- Canada

- /

- Capital Markets

- /

- TSX:CRWN

Crown Capital Partners Inc. (TSE:CRWN) Soars 30% But It's A Story Of Risk Vs Reward

Crown Capital Partners Inc. (TSE:CRWN) shares have continued their recent momentum with a 30% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 76% share price drop in the last twelve months.

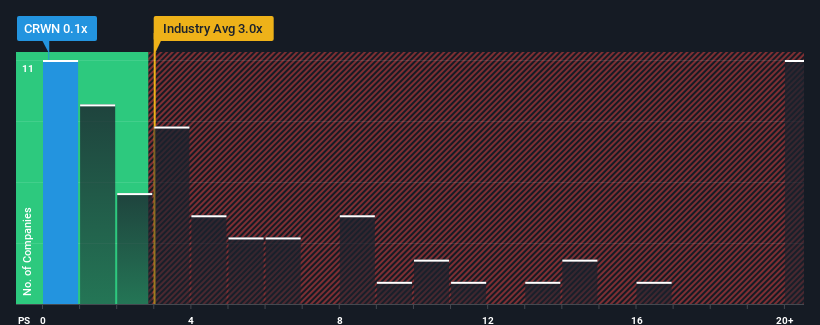

Although its price has surged higher, Crown Capital Partners' price-to-sales (or "P/S") ratio of 0.1x might still make it look like a strong buy right now compared to the wider Capital Markets industry in Canada, where around half of the companies have P/S ratios above 3x and even P/S above 11x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Crown Capital Partners

What Does Crown Capital Partners' P/S Mean For Shareholders?

For instance, Crown Capital Partners' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Crown Capital Partners, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Crown Capital Partners would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 9.5% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 2.5% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that Crown Capital Partners' P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Crown Capital Partners' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Crown Capital Partners revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Crown Capital Partners you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CRWN

Crown Capital Partners

A private equity firm specializing in acquisitions, special situations, management and leveraged buyouts, subordinated debt, recapitalizations, PIPES, industry consolidation, mezzanine, alternative debts, bridge loans, mezzanine debt, and growth capital investments in private and public middle market companies.

Mediocre balance sheet and slightly overvalued.