- Canada

- /

- Capital Markets

- /

- TSX:CRWN

Positive Sentiment Still Eludes Crown Capital Partners Inc. (TSE:CRWN) Following 27% Share Price Slump

Unfortunately for some shareholders, the Crown Capital Partners Inc. (TSE:CRWN) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

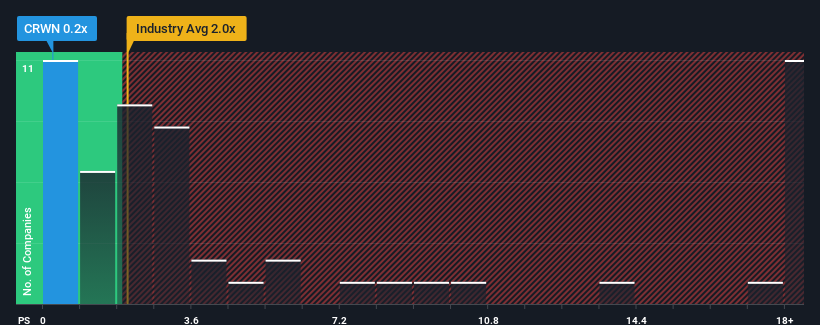

After such a large drop in price, Crown Capital Partners' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Capital Markets industry in Canada, where around half of the companies have P/S ratios above 2x and even P/S above 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Crown Capital Partners

How Has Crown Capital Partners Performed Recently?

Recent times have been pleasing for Crown Capital Partners as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Crown Capital Partners will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Crown Capital Partners will help you uncover what's on the horizon.How Is Crown Capital Partners' Revenue Growth Trending?

In order to justify its P/S ratio, Crown Capital Partners would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. Pleasingly, revenue has also lifted 41% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 16% during the coming year according to the lone analyst following the company. With the rest of the industry predicted to shrink by 5.6%, that would be a fantastic result.

With this in mind, we find it intriguing that Crown Capital Partners' P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What Does Crown Capital Partners' P/S Mean For Investors?

The southerly movements of Crown Capital Partners' shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Crown Capital Partners' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Crown Capital Partners (2 can't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRWN

Crown Capital Partners

A private equity firm specializing in acquisitions, special situations, management and leveraged buyouts, subordinated debt, recapitalizations, PIPES, industry consolidation, mezzanine, alternative debts, bridge loans, mezzanine debt, and growth capital investments in private and public middle market companies.

Mediocre balance sheet low.