- Canada

- /

- Capital Markets

- /

- TSX:FSZ

After Leaping 26% Fiera Capital Corporation (TSE:FSZ) Shares Are Not Flying Under The Radar

Fiera Capital Corporation (TSE:FSZ) shares have continued their recent momentum with a 26% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.5% over the last year.

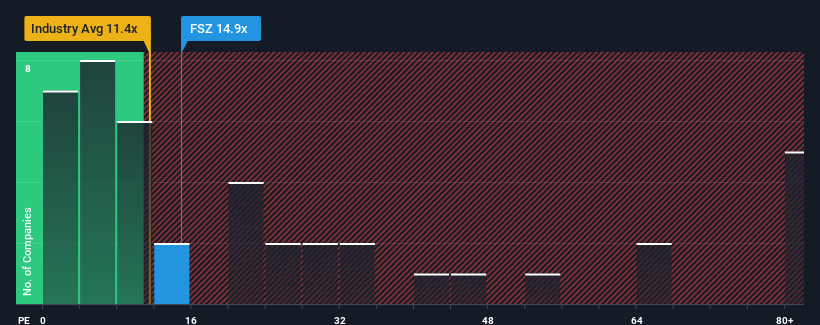

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Fiera Capital's P/E ratio of 14.9x, since the median price-to-earnings (or "P/E") ratio in Canada is also close to 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Fiera Capital as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Fiera Capital

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Fiera Capital's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 126% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the six analysts following the company. That's shaping up to be similar to the 9.7% each year growth forecast for the broader market.

With this information, we can see why Fiera Capital is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Fiera Capital's P/E

Fiera Capital appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Fiera Capital's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 5 warning signs for Fiera Capital (2 don't sit too well with us!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FSZ

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives