- Canada

- /

- Capital Markets

- /

- CNSX:HODL

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As we move into February 2025, the Canadian market is navigating a complex landscape of persistent inflation and solid corporate earnings, while European equities quietly outperform. In this context, penny stocks—an investment area often associated with smaller or newer companies—remain relevant for those seeking growth opportunities at lower price points. When these stocks are supported by strong financial health and fundamentals, they can offer potential upside without many of the risks typically linked to this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.19 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sol Strategies (CNSX:HODL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sol Strategies Inc. is a company that invests in cryptocurrencies and blockchain technologies, with a market cap of CA$632.53 million.

Operations: The company's revenue is derived entirely from its investment in cryptocurrencies and blockchain technology, amounting to CA$10.69 million.

Market Cap: CA$632.53M

Sol Strategies Inc. has shown significant growth, reporting CA$10.67 million in revenue and a net income of CA$6.61 million for the year ended September 30, 2024, marking a turnaround from previous losses. The company recently secured CA$30 million through convertible debenture units to bolster its financial position and expand operations. A strategic partnership with 3iQ Corp., as a staking provider for their Solana Staking ETF, underscores Sol Strategies' expanding role in institutional blockchain adoption. Despite volatility and insider selling concerns, the company's debt-free status and high return on equity (24.7%) are positive indicators for potential investors.

- Unlock comprehensive insights into our analysis of Sol Strategies stock in this financial health report.

- Assess Sol Strategies' previous results with our detailed historical performance reports.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is involved in the exploration and development of mineral properties in the United States, with a market cap of CA$311.49 million.

Operations: Trilogy Metals Inc. currently does not report any revenue segments, focusing primarily on the exploration and development of mineral properties in the United States.

Market Cap: CA$311.49M

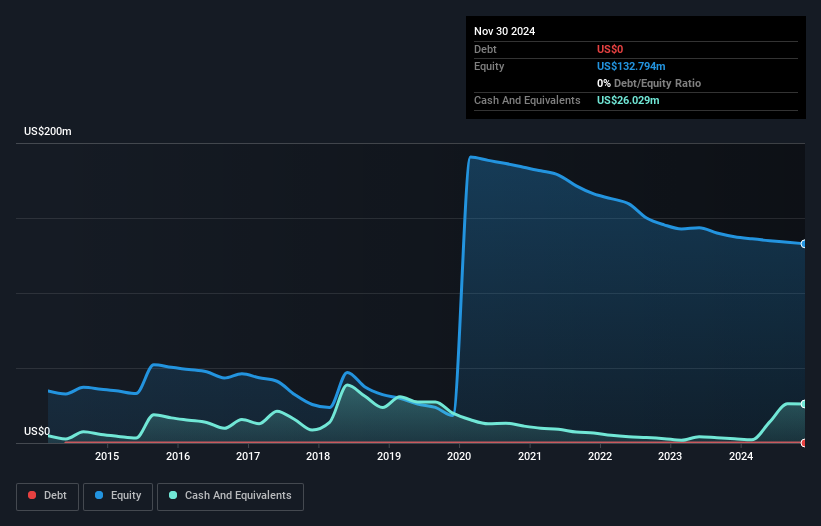

Trilogy Metals Inc., a pre-revenue company with a market cap of CA$311.49 million, focuses on mineral exploration and development in the U.S. Despite reporting an annual net loss of US$8.59 million, it has no debt and maintains sufficient cash runway for over three years. The recent Preliminary Economic Assessment (PEA) for its Bornite copper project highlights significant potential with 1.9 billion pounds of copper projected over a 17-year mine life and an after-tax NPV of US$394 million, though these figures remain speculative without confirmed mineral reserves. The board's experience supports strategic decision-making amid ongoing financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Trilogy Metals.

- Learn about Trilogy Metals' historical performance here.

Western Forest Products (TSX:WEF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Forest Products Inc. is an integrated softwoods forest products company operating in Canada, the United States, Japan, China, Europe, and internationally with a market cap of CA$148.87 million.

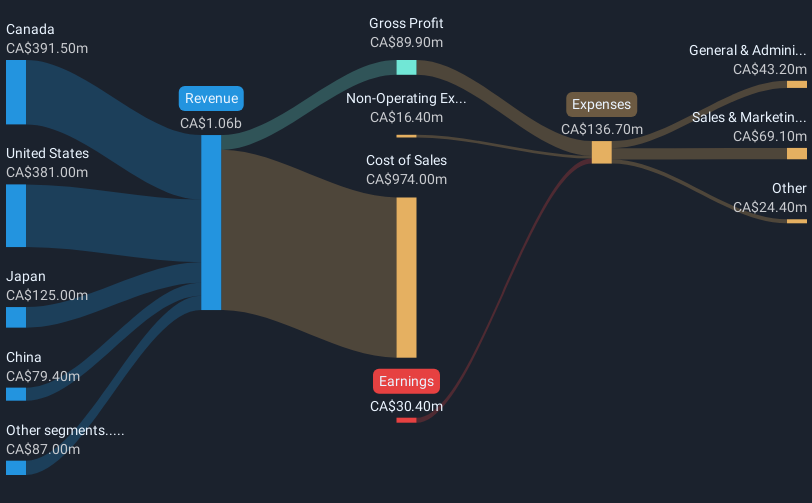

Operations: The company generates revenue of CA$1.06 billion from its Paper & Lumber segment.

Market Cap: CA$148.87M

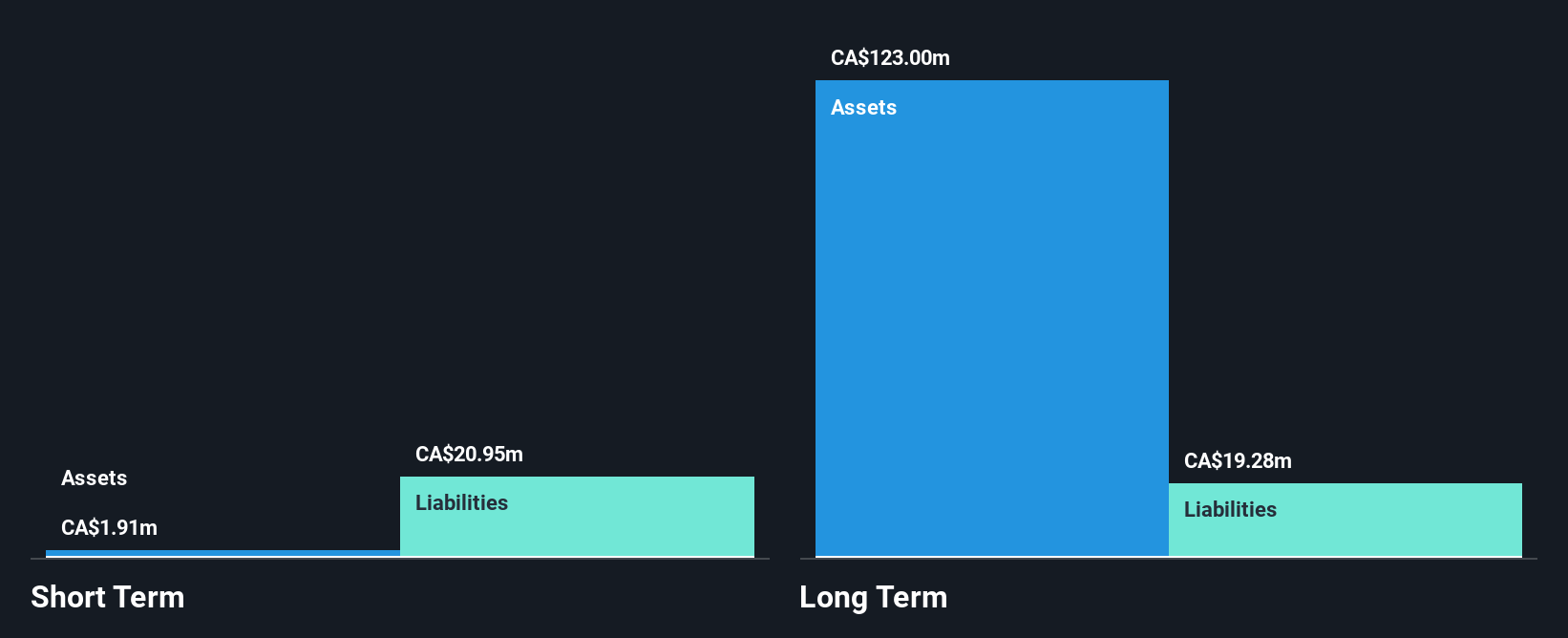

Western Forest Products Inc., with a market cap of CA$148.87 million, reported annual sales of CA$1.06 billion, showing revenue growth despite a net loss reduction from CA$68.5 million to CA$30.4 million year-over-year. The company's debt management appears satisfactory with a net debt to equity ratio of 13.7% and reduced liabilities over time, supported by short-term assets exceeding both long-term and short-term liabilities significantly. While unprofitable with negative return on equity, its seasoned management team and stable weekly volatility provide some stability in the volatile penny stock arena, alongside favorable labor agreements enhancing workforce relations for future operations stability.

- Dive into the specifics of Western Forest Products here with our thorough balance sheet health report.

- Gain insights into Western Forest Products' future direction by reviewing our growth report.

Seize The Opportunity

- Dive into all 940 of the TSX Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:HODL

Sol Strategies

Invests in and provides infrastructure for the Solana Blockchain ecosystem.

Moderate risk with concerning outlook.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)