- Canada

- /

- Hospitality

- /

- TSX:BRAG

One-Week Return Of 10% Takes Bragg Gaming Group's Shareholders' Three-Year Gains To 162%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For instance the Bragg Gaming Group Inc. (TSE:BRAG) share price is 162% higher than it was three years ago. That sort of return is as solid as granite. Also pleasing for shareholders was the 37% gain in the last three months.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Bragg Gaming Group

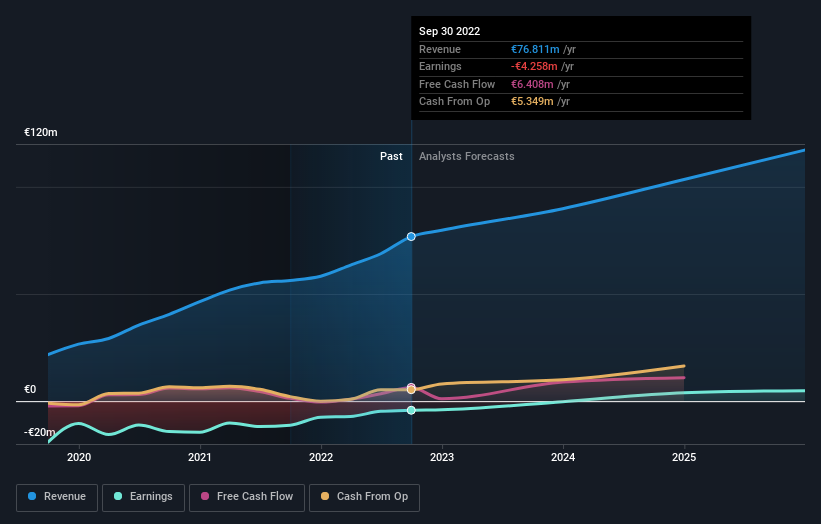

Bragg Gaming Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Bragg Gaming Group saw its revenue grow at 36% per year. That's well above most pre-profit companies. Along the way, the share price gained 38% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Bragg Gaming Group is still worth investigating - successful businesses can often keep growing for long periods.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Bragg Gaming Group shareholders are down 14% for the year, but the market itself is up 0.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Bragg Gaming Group you should be aware of.

But note: Bragg Gaming Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bragg Gaming Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BRAG

Bragg Gaming Group

Operates as an iGaming content and technology solutions provider serving online and land-based gaming operators with its proprietary and exclusive content.

Excellent balance sheet and good value.

Market Insights

Community Narratives