- Canada

- /

- Consumer Finance

- /

- TSX:PRL

Propel Holdings (TSX:PRL) Is Up 8.2% After Puerto Rico Bank Approval Is The Growth Story Evolving?

Reviewed by Sasha Jovanovic

- Propel Holdings has received regulatory approval from Puerto Rico’s Office of the Commissioner of Financial Institutions to establish Propel International Bank, Inc., a wholly owned International Financial Entity that will provide core consumer lending services to support existing and future bank partners, with operations targeted to begin in the first half of 2026.

- This new Puerto Rico-based bank is intended to broaden Propel’s product set, centralize underwriting and compliance, and potentially open access to new international markets and funding channels.

- We’ll now examine how launching a Puerto Rico-licensed international bank could influence Propel Holdings’ investment narrative and growth ambitions.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Propel Holdings Investment Narrative Recap

To own Propel, you need to believe that its AI driven, Lending as a Service model can keep compounding earnings while managing credit risk in nonprime segments. The Puerto Rico banking license could become a medium term enabler of that story, but it does not materially change the near term focus on credit performance and regulatory risk as the key swing factors for the share price.

The recent authorization of a new normal course issuer bid to repurchase up to 2,703,439 shares sits alongside the Puerto Rico bank announcement as part of a broader capital allocation story. For investors, the combination of growing earnings, increasing dividends, and potential buybacks is now intersecting with heavier investment in new platforms, which could weigh on margins if revenue momentum slows.

Yet beneath the promise of new markets and products, investors still need to weigh the risk that tighter lending rules in key regions could...

Read the full narrative on Propel Holdings (it's free!)

Propel Holdings’ narrative projects $1.1 billion revenue and $163.9 million earnings by 2028. This requires 28.1% yearly revenue growth and about a $103 million earnings increase from $60.7 million today.

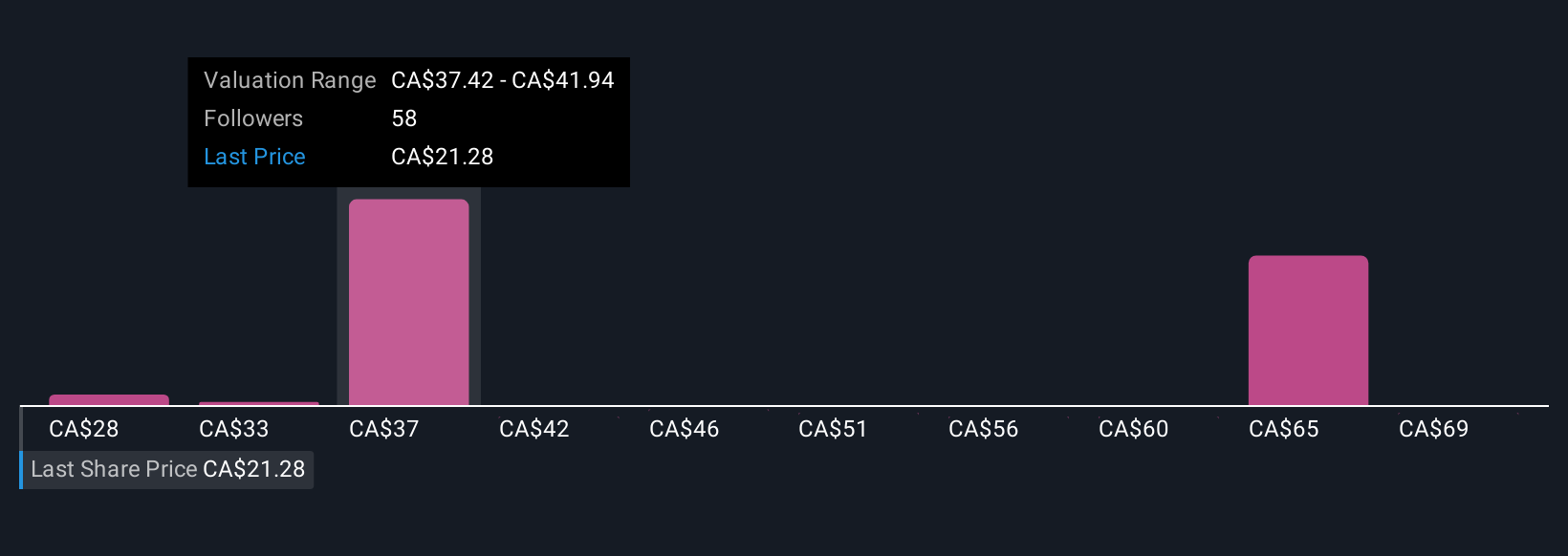

Uncover how Propel Holdings' forecasts yield a CA$37.24 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Sixteen members of the Simply Wall St Community now value Propel between CA$31.28 and CA$63.96 per share, underlining how far apart views can be. Set against this, the push into new geographies such as Puerto Rico keeps regulatory complexity front and center for the company’s future performance, so you may want to compare several of these viewpoints before deciding where you stand.

Explore 16 other fair value estimates on Propel Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Propel Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Propel Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Propel Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Propel Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Exceptional growth potential and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026