- Canada

- /

- Capital Markets

- /

- TSX:FSZ

Fiera Capital Corporation (TSE:FSZ) Looks Just Right With A 26% Price Jump

Fiera Capital Corporation (TSE:FSZ) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

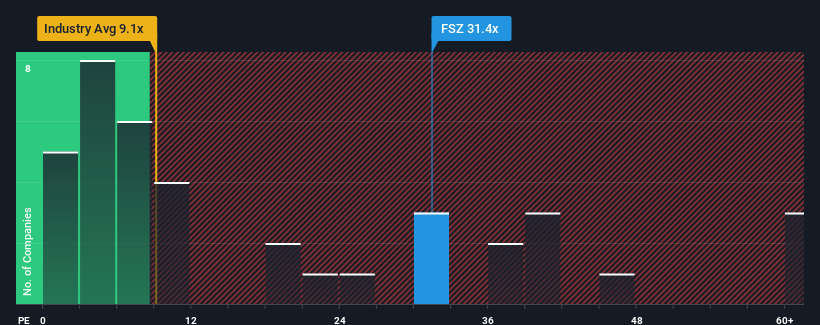

Since its price has surged higher, given close to half the companies in Canada have price-to-earnings ratios (or "P/E's") below 13x, you may consider Fiera Capital as a stock to avoid entirely with its 31.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Fiera Capital as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Fiera Capital

How Is Fiera Capital's Growth Trending?

In order to justify its P/E ratio, Fiera Capital would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. Even so, admirably EPS has lifted 2,024% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 67% as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 12%, which is noticeably less attractive.

In light of this, it's understandable that Fiera Capital's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Fiera Capital's P/E?

The strong share price surge has got Fiera Capital's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Fiera Capital's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Fiera Capital (1 is significant!) that you need to be mindful of.

If you're unsure about the strength of Fiera Capital's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FSZ

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives