Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies CIBT Education Group Inc. (TSE:MBA) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out the opportunities and risks within the CA Consumer Services industry.

What Is CIBT Education Group's Net Debt?

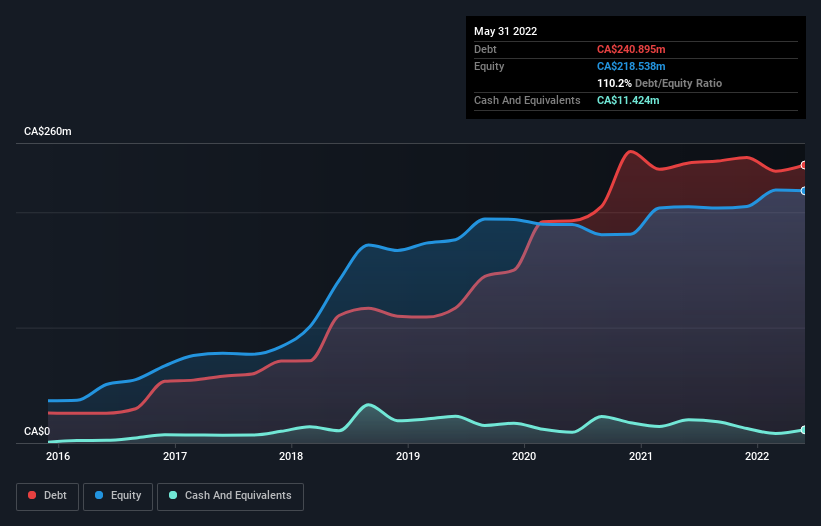

As you can see below, CIBT Education Group had CA$240.9m of debt, at May 2022, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of CA$11.4m, its net debt is less, at about CA$229.5m.

A Look At CIBT Education Group's Liabilities

The latest balance sheet data shows that CIBT Education Group had liabilities of CA$235.3m due within a year, and liabilities of CA$79.0m falling due after that. On the other hand, it had cash of CA$11.4m and CA$47.9m worth of receivables due within a year. So it has liabilities totalling CA$255.0m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CA$30.6m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, CIBT Education Group would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

CIBT Education Group shareholders face the double whammy of a high net debt to EBITDA ratio (31.1), and fairly weak interest coverage, since EBIT is just 0.43 times the interest expense. The debt burden here is substantial. Looking on the bright side, CIBT Education Group boosted its EBIT by a silky 64% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is CIBT Education Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, CIBT Education Group actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both CIBT Education Group's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that CIBT Education Group's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for CIBT Education Group (2 are potentially serious) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GEC

Global Education Communities

Operates as an education and student housing investment company in Canada and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.