- Canada

- /

- Capital Markets

- /

- TSX:BN

Brookfield (TSX:BN) Sets New Dividend Rates for Series 42 & 43 Shares

Reviewed by Simply Wall St

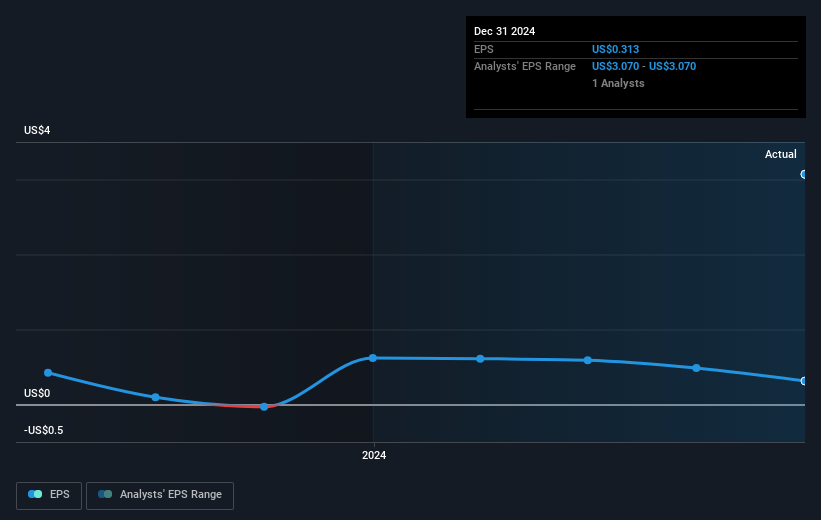

Brookfield (TSX:BN) recently announced a fixed dividend rate for its Series 42 preferred shares, along with conversion details, which provides clarity for investors regarding future payouts. Over the last month, the company's stock price rose by 4%, a movement consistent with general market trends, as there were no major deviations in market performance. Although earnings showed declines, the broader suite of dividend announcements and authorized share buyback initiatives released in recent weeks may have added weight to the broader market movements, aligning Brookfield's performance with prevailing market conditions.

Find companies with promising cash flow potential yet trading below their fair value.

The recent dividend announcement for Brookfield's Series 42 preferred shares provides clarity for investors, likely supporting market sentiment around the stock and its stable income potential. While Brookfield's shares rose by 4% over the past month amid broader market trends, the company's total return was an impressive 108.37% over a five-year period. Compared to the past year, Brookfield lagged behind the Canadian Capital Markets industry but exceeded the overall Canadian market. Despite recent earnings declines, these total returns highlight the company's capacity to deliver substantial investor value over the long term.

Looking forward, the dividend policy and share repurchase initiatives could influence revenue and earnings growth projections. The market's perception of these actions might factor into Brookfield's ability to achieve its CA$74.14 price target, with the stock currently trading in line with this valuation. Investors should consider the balance between Brookfield's asset sales and its global expansion strategy, evaluating how these elements might impact future earnings forecasts and market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BN

Brookfield

A multi-asset manager focused on real estate, credit, renewable power and transition, infrastructure, venture capital, and private equity including growth capital and emerging growth investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.