 2025, a significant turnaround from a net loss of C$71.69 million the previous year. The company’s debt management has improved over five years, reducing its debt to equity ratio from 71.6% to 63.1%. Senvest also announced a share buyback program to repurchase up to 100,000 shares or about 4.12% of its outstanding shares by August 2026, reflecting confidence in its financial health and growth prospects.

TWC Enterprises (TSX:TWC)

Simply Wall St Value Rating: ★★★★★★

Overview: TWC Enterprises Limited owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States with a market capitalization of CA$575.94 million.

Operations: TWC generates revenue primarily from its Canadian Golf Club Operations, contributing CA$162.99 million, while its US Golf Club Operations add CA$24.81 million to the total.

TWC Enterprises, a relatively smaller player in the market, has shown impressive financial resilience. Over the past year, its earnings skyrocketed by 141%, outpacing the broader Hospitality industry's slight drop of 0.2%. With a significant one-off gain of C$23.9 million impacting recent results, this could be a factor in its robust performance. The company's debt-to-equity ratio has impressively shrunk from 30% to just under 4% over five years, indicating prudent financial management. Additionally, TWC's share repurchase program aims to buy back up to 1.21 million shares by September next year, potentially enhancing shareholder value further.

- Delve into the full analysis health report here for a deeper understanding of TWC Enterprises.

Review our historical performance report to gain insights into TWC Enterprises''s past performance.

Itafos (TSXV:IFOS)

Simply Wall St Value Rating: ★★★★★★

Overview: Itafos Inc. is a company that specializes in phosphate and specialty fertilizers, with a market capitalization of CA$541.06 million.

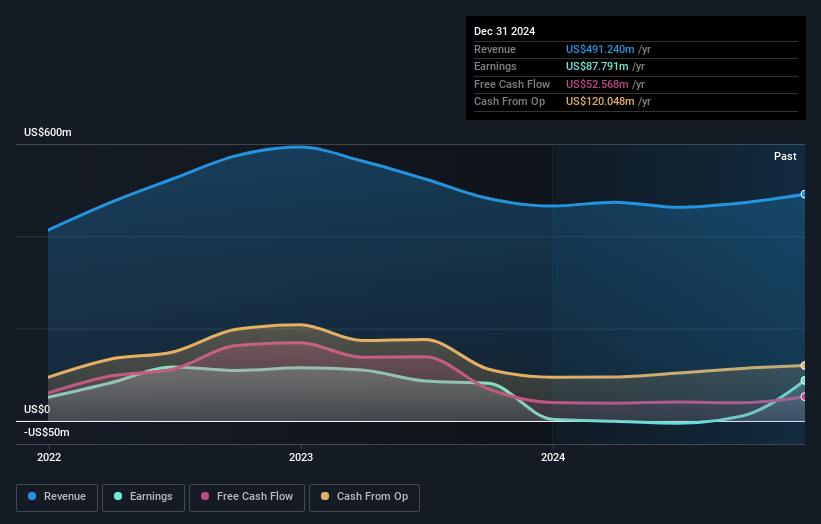

Operations: Itafos generates revenue primarily from its Conda and Arraias segments, contributing $488.06 million and $32.65 million respectively.

Itafos, a dynamic player in the Canadian chemicals sector, has made notable strides in profitability, now boasting a debt to equity ratio of 23.1%, down from 211.7% over five years. Its interest payments are comfortably covered by EBIT, with a coverage ratio of 43.3x. This financial stability is complemented by trading at 40.3% below estimated fair value, presenting potential upside. Recent earnings show a solid performance with Q2 2025 sales hitting US$126.8 million, up from US$105.06 million a year earlier, and net income rising to US$24.82 million. The company’s future appears promising with robust sales guidance.

- Dive into the specifics of Itafos here with our thorough health report.

Assess Itafos' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 48 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SEC

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives